The magnitude of the rise that the central bank will carry out is still a mystery. However, the reiteration of these measures in the face of one of the worst inflationary dynamics of the last forty years could considerably affect those economies that are not in a position to bear the consequences of these policies.

A recent report from the Dallas Fed details that most of the world’s largest emerging market economies should be able to withstand the Fed’s rapid and sharp interest rate hikes.

Difficulties for Argentina

Nevertheless, To do this, these countries must have high reserves in state coffers and low current account deficits, qualities that Argentina lacks. currently.

The country is outside the debt market in dollars, which would not affect financing issues. But it could exacerbate the difficulties in accessing the debt market for private companies.

Among the 13 emerging market countries examined in the Dallas Fed document, only Argentina and Turkey have a negative reserves figure.

Colombia Y Chili they have a large current account deficit, but have ample reserves and low amounts of foreign currency debt. Mexicowith one of the lowest foreign-currency debt holdings among the 13 economies, is in a much better place to withstand US currency shocks than it was 30 years ago, during the economic crisis that heralded the Tequila Effect.

reservations

This Friday the Central Bank (BCRA) It bought about $4 million from the market for its meager reserves, racking up about $95 million worth of purchases in the week, traders told Reuters.

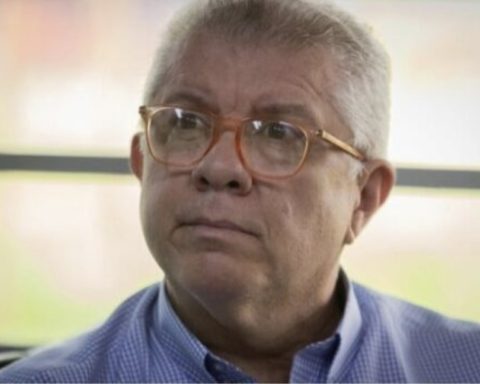

A report published days ago by the consulting firm Quantum, headed by former Finance Secretary Daniel Marx, indicated that the level of net liquid reserves of the Central Bank would be negative by some US$3.1 billionif it were not for the contribution made by the IMF in its currency, the Special Drawing Rights (SDR).

The report, which warns of the weakness of the monetary authority to deal with the exchange run, estimated that, given the liabilities, the Central is using the “laces” of deposits in dollars -although he highlights the “soundness” of these deposits in the banking system-.

On this subject the president of the Central Bank referred again this Saturday, Miguel Pescewho pointed out that the increase in the price of energy is affecting the ability to accumulate reserves in the short term, after which he assured that it is not a structural problem.

“We are in a moment of transition” that will come to an end with the winter and with the completion of the Néstor Kirchner gas pipeline, for which he stated: “we do not believe that an adjustment is necessary to contract aggregate demand or a violent devaluation.”

The rate hike in 1994

Inflation in the United States climbed to 9.1% year-on-year in June, with a large impact on energy and fuel prices, and reached a new record in the last 40 years.

The upward trend in the interest rate has not had a similar magnitude since 1994, which triggered a crisis in Mexico which caused a depreciation of its currency of more than 40% in real terms and an increase in the interest rate of the Mexican Treasury bill to three months to 70%.

The so-called Tequila Crisis was fueled by Mexico’s high level of external debt and low level of reserves, in addition to internal factors, including political instability. Still, emerging markets, with the exception of Argentina and Turkey, are in a much better place today, according to the article by economists J. Scott Davis, Michael Devereux, and Changhua Yu.

By El Cronista-RIPE