On January 18, at Fitur 2023, the Dominican Government will have to make an important precision that it forgot to reveal in January of this year in Madrid: investors interested in operating hotels in the Dominican Republic must carefully select the geography where they wish to do so; If the provinces bear the name of a Saint or Apostle of Jesus (Santo Domingo, Santiago, San José, San Pedro, San Juan or San Cristóbal), the electricity rate they will pay will be exempt from the payment of fuel consumption taxes. used in the generation of electricity; On the other hand, if they are installed in geographical areas within provinces that bear the name of the Virgen de la Altagracia, Santa Bárbara (from Samaná) or La Romana, concessioned to private companies that operate Isolated Electric Systems (SEA), the rate they will pay include these taxes. Someone might think that discrimination has its origin in some macho tradition of Catholicism inserted in our tax system or in some settling of accounts ad infinitum with the descendants of Pilate, the Roman Governor of Judea.

The discriminatory treatment based on geography that has been submitted to the Legislature for its approval, is contained in Article 9 of the Bill that modifies Law 112-00 on Hydrocarbons. There, an amendment to Law No. 253-12 of November 9, 2012 is introduced, so that from now on the sales of electricity generating companies that are not to the Electric System are excluded from the refund granted by the Tax Administration. National Interconnected (SENI).

If this modification is approved, the electricity companies that operate the SEAs in geographical areas not served by the EDEs will pay the taxes levied on fuel consumption. Currently, all electricity generation companies, regardless of who they sell their energy to, are exempt from these taxes, since the State knows that, if they are taxed on fuel consumption, the generators would include it in the invoices they deliver to EDEs or, in the case of SEAs, end users of the service. Which companies operate SEAs? The Punta Cana-Macao Energy Consortium (CEPM), the Bayahibe Electricity Company (CEB), Cap Cana Caribe, the Punta Cana Tourist Services Corporation, Costasur Dominicana, the Las Terrenas Light and Power Company (intervened), El Progreso del Limón (intervened), Puerto Plata de Electricidad, and Edesur, which operates an SEA in Pedernales.

The promoters of this initiative maintain that it is progressive because by establishing this tax in the case of SEAs, the wealthy who have second homes in Punta Cana, Cap Cana, Bávaro, Bayahibe and La Romana will be the ones who will pay for the inevitable increase in electricity rate that will occur when the companies that operate the SEA proceed to carry out the complete “pass-through” of the liquidated tax. Observing the annual consumption of fuel oil, gas oil and natural gas of the main companies that operate SEAs in the country, as well as the energy that they buy from SENI generators, it is estimated that the proposed change would generate an increase in tax revenues close to to RD$2,000 million (0.04% of GDP), assuming that the rate increase does not reduce consumption and, therefore, electricity generation.

The fundamental problem with this initiative is the discrimination it generates. For what reason should the 126 hotels established in Bávaro, Macao, Punta Cana, Cap Cana or Bayahibe pay an electricity rate that includes a tax on fuel consumption, while those operating in Santo Domingo or Santiago would continue to pay a rate exempt from this? tax? For what reason would the 4,699 small and medium-sized companies established in the area of Bayahibe, Punta Cana, Macao and Bávaro have to pay a hefty electricity rate for this tax, while the hundreds of thousands of large, small and medium-sized companies established in Greater Santo Domingo, Santiago and San Cristóbal would be exempt from paying it?

How could it be justified that the hundreds of thousands of households in the National District and Santiago are exempt from paying this tax on their electricity bill, while we order 44,096 households in the towns of Bávaro, Macao, Punta Cana and Bayahibe to pay this tax on the consumption of fuel used in the generation of electricity, aware that the monthly income received by the latter, according to the ENGIH-2018 of the Central Bank, is barely equivalent to 25% of the income received by households in Greater Santo Domingo?

Is the requested change compatible with what is stipulated in number 6 of Article 75 of the Constitution on the Fundamental Duties that mandates “pay taxes, in accordance with the law and in proportion to their taxpaying capacity, to finance public expenses and investments ”? Is it possible to reconcile the discriminatory treatment contemplated in the initiative submitted to Congress, with the Right to Equality established in Article 39 of the Constitution that reads “all people are born free and equal before the law, receive the same protection and equal treatment? institutions, authorities and other people and enjoy the same rights, freedoms and opportunities, without any discrimination for reasons of gender, color, age, disability, nationality, family ties, language, religion, political or philosophical opinion, social or personal condition ”? Wouldn’t people be discriminated against based on the province where they reside? Is discriminatory treatment against national and foreign companies with concessions to operate SEAs in certain geographies compatible with Article 221 of the Constitution on Equal Treatment, which ensures the same legal treatment for business activities, public or private, as well as equality of conditions for domestic and foreign investment? If the province of La Altagracia has a lower degree of development than Greater Santo Domingo, how would we justify legislating to punish one of the least developed and reward the most developed, contrary to what is postulated by Article 221?

Discrimination can be resolved in two ways. A first option is to levy the consumption tax on all fuels used in the generation of electricity, regardless of whether the energy is sold to the SENI or the SEAs. This option would be ideal if fuel prices were low, such as those prevailing in April 2020 (US$17.30/BBL for fuel oil, US$27.50/BBL for diesel, US$1.80/MMBtu for Henry Hub natural gas and US$47.30/MT for coal).

However, in a situation like the current one, in which the prices of fuel oil, diesel, natural gas and coal are 5.5, 6.9, 3.0 and 6.9 times higher, this option would trigger an unprecedented increase in the electricity rate, more even if it is accompanied by the “pass-through” not carried out to the date of the fuel price increases. The second option, maintaining the exemption for all and without discrimination, would therefore be compatible with “The Theory of Second Best” that Richard Lipsey and Kelvin Lancaster developed in 1956.

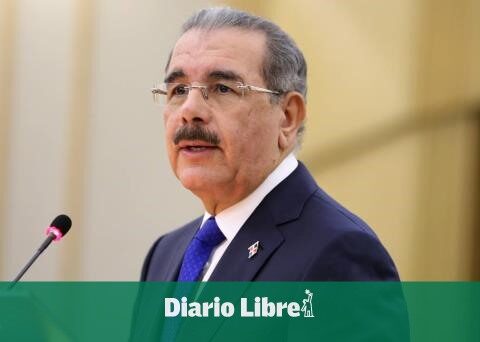

Could someone suggest a “third best” alternative: Let’s eliminate the SEA exemption and grant cash transfers to the 44,096 affected households and 4,699 small and medium-sized businesses to compensate them for the electric rate increase they will suffer. Tourists and the wealthy who have second homes in resorts would be affected. In this case, the electricity rates paid by hotels would be higher than the current one, which is higher than the subsidized rate paid by hotels in the capital to EDEs and the privileged rate they pay if they buy as Non-Regulated Users from generators. of the SENI. Both, the subsidized and the privileged, explain a part of the deficit of US$1,000 million that the EDEs had in 2021. With 270,000 fewer Russian and Ukrainian tourists, with an increase projected by the “Consumer Airfare Index Report” of 5% monthly in international tickets until June of this year without including the impact of the Avtur price increases, and with the “pass-through” to the hotels of the increase in generation costs of the companies that operate the SEA caused by the rise in fuel prices in the international market, any marginal increase in the rate paid by hotels served by companies that operate SEAs induced by a “tax reform” would not be sensible. Much less, after the extraordinary effort made by President Abinader in January of this year in Madrid, when he marketed the Dominican Republic as the promised land for hoteliers around the world.