The Production prospects for vegetable oils in the 2022/23 marketing year remain highly uncertain, exacerbated by the war in Ukraine and its still unknown impact on oil production and trade.

However, beyond this uncertainty, the strength of the prices of vegetable oils in recent months has encouraged significant increases in the production of oilseeds around the world. In this way, the contribution of the oil in the value obtained from the crush of oilseeds has grown overwhelmingly. On the other hand, large volumes of flour are being obtained that will be used to supply the grain market, which is anticipated to be tighter for the next cycle. In this context, a drop in vegetable oil quotations can be expected in 2022/23.

All this based on a report published on the site of the Rosario Stock Exchange (BCR).

There are four vegetable oils that dominate this market: palm oil, soybean oil, rapeseed oil and sunflower oil.. These four varieties make up 75% of the volume of oils produced each year and for the 2022/23 cycle, a growing behavior is expected in the production of all of them. In fact, it is the first time in nine cycles (since 2013/14) that there has been a general increase in the four leading oils, according to data from Oil World.

- The production of palm oil, which represents more than 40% of all oils, will record its third consecutive growing season. In 2022/23, 80.5 Mt of this oil will originate, which has accumulated growth of 9% since 2019/20.

- Soybean oil will increase its production for the fourth consecutive cycle, achieving a volume 7.8% higher than that obtained in 2018/19. Soybean oil accounts for almost a third of oil production in the world.

- With a 15% share of total oils, rapeseed oil will recover in the next cycle the significant production loss that it registered in 2021/22 (-5.2%). The rebound in its production will allow it to even improve its performance in 2020/21.

- In 2022/23, the production of each of these three oils will reach a historical maximum, reaffirming the productive boom driven by excellent international prices that arise from a consistent demand for vegetable oils.

- On the other hand, the fourth most important oil, sunflower oil, will achieve a second consecutive cycle with growing production. However, global production will still not be able to match the volume achieved three seasons ago, prior to the significant drop in 2020/21. This oil has a smaller share in world production, around 11%.

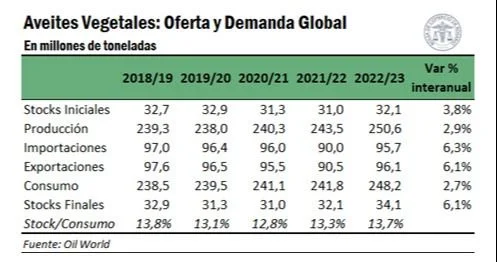

As expected, the greater production in the leading oils is decisive for the offer in the balance of the oils. According to projections by Oil World, in the 2022/23 cycle the production of vegoils will grow by 3.8%, achieving the largest year-on-year increase in the last five cycles.

It is expected that the greater production will also boost a greater volume of international trade. The blockade of export ports in the Black Sea and other logistical bottlenecks that may develop are expected as limitations to the exchange. In 2022/23, exports of 96.1 Mt are anticipated, more than 5 Mt above what was exchanged in 2021/22, after having suffered contractions in trade flows for three consecutive campaigns.

BCR

EO

What about the demand?

On the demand side, it is anticipated that the effects of covid-19 on global consumption behavior will continue to soften in the next cycle, while the lower estimated prices for oils will strengthen their demand in lower-income countries.. Likewise, major oil importing markets such as India and China will lead the largest purchases next business year. Consequently, the demand for vegetable oils will increase by 6.4 Mt, the largest jump in the last four years.

Oil World points out that it is important to keep in mind that the current 2021/22 cycle was the third with a decreasing per capita consumption of oils, with strong cuts in key applicants such as India, Bangladesh, Nigeria, among others. On the other hand, many importing markets will take advantage of the ample supply to reconstitute their stocks.

Lastly, ending stocks for the next business year are estimated at 34.1 Mt, reaching a record for oils. If the proposed production, consumption and trade patterns are confirmed, the stock/consumption ratio will be 13.7%, one of the highest values observed.

BCR

EO

Indonesian tariff policy

The upward trend in the prices of vegoils in recent years was crowned with all-time high prices for several oils in the first half of 2022. However, in recent weeks many of these values have plummeted.

The FOB value of palm oil in Malaysia, which reached a maximum of US$1,952.5/t in March, is today trading at less than half this value, US$972.5/t. The collapse in the price of the leading oil in the oleic segment is mainly due to two reasons:

- Expectations of ample global supply and trade in the 2022/23 cycle

- The pressure exerted by the high stocks of palm oil in Indonesia. Indonesian exports have started to grow and will add further pressure as the government lifts export restrictions and continues to reduce export duties.

This drop in palm oil of around 50% from its peak in March put downward pressure on the prices of the rest of the oils. The FOB price of Argentine soybean oil today stands at around US$1,276/t, US$726/t below its maximum price reached at the end of April (US$2,002/t). Thus, in less than two months its price fell by 36%.

Rapeseed and sunflower oils also yielded to the general downward pressure of the market and also responded to the good dynamism shown by exports of both products in recent weeks. In the case of sunflower oil, its price falls due to crush data and European exports higher than expected. The FOB price of Argentine sunflower oil, which peaked at US$2,300/t in March, is currently trading at US$1,430/t, losing 38% in value. The export price of colza oil in the Netherlands, for its part, registered a fall of 27% from its maximum in April (US$ 2,392.5), currently trading at US$ 1,735.7/t. In this market, the pressure of the proximity to the harvest season is added, which will recompose the offer of the crop in the northern hemisphere.

Since the beginning of June, the FOB prices of the main oils in their reference origins have lost between 25% and 40% in value. These cuts had their own fundamentals in each market, but the deepest bearish driver was the deregulation of the Indonesian palm oil market. Even so, and beyond the latest drops in prices, the four main oils are trading at similar levels in mid-2021. These are values that, even in nominal terms, are historically high. In the next business year, the abundant supply of raw material for crush will measure its strength, with the thriving world demand that has left behind the lethargy of the last years of the pandemic and is growing thanks to energy and food demand.

BCR

EO

Source: Report by Desiré Sigaudo, Emilce Terré and Julio Calzada published on the website bcr.com.ar