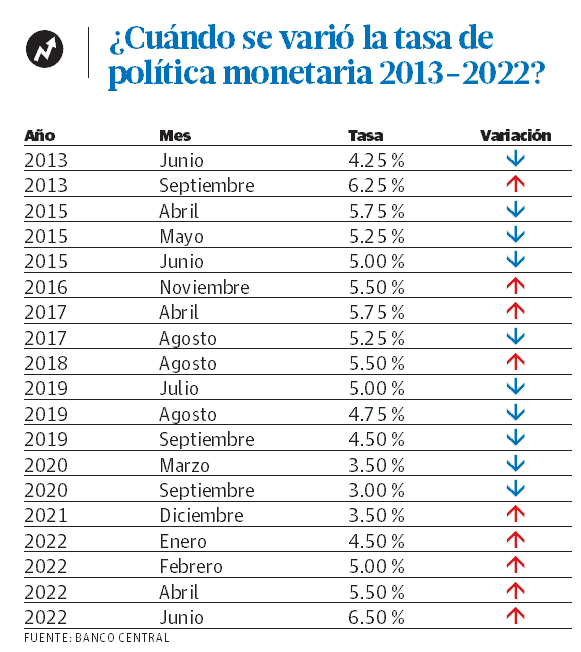

The new increase to 6.50% of the interest rate of monetary politics It is the highest percentage of this variable since 2015, when at the end of the first quarter of that year the central bank decreased to 5.75% the trend of 6.25% that had been fixed since September 2013.

The recent decision announced the day before yesterday to increase it by 100 basic points, that is, from 5.50 to 6.50% per year, is considered appropriate and timely by the Association of Multiple Banks of the Dominican Republic (ABA) under the understanding that “one of its main reasons is to control inflation”.

In a press document, the ABA highlighted that “the accumulation of two relevant shocks such as the pandemic and Russia’s war with Ukraine has placed the world in an inflationary situation that has not occurred in recent decades, turning into a complex panorama, volatile and uncertain.

He pointed out that the United States Federal Reserve recently approved the highest interest rate hike in 22 years to contain inflation and expects to continue raising it this year.

“Most central banks in the region have made significant increases in their interest rates. monetary politicsespecially those that follow the inflation targeting model,” he added.

The accumulated inflation (rise in the prices of goods and services) between January-April of this 2022 was 3.78%, and if it is measured from April of last year to April of the present it was 9.64%.

How does this apply to the consumer?

Although it is a measure that is taken economically to counteract inflation, the consumer feels it in an important way.

The ABA warns that “the transmission channel of this measure is verified through bank interest rates, both active and passive, which banks are obliged to adjust as these operations are renewed, always considering the particularities and characteristics of each activity.

But, in addition to the interest rates of financial products, when the interest rate of monetary politics is impacted on consumption and investment. “As the cost of loans increases, people see their resources reduced and, therefore, restrict, substitute or postpone consumption,” observes the ABA.

“In times of high and persistent inflationary pressures, largely of external origin, the right thing to do is mitigate internal factors that could exacerbate price increases. To do this, the cost of money is increased through active interest rates and signals are sent that favor domestic savings through passive rates. If this does not happen, the fundamentals of macroeconomic stability would be affected”, says the ABA.

The central bank projects that the country’s economic growth would be around 5.0% in 2022.

The ABA Explains

-

It is the rate established by the Central Bank as a target and reference for interbank operations, that is, for loans between banks, which in turn influences the rates that banks apply to their products.

-

If it rises, it is because the Central Bank is trying to contract inflation, impacting the purchasing power of people and companies, by somehow affecting domestic aggregate demand. If it falls, the aim is to expand the economy by providing money at the cheapest cost.

-

It will be directly influenced by the inflation in the country. Everything is interrelated; If the increase in demand does not come with a consideration on the supply side, an imbalance is produced, having an impact on inflation and, therefore, on wages and purchasing power. By raising the monetary policy rate, the aim is to reduce pressure and bring about a balance between supply and demand.

-

When it falls, it tends to produce a reduction effect on the rates at which banks are going to lend to each other. This influences the price curve of the products of financial intermediation entities, both assets (investments, loans, etc.) and liabilities (deposits, certificates, etc.). When it rises, it leads to a gradual increase in interest rates on credit and deposit products in the financial system. In the event that a fixed rate has been contracted, these instruments (assets and liabilities) must expire in order to adjust the rate at the time of relocation. While, if they are at a variable rate, they would be adjusted according to the contractually established moment.