Slow progress of disastrous summer harvest delays planting of winter crops, the consequences of the lack of rain worsen in the property marketboth in the availability of cattle for slaughter and in the prices of calves and other replacement and wintering categories and wool price failed to maintain bullish momentum from the previous week.

Grains: the worst case scenario

With the uncertainty regarding the rains that allow a good start of the crops, the Uruguayan producers begin to advance in the planting of winter crops -both rapeseed and wheat- in a framework that has a feeling of revenge after what could be considered the worst summer crop harvest in history.

It is a harvest that is also delayed due to the greening of the withered soybeans during the summer and that reacted to the rains in March.

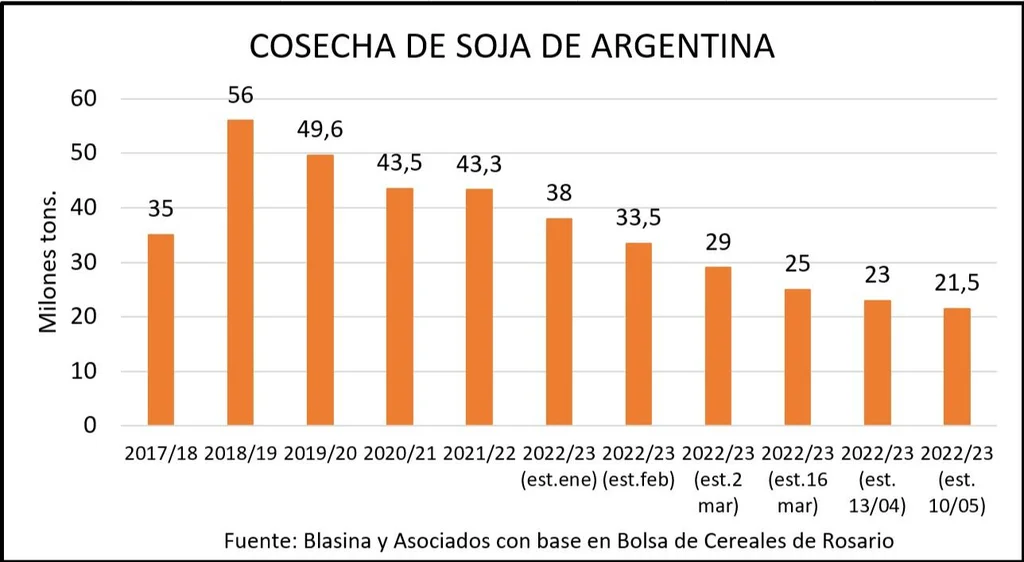

In uruguay it will not reach even close to a million tons of soybeans. The progress of the harvests confirms the worst scenarios in both Uruguay and Argentina.

Indeed, the Rosario Stock Exchange once again cut its forecast for Argentine soybean production from 23 to 21.5 million tons. Cold days, even with frost in February in the southern zone, and the persistence of drought in the rest of the territory are behind this new cut, which is already based on real data that corresponds to 54% of the harvested area.

Market closing

The low production of Argentina contrasts more and more with the gigantic Brazilian production which was corrected upwards by the National Supply Company of Brazil (Conab) at 154.8 million tons, above the 153 million projected by the United States Department of Agriculture (USDA).

Precisely in its projection this Friday, the USDA corrected Brazil’s soybean production to 155 million and ratified the corn production record.

This great production in Brazil is the preview of a great harvest in the US, which in the case of corn is projected to be a record. And if the 155 million tons of soybeans this year in the neighboring country impress, for next year the first projection is 163 million tons.

It is very likely that the high prices of soybeans and corn that Uruguay has at this time will end. In the next harvest the accounts should be with very different figures.

Instead, In wheat and rice, the world would continue with limited stocks so that the most basic crops for human consumption must continue to have a price that is at least firm..

For livestock, the grains that are raw material for the rations enter a period of much more accessible prices than in the past. All this, of course, if the weather allows it and normal yields are achieved.

Market closing

Price wrestling in the livestock market

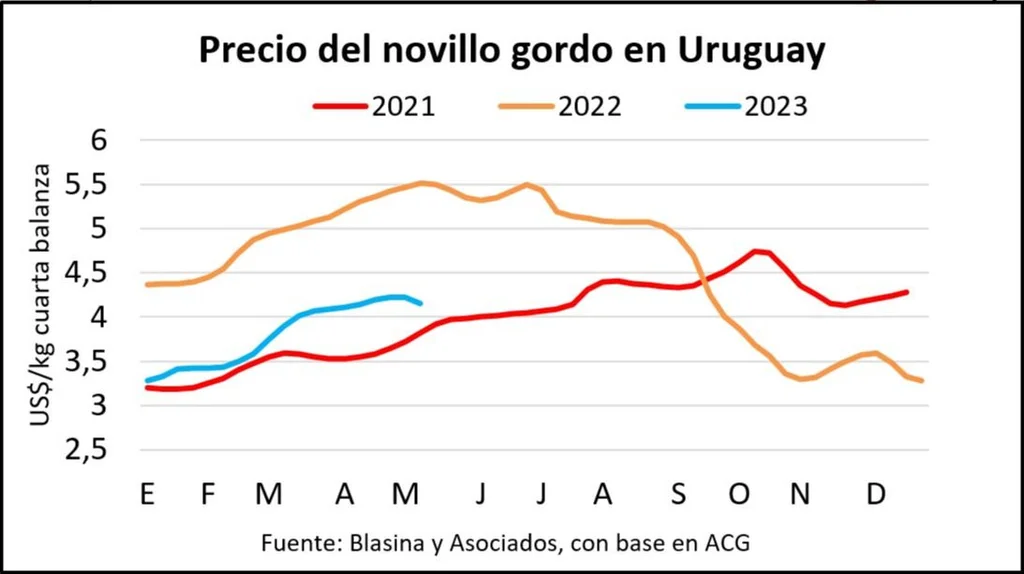

Stability in the fat cattle market was followed by a value adjustment proposed by the industryin a context of predominance of slaughter of farmyard animals through the quota window 481.

The drop in prices is being gradual, with minimal business volume hand in hand with an offer that continues to be low.

“The adjustment is greater in the intention than in the completed deals”commented Alejandro Zugarramurdi, owner of the desk of the same name.

The price proposal for fat steer, depending on the refrigerator, ranges from US$4 to US$4.15 per kilo in fourth scale. For the fat cow it goes between US$3.70 and US$3.80, and for the heifer on the axis of US$3.90.

Considering a very low level of cattle supply heading into winter, this downward movement in prices could be short-term or be reflected in a lower level of activity. For the operator, there will be a reduction in the post-window work of quota 481.

Last week 41,652 cattle were slaughtered, 12% below the previous weekbut with one less day of operation due to the May 1 holiday.

It remains persistently below 50,000 heads per week and so far in 2023 it shows a year-on-year drop of 20%.

In addition to the low supply, there are some international signs of low demand and prices. Chinese demand remains weak for both beef and sheep meat. To the extent that stocks are reduced and consumption recovers in the Asian giant, a revitalization of purchases is expected, with a view to the second half of the year.

This was stated this week by the multinational Minerva Foods in its quarterly report: “The movement of China should gain speed in the coming quarters as a result of the increase in consumption and the reduction of stocks, which would be transferred directly to Chinese imports of beef”.

The export price had a weekly rebound for beef to US$ 4,890 per ton –in the middle of the quota window– but in 30 days it has not managed to cross US$ 4,500, according to preliminary data from the National Meat Institute (INAC). In the last 30 moving days the average was US$ 4,390, stable since the beginning of April.

Market closing

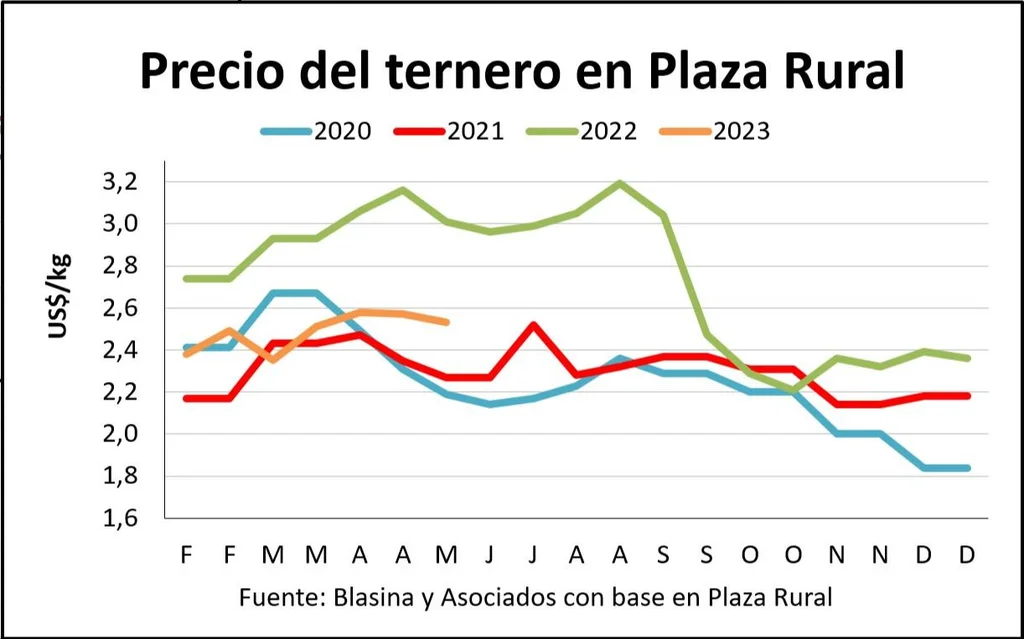

The replacement market also seems calmer, except for the export calf. On the one hand, there is the effect of meteorological uncertainty, with rains that continue to be delayed and that delay the growth of verdeos and pastures at the gates of winter. On the other, caution affects the fat market.

Whole calves, however, go another lane. Hand in hand with a reactivation of standing exports, it has supported prices in this category.

The overall average for calves was down just 1.6% at Plaza Rural this week, from $2.57 to $2.53. Light and medium steers rose 1%, and were the exception in a context of price correction.

Zugarramurdi commented that, outside of the screens, it is being difficult to close deals in the field and join the ends between buyer and seller. More sense cattle appear, mainly in breeding pieces and pregnant cattle.

In lanares the entrances are longerin some cases up to 20 days and without price, and in others around 10 days. Prices are around US$3 for the ewe and up to US$3.30 for the heavy lamb.

There is more supply and demand has dropped. The slaughter, in fact, was 19,568 sheep last week, very similar to the same period in 2022. Since the beginning of the year, there has not been a week with less than 20,000 slaughtered sheep.

Market closing

Wool: weak demand and falling prices

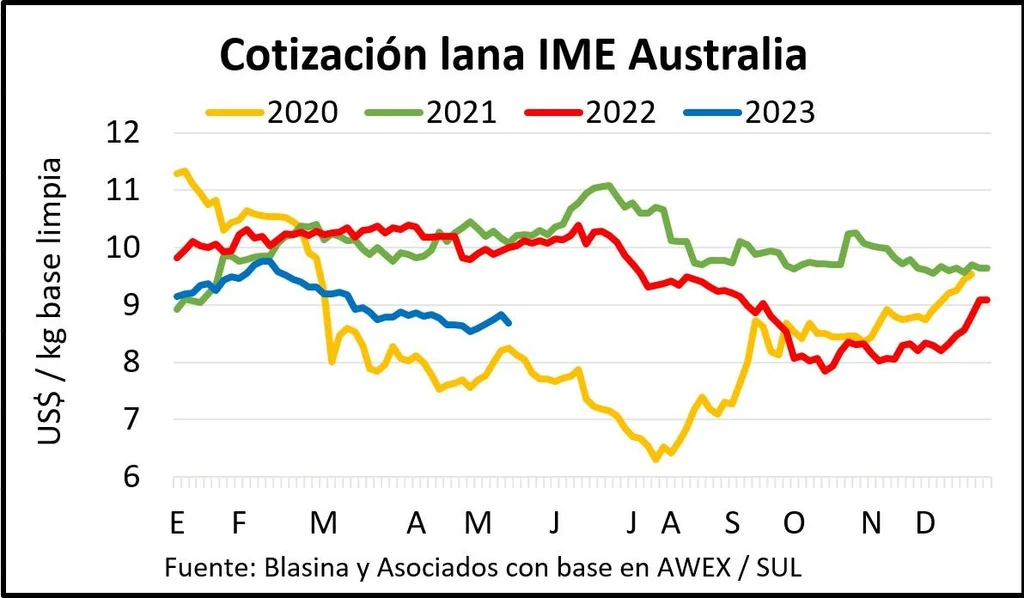

The price of wool failed to maintain the momentum of the previous week, the most advanced of the year, and closed lower in the Australian markets.

The Eastern Markets Index (IME) fell 0.7% to US$ 8.68 per clean kilo base. In local currency the drop was stronger, 2%. The Australian currency appreciated 1.3% after the rate increase announced by the local monetary authority.

The rejection of the drop in prices meant that almost a third of the wool registered in the auctions on Tuesday and Wednesday was withdrawn by the sellers, in a market where it was difficult to do business.

European demand also fell due to low quality levels in fine and superfine wool, as the volume of batches with low vegetable matter content remains low.

For Chinese buyers it was an opportunity to improve the quality of their purchases as prices declined, targeting sub-18.5 micron Merino wools, where the Australian dollar declines were 20 to 40 cents.

The exception was 26 micron wool, which increased its price in dollars by 6%.

References for 28 micron wools also advanced 1.3%.

in the local market The Uruguayan Secretariat for Wool (SUL) reported the sale of numerous batches of Ideal wool between 22.2 and 24.3 microns, conditioned with green piping and good washing performance values, with prices between US$4.20 and US$ 2.80 per kilo dirty base. In total, 43 thousand kilos were placed.

In the first quarter of 2023, US$ 51 million were billed for exports of about 10 million kilos of wool and by-products. The amount fell 16% compared to 2022 and the volume fell 2%.

The drop was greater in the washed wool market, where the volume traded fell 14% and income 22%. In the dirty wool market, the volume exported grew 11%, although the amount in dollars fell 8% due to the drop in prices, particularly from March.

In turn, income from exports of frozen bone-in sheep meat was US$ 40 million between January and April.