With Reserve it is possible to deposit money with different currencies, such as bolívares, dollars, Argentine pesos, Colombian pesos and Peruvian soles, to change to dollars and save in the American currency

The Venezuelan economy is currently supported by the bi-monetary scheme that it currently manages, since dollars are equally or more important than bolivars, despite the fact that the government tries to promote the use of the national currency.

A large percentage of the country’s working population continues to receive a significant portion of their income in bolivars, such as those over four million public administration employees.

Despite the fact that the national currency has remained relatively stable in the last year, there is a lot of distrust, since in the course of days it could suffer a strong devaluation again.

In this sense, for many Venezuelans the best option is to migrate to green bills, dollars. But in Venezuela the management of foreign currency is mainly through cash.

Cash has a long list of problems, such as the absence of low-denomination bills or the inability to pay amounts with cents.

For this reason, various digital platforms began to offer solutions so that people can exchange your bolivars for dollars deposited in digital accounts, which can be extracted from those platforms to exchange again for bolivars or other currencies.

*Also read: How to exchange digital currencies for bolivars in your bank account?

In this way, the person has the facility to collect in bolivars, make the change to dollars to save without fearing a pronounced devaluation and when they need to spend their savings, change them back to bolivars.

One of the most extensive platforms to make these types of changes is Reserve, which has become enormously popular since the beginning of the pandemic. Next, we will explain how to use this service.

What is Reserve?

Reserve is a smartphone application that consists of a digital wallet in which you can save money. It has support to receive money from different national bank accounts, but also currencies such as dollars, Argentine pesos, Peruvian soles or Colombian pesos. Therefore, it is ideal for receiving remittances or international payments.

For example, a Reserve user may receive about $150 transferred from Zelle. Then save that money and when you spend it, withdraw its equivalent in bolivars to a national bank account.

How to create an account in Reserve?

There are few requirements to open a Reserve account and start using the service. Registration is completed in a few minutes by entering data into the smartphone app that you can download from the Google app store (Google Play Store) or Apple (AppleStore). The steps are the following:

Download the app and install it on the device, whether it is a cell phone or tablet.

- Select the option, “Register” and enter the phone number of the cell phone you are using to register. The system will send a code to that phone, which you will need to enter to confirm to the system that it is the correct number.

- Enter a username between 5 and 20 characters.

- Add your email address, to which they will also send a code that you must enter in Reserve as confirmation.

- Set a password. Should have at least eight characters, one uppercase letter, one lowercase letter and one number or special character (periods, commas, hyphens, among others).

- Create a four digit pin. Remember it because it will be requested in each transaction.

- Optionally, you can “Add Contacts”. The app will access your contact list and check which numbers are registered with Reserve, so you can exchange funds with them.

With the account created, you can start trading. Either “load” (deposit money) or “withdraw” (withdraw to your bank account) funds.

How to deposit bolivars in Reserve to save in dollars?

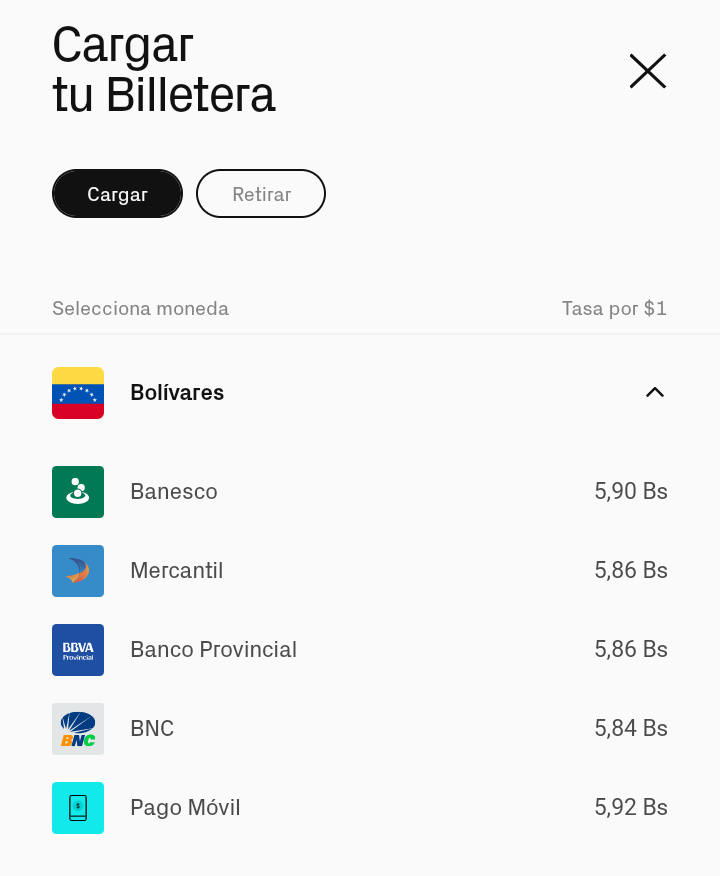

By pressing the “Load” option on the initial screen of our account, it will display a list of options to make deposits using different currencies.

The system allows deposit bolivars, US dollars, cryptocurrencies, Argentine pesos, Colombian pesos and soles. These currencies will be stored in dollars.

*Also read: How to start investing in cryptocurrencies without being an expert?

To exchange Bolivars for dollars, you must select the “Bolivares” option. Then, choose between one of the four banks available for bank transfers or the alternative of carrying out the operation by mobile payment from any bank.

For this example, Banco Mercantil was used, but the mechanism is the same for the four available entities.

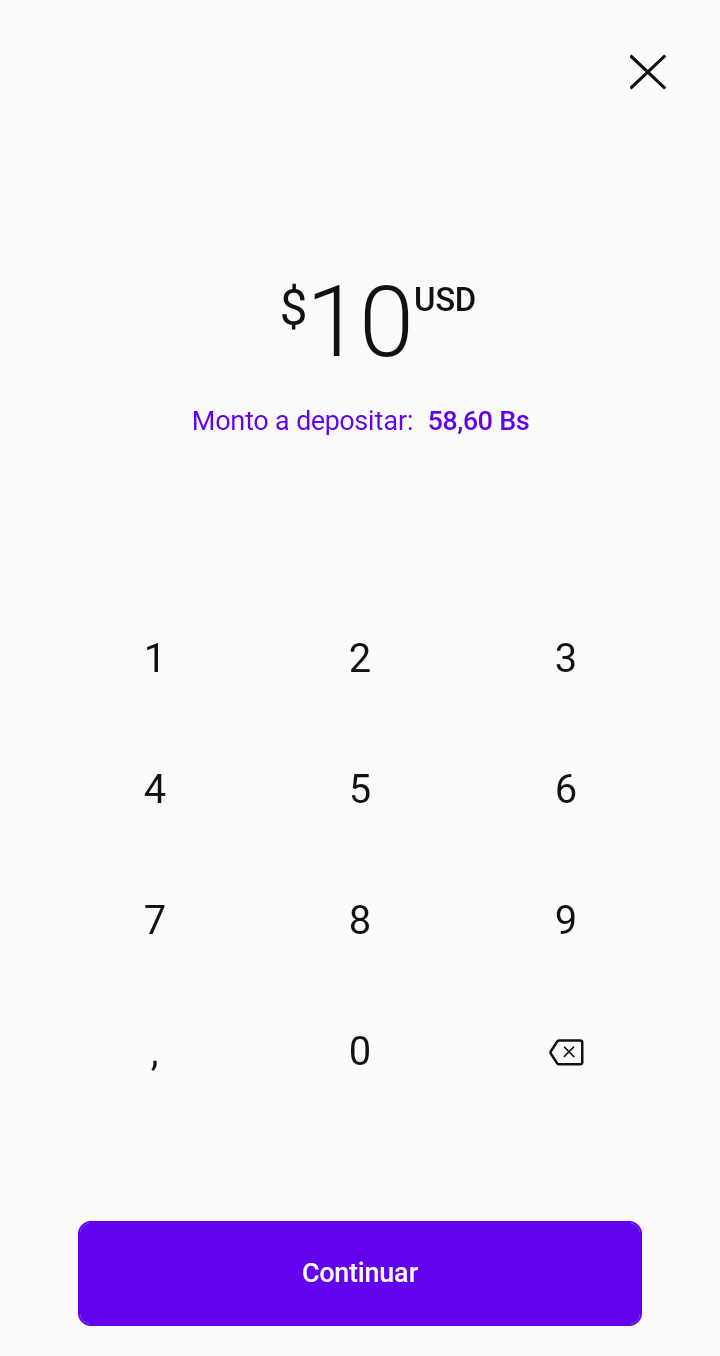

The next step is to indicate the dollar amount to save in Reserve. The app will indicate the amount to be deposited in bolivars from the bank account to change to that amount of dollars. The rate used is usually slightly higher than that indicated by the Central Bank of Venezuela (BCV).

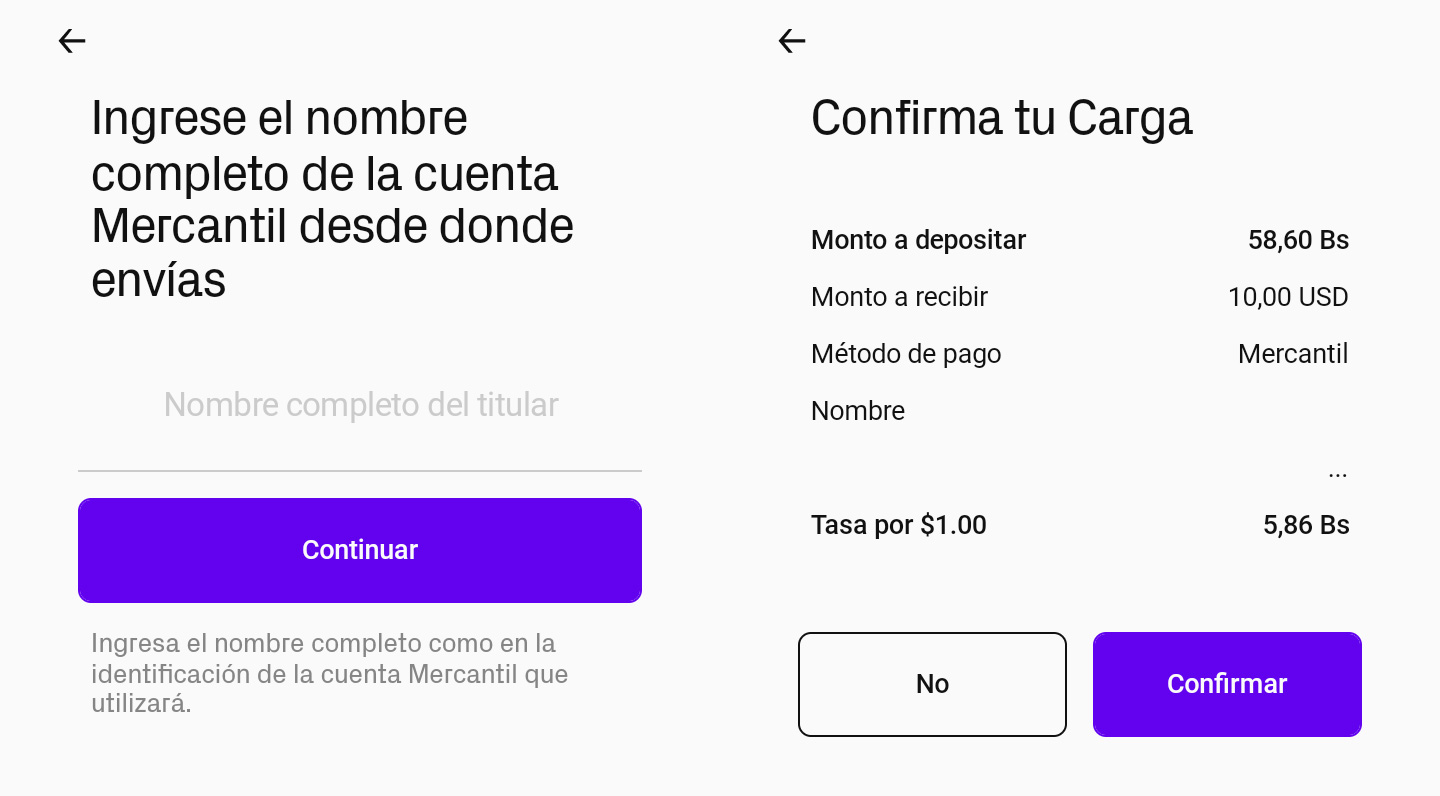

The system asks you to indicate the full name of the owner of the bank account from which you will send the money. Subsequently, confirm the loading operation.

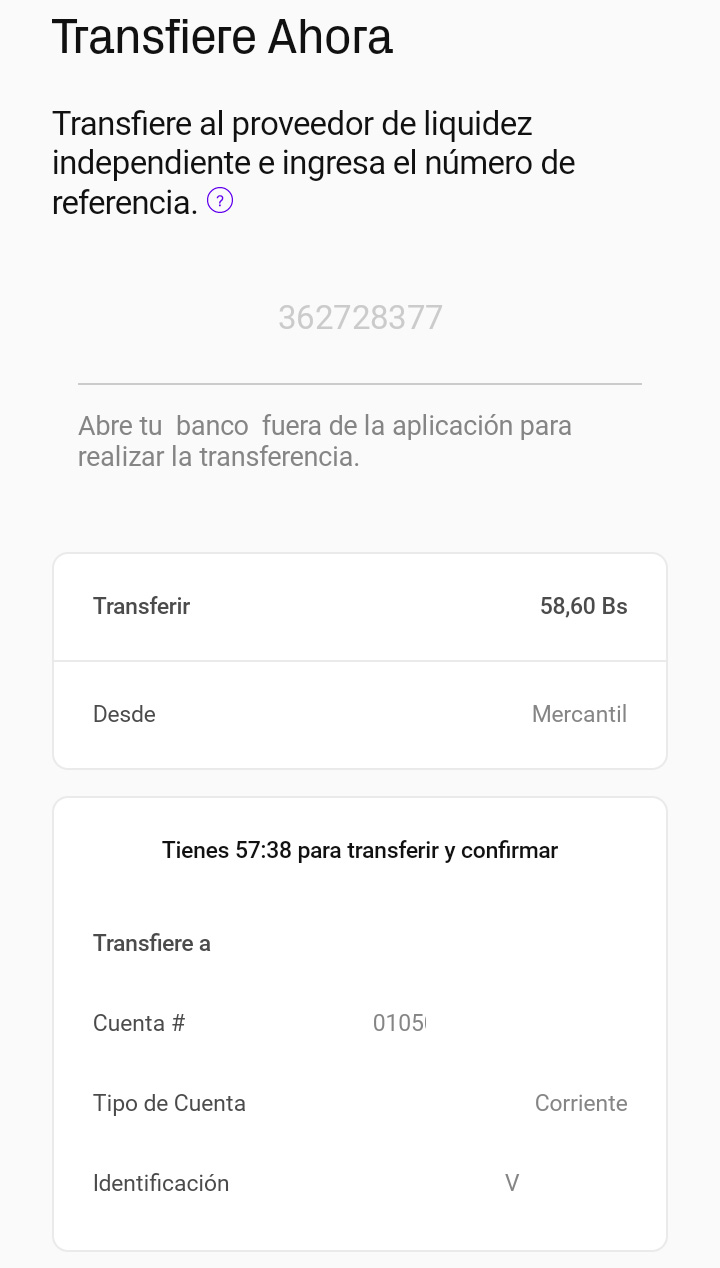

The application details that they will provide you with the data of another bank account, to which you must make the deposit. When doing so, it is important to specify in the concept of the transaction «Payment of service» and save the transaction reference number.

Next, a new screen will be displayed with the details of the operation. It will indicate the amount to be transferred, the bank account from which it is transferred, the name of the receiver, his number and type of account, and his identification. Similarly, there is a text box for enter the transaction reference number. Doing so will start the operation processing.

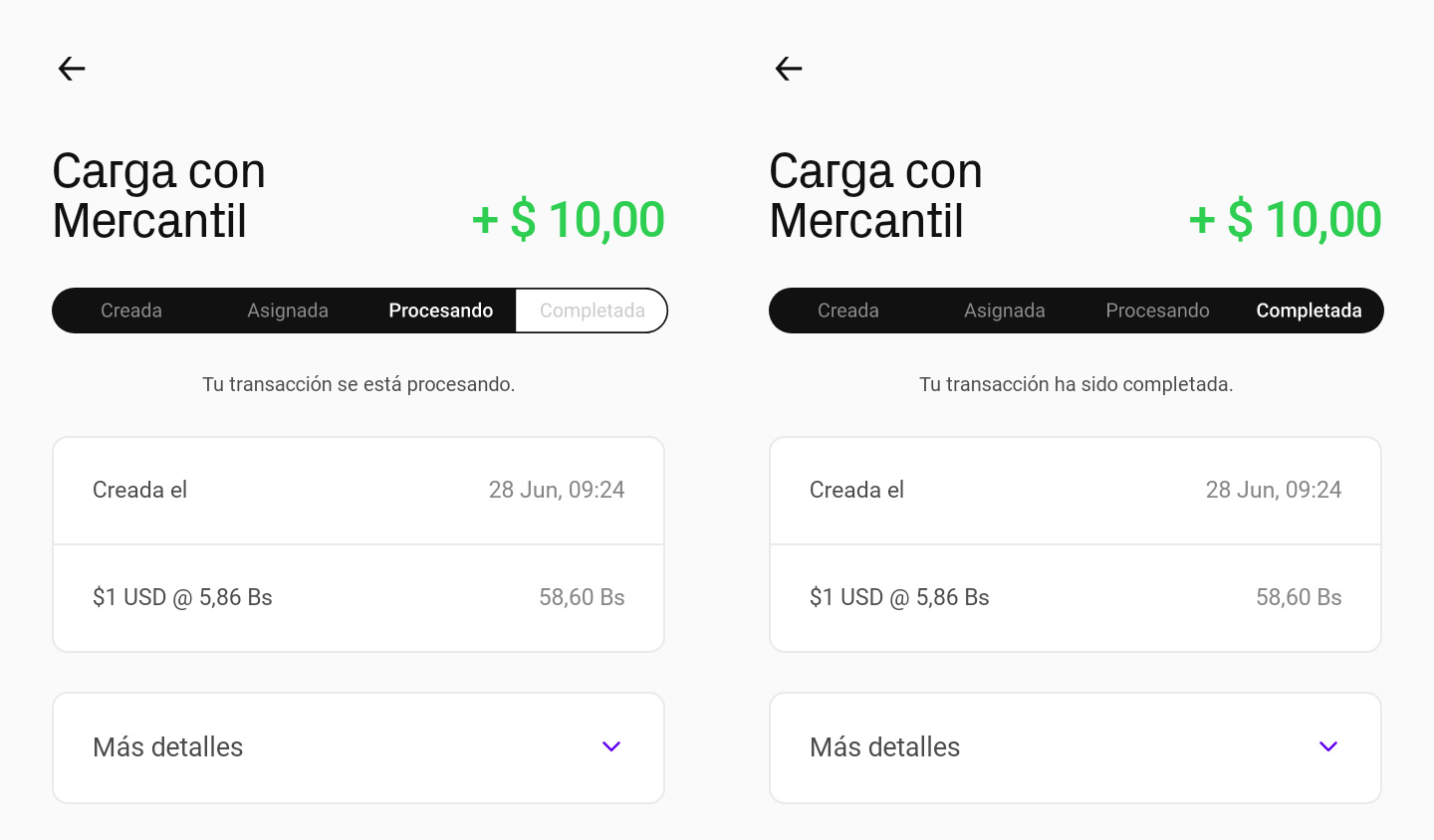

A new screen will open, indicating that the transaction is being processed. Once this stage is complete, it will mark the transfer as “completed” and your funds will be deposited into your Reserve wallet.

Increase account level

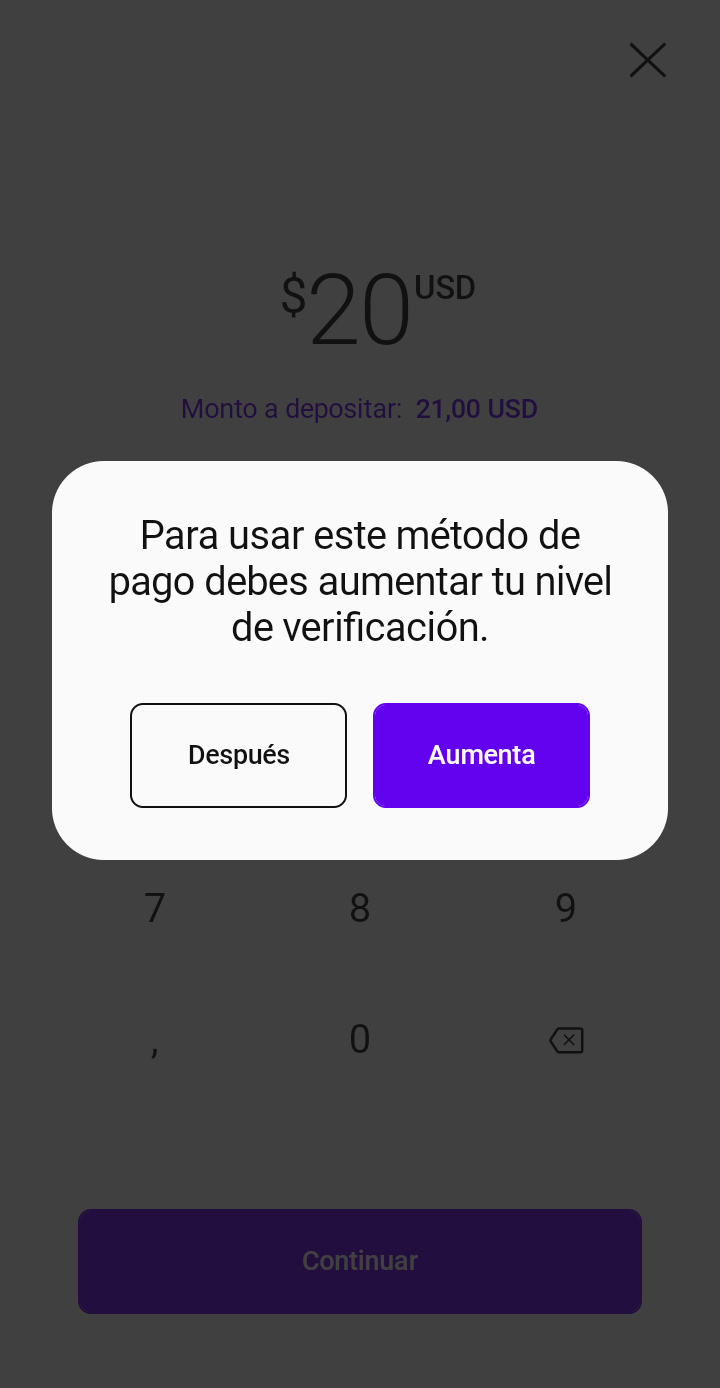

For certain transactions, an account of a higher level will be required, with more advanced security protocols with which it is possible to transfer larger amounts of money and expand the deposit mechanisms.

The same system will offer an increase in the level of the account when a transfer is made that exceeds the daily limit or a prohibited deposit system is used with the registration level. For example, if you want deposit from Zelle, it will indicate that you need to increase the verification level from account.

*Also read: Learn how to apply for a Visa prepaid card to make virtual purchases

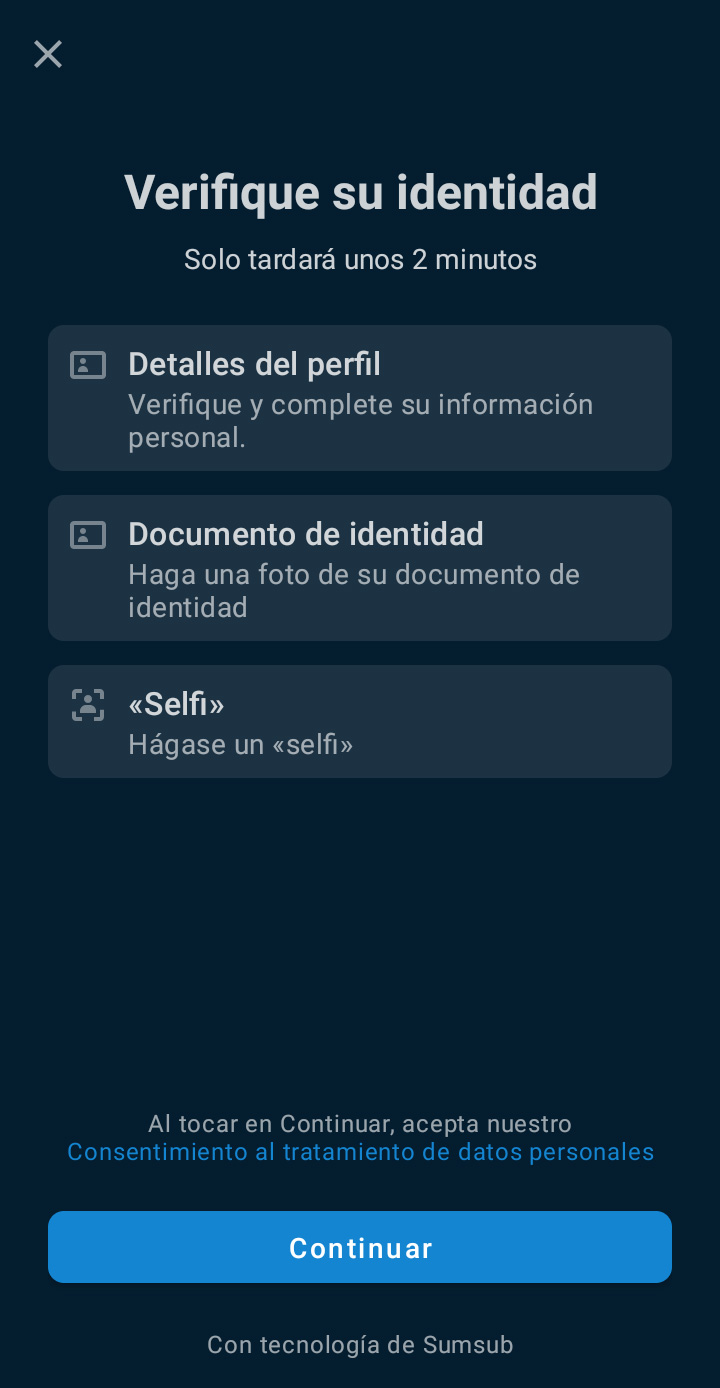

After confirming that you want to increase the level, the platform will throw a series of protocol questions of simple choice, such as the reason for your operations in Reserve and what is the origin of the funds that you deposit in this wallet.

You will then start a three-step process. In each one you must provide different information. The first requires providing personal information, such as place of residence or mobile phone.

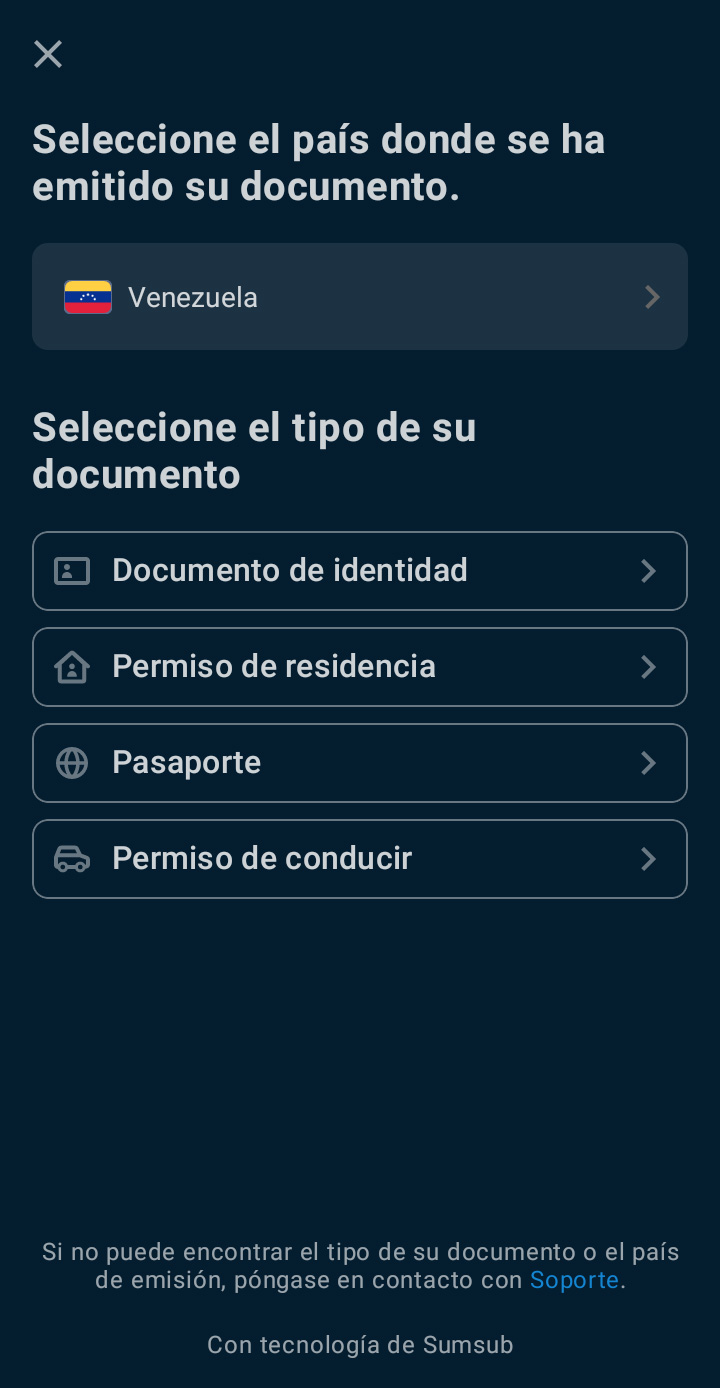

The next requirement is to take a photo of a document that confirms the identity of the user. It can be an identity card or passport, a residence permit or a driver’s license. It is important that the document data is legible in the photo.

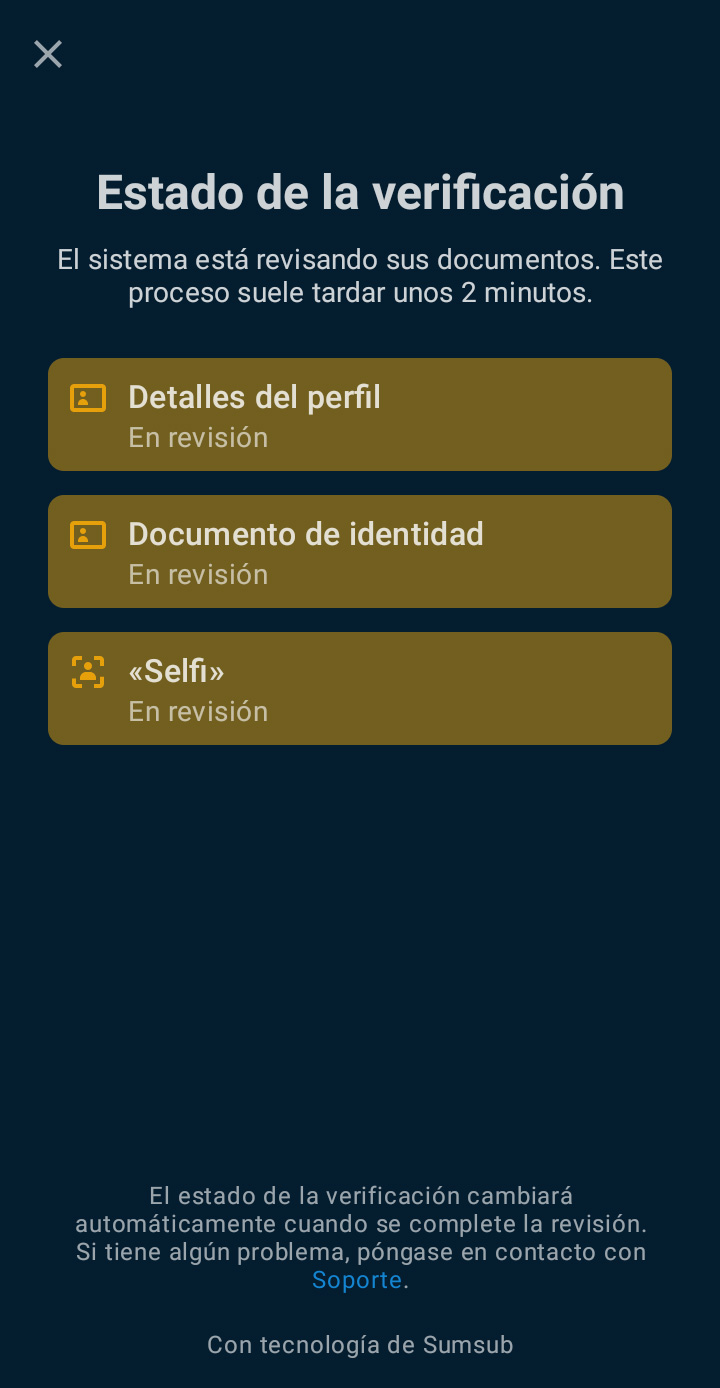

Finally, it is required to take a photograph of the face. The platform will automatically activate the camera in ‘selfie’ mode to perform facial recognition. After a few minutes, the process ends and the data is verified.

In this way, you will be able to make your operations with much greater freedom, in addition to having access to more currencies and deposit and withdrawal methods. This will make it easier to manage money with a single platform.

Post Views:

104