As every year, March 31 is the deadline for taxpayers to comply with the declaration and/or payment of the ISLR. The regulations establish that any employee who has received enrichment for an amount greater than Bs 400 will be obliged to declare and, if applicable, pay the respective tax to the National Treasury.

By Ahiana Figuera and Brian Contreras

March began and also the last period of the year for Venezuelan taxpayers to comply with their declaration and/or payment of Income Tax (ISLR). Until Friday the 31st of this month is the deadline for natural persons and legal entities carry out this procedure corresponding to the fiscal year of 2022.

The tax regulations establish that salaried natural persons must declare and pay the ISLR during the first quarter of each year, so the recommendations of tax lawyers is that taxpayers take their time or seek advice to comply with this obligation.

«I always recommend that in this and other issues, to the extent possible and based on a healthy assessment of the level of patrimonial risk that involves the activity that is carried out or the decisions that must be made, that people get assistance for a qualified advisor in tax matters”, said Camilo London, a tax expert in his blog Management and Taxes.

He recalled that natural persons are classified as ISLR taxpayers in accordance with the provisions of literal (a) of article 7 of the Law that governs this tax for the fiscal year of 2022, published in the Extraordinary Official Gazette 6,210 of December 30, 2015. .

In particular, people who work under a labor relationship, that is, those who provide their services to an employer with whom they have a labor relationship; they have a type of enrichment with a specific treatment unlike those who exercise trade or provide independent services.

“The difference is that for employees there is no possibility of applying costs or deductions to their received remuneration, since their salary perception is considered directly as Net Enrichment for the purposes of the ISLR,” said London.

Some doubts about the ISLR

From what amount should they make a declaration?

Article 77 of the Income Tax Law establishes that “individuals residing in the country and the lying inheritances that obtain an annual net global enrichment greater than one thousand tax units (1,000 UT) or gross income greater than one thousand five hundred tax units (1,500 UT) ) must declare them under oath before an official, office or before the institution that the tax administration indicates in the terms and forms prescribed by the regulation.”

In the case of those who exclusively provide services under a dependency relationship, his normal salary is net enrichment and not gross income.

Because of this, employees will not consider the reference value of 1,500 UT for gross income, but only the milestone of more than 1,000 Net Enrichment Tax Units established in article 77 of the Income Tax Law.

“In the case of employees who exclusively provide services under a dependency relationship, they will not be obliged to file an income statement, if their annual net enrichment is less than or equal to 1,000 Tax Units,” London explained.

What value of the Tax Unit to apply?

For the determination of the ISLR of the annual exercise between January 1 and December 31, 2022, the value of the Tax Unit is only Bs 0.40.

This implies that any wage earner who has received net enrichment from a territorial source for an amount greater than Bs 400 will be obliged to declare said enrichments and determine, if applicable, the respective ISLR to be paid in favor of the National Treasury.

“For this reason, in general, practically every employee in the country will be obliged to present their 2022 income statement, whether or not they generate tax to pay. Because it is difficult for us to find an employee with a total salary for the year 2022 of less than 400 bolivars,” London stressed.

How to declare and pay the ISLR?

One of the positive points of this tax is that you can complete the process without leaving home. Everything necessary to make the declaration can be found on the Seniat website (http://declaraciones.seniat.gob.ve), while the payment can be made from the taxpayer’s bank account.

1.- The first step It will be to enter the system with the user of the taxpayer who must pay the tax. This can be done in the “Seniat Online” box by clicking on “Natural Person”. A new window will be enabled in which the system will request your access data. Enter your username and password to access.

Having entered the system, the “Taxpayer Menu” will be enabled, a panel that presents four options: tax processes, customs processes, inquiries and taxpayer services. To declare the ISLR you must click on “Tax Processes”. More options will be displayed and you must select the first one: “ISLR Declaration”. Subsequently, choose the “Final” declaration.

The window will update with a form with several questions and single selection items. The usual thing is that the marked options remain as they are. In the same way, it is advisable to read and introduce any changes in case you need it and then click on “Save”.

2.- Next, a new screen will be loaded in which the taxable amount of the total remuneration received by the taxpayer during the previous year will be requested. Check your monthly statements or ask the company’s Human Resources department for help to get a more accurate number. Enter the amount in bolivars and click “Continue”.

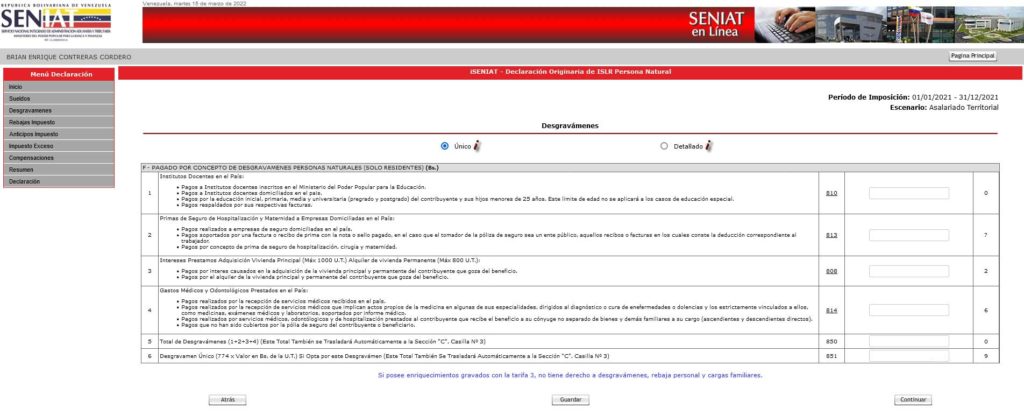

The following screen establishes a set of cases of payments from the taxpayer during the year to the State. If during the previous tax year, the person made payments to educational institutes, insurance companies, interest payments for the purchase of a home or had medical expenses, you can enter the amounts paid to calculate a tax credit and reduce the amount of your ISLR. If these payments do not apply, leave the boxes blank.

Other rebates and deductions can be entered on the next screen. The reduction of 10 UT applicable for natural persons is automatically calculated, but you can also enter family responsibilities (decrease of 10 UT for each one), the amount of a possible surplus of tax payments for investments in previous years or if you develop activities industrial or agricultural. Enter the corresponding data and the system will calculate the deduction.

In the event that the taxpayer issues a mandatory advance payment during the fiscal year, he must also specify it according to the cases presented in this return. Otherwise, leave the boxes blank and continue with the process.

3.- The following screen It is to specify if there were overpayments in previous years. You must indicate the year of the exercise and the number of the statement, and then detail the amount in excess. If this is not the case, leave the boxes blank and continue.

Now the system will present the possible compensation options, which depending on the case could deduct the amount to be paid if you have a favorable balance for tax credits. You must specify the possible amounts to be compensated. If you don’t have any, leave the boxes blank and continue.

The last form will calculate the total amount to be paid after all deductions and compensations. In “Number of Portions” you can specify in how many parts you are going to issue the payment, to choose between one and three. In addition, in the last box you must enter your email to receive the ISLR notification with the amount and details to make the payment. After filling in the box, continue.

In this way you will have registered your declaration in the Seniat.

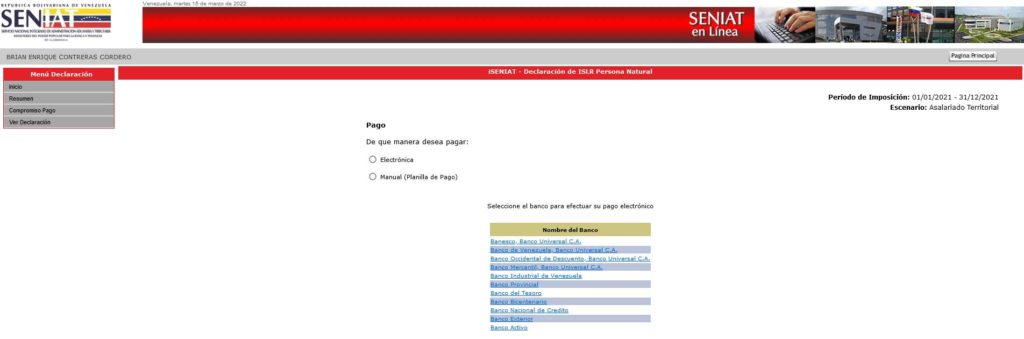

4.- The next step is to pay. To do this, you need to click on the number of the fraction you determined. A new screen will appear asking if you want to make the payment electronically or manually (with a physical form), select your preference and continue. You will be presented with a list of banks with which you can make the payment.

What remains to be done is select a bank of your choice and see how the ISLR payment is processed in that system, since the mechanism will depend on the bank.

*Read also: How to make a complaint about the air service in the new INAC automated system

Post Views: 2,279