Iberia successfully overcame the first hurdle on the way to take control of Air Europa. The creditor bank and the State Company of Industrial Participations (SEPI) they gave the go-ahead to the credit of 100 million euros (about US$ 104 million) granted by Iberia’s parent company, International Airlines Group (IAG) to the airline that owns Air Europa, Globalia.

According to the ABC newspaper, The approval of these organizations was essential for the approval of the loan. On the one hand, because the bank granted loans to Air Europa endorsed by the Official Credit Institute (ICO) worth 140 million euros (about $146 million). On the other hand, because SEPI is present on the airline’s board after granting two loans (one ordinary and one participative) valued together at 475 million euros (about US$ 494 million).

The credit is convertible so will allow Iberia to acquire 20% of its historical rival this year. The next step that Iberia’s parent company intends to take is to convert the amount injected into a stake of up to 20% in the capital of Air Europa. The proposal is for this to happen in a maximum of six months.

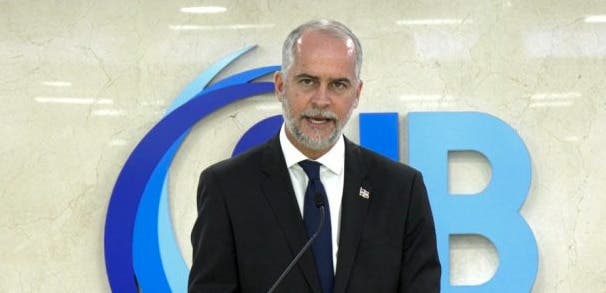

Later, the airline will seek to increase that percentage to 100%. But this process will already be more complex and will last about eighteen months, according to Iberia’s calendar. “The operation is complex and as it happens with all good things in this life, it costs”, said the CEO of Iberia, Luis Gallego.

How can it affect Uruguay?

Iberia’s entry into Air Europa would not be good news for the country given that benefits from the competition between both airlines years agoaccording to Passport News.

Since there is no monopoly on the route, the rates have always been lower than those that an airline would publish if it had a monopoly on the route. According to Iberia’s website, a Montevideo-Madrid round-trip ticket costs US$1,034 today. Meanwhile, in the case of Air Europa, the same route is offered with a rate of about US$900. This last European airline touched Uruguayan soil for the first time in 2013.