At the beginning of the week the agricultural market reached new peaks that it failed to sustain. Wheat in Chicago approached $ 300 as it closed Monday at the highest since 2012.

There is a shortage that comes from the last harvest, Saudi Arabia hit the ground running by buying 1.3 million tons and the deterioration of crops in the United States (USA) is beginning to worry, in some areas due to excessive rains and in others, where it is already implanted, again due to drought.

In addition, Egypt bought 180,000 tons of Russian wheat, whose exports are shrinking due to the increase in export taxes by the Putin government (26% was exported in October compared to the same month of 2020). The Russian wheat export tax is around US $ 70 per ton.

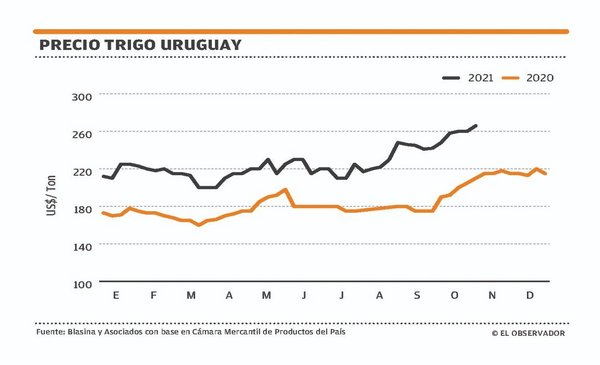

Price reference.

Biofuel production

Corn Ethanol Production Is At All-Time Highs. Thus, the summer cereal started the week prolonging the rise of previous weeks that it did not confirm later, sustaining a stability of high prices. But last week was the largest ethanol-making week in US history. Due to price relationships given the high value of corn, in that country there will be what is called a “war for the hectares” between corn, soybeans and wheat in the next boreal spring.

Soy is in the calmest and most stable market in recent weeks. With a good advance of the US harvest, beyond some delay due to rains and a good start to the Brazilian planting, the market remains stable and the prices offered in Uruguay are between US $ 440 and US $ 445 for the next harvest.

In oilseeds, the United Nations Food and Agriculture Organization (FAO) reported the highest price in history for October and rapeseed is an example of this, since it holds a value of the order of US $ 730 per ton to the producer.

A stage in the markets ends in which the pressure of the US harvest is felt. The eyes will go to South America where for now La Niña has only been felt with the week of strong heat at the end of October, which will cut the yield of wheat and barley that will not reach as high levels as last year.

Prices remain high, as do costs. China banned the export of fertilizers in October, and this week Russia took the same action. The US warns of a shortage of herbicides, as part of the same phenomenon. The adjustments needed to reduce greenhouse gas emissions are felt in supply chains, and a low-yield grain harvest can result in a serious loss.

The winter harvest is assured. The summer season begins its most intense sowing stage.