The gross tax collection of the DGI reached $47,406 million in July and grew 2.9% in real terms (discounted inflation) compared to the same month last year. Meanwhile, the net collectionthat is, discounting the tax refund, reached $39,702 million and expanded 3% in the year-on-year comparison, the agency reported.

The difference between the gross collection and the net collection corresponds to the tax refund, which can be made through payments made with credit certificates issued by DGI or by cash/bank refunds.

Income to the main state bank in July showed a marked slowdown in its growth rate compared to June (+7.4%) and May (+10.6%).

DGI

In the accumulated figure for the last 12 months, the rise in interannual gross tax collection was 7.9%, while in the accumulated figure for January-July it grew 7.6% in real terms.

DGI

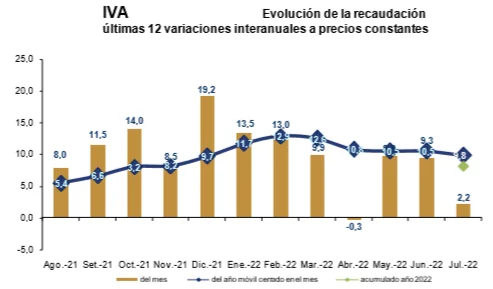

VAT collection totaled $23,367 million in July and represented 49.3% of total gross collection. In that month the real rise was 2.2% and 8.1% in the accumulated January-July. Meanwhile, Imesi collection reached $3,626 million and increased 6.1% in the interannual comparison and 3.1% in the accumulated annual.

For its part, IRAE collection reached $6,403 million in July 2022 and increased 8.4% in the year-on-year comparison and 6.6% in January-July.

Personal income tax collection (graph on the right) reached $7,699 million and fell 2.6% year-on-year. Leaving a cash shift effect, it would have grown 0.9%, according to the DGI. In turn, the real interannual variation for the January-July period of this personal income tax was 6.4%.

Finally, income from property taxes fell 0.6% in the year-on-year comparison, to $2,655 million. The most pronounced decrease occurred in the Primary Tax (-9.8%), followed by the Property Transfer Tax (0.5%).