PDVSA informed through a statement of the suspension of the limitation period for bonds issued in the international market. The measure will enter into force for five years or until the US Government lifts the economic sanctions that prevent a restructuring of the Venezuelan debt

Venezuela’s state-owned Petróleos de Venezuela (PDVSA) has suspended the maturity terms applicable to debt bonds and related enforcement measures, the company said in a statement on Thursday, March 30.

The offer, known as a suspension of the statute of limitations, would give the Nicolás Maduro regime and creditors more time to work on a possible restructuring. But since the United States does not recognize the Maduro government, creditors say other guarantees are needed.

The country stopped complying with its interest and principal payments on bonds from PDVSA, Elecar and the Republic at the end of 2017. Time before the US announced sanctions against the Venezuelan oil industry. By October 2023, it will have six years without canceling the bondholders, so there are risks of lawsuits from creditors before that period.

Much of the Venezuelan bonds were issued under New York State law and have a statute of limitations clause stating that the interests of these titles are not legally enforceable after six years of non-payment, remembered Reuters.

The statute of limitations grants the possibility of suing after payment commitments have not been met; in the Venezuelan case, the term is usually valid for five years.

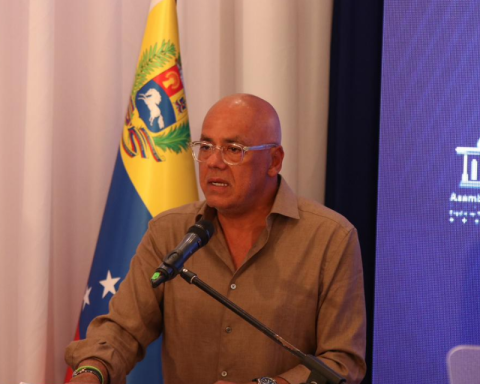

«From the date of this announcement and until the date set forth in section 3 below (the “Suspension Period”), all prescription and expiration periods (each one of them a “SOL Period”) applicable to the Bonds and the Enforcement Actions, whether under New York law, Venezuelan law or any other, will be deferred and suspended.” was indicated in the statement signed by Pedro Tellechea, president of the company.

Venezuela said it will postpone the legal deadline to sue for the maximum of 60,000 million dollars in debt in arrears, an attempt by the representative of the Maduro administration, to prevent creditors from filing a wave of lawsuits while trying to regain recognition from the US government, reported Bloomberg.

Through the statement it was announced that the prescription will enter into force for five years or until the US Government lifts the economic sanctions that prevent a debt restructuring.

Bondholders must now decide whether to accept Maduro’s offer or file a lawsuit to protect their claims, explained the news agency.

After PDVSA’s announcement, the creditors’ committee, which brings together funds that have Venezuelan debt for some 10,000 million dollars, celebrated the decision of the oil company and urged the opposition National Assembly of 2015 to support the suspension of the term of prescription.

Washington, after the elimination of the interim government led by Juan Guaidó, has given support to the opposition congress that created a committee to protect assets abroad, including the refiner Citgo, a subsidiary of PDVSA.

“A legally enforceable statute of limitations and expiration agreement would avoid wasting money and resources on litigation,” the creditors’ committee said in a statement reviewed by Reuters.

The Maduro administration made a similar offer to bondholders in 2020, to no avail. However, PDVSA stated that “the issuer once again expressly states its willingness to comply with the obligations derived from the Bonds.”

*Also read: PDVSA ad hoc board will appeal new decision of the Delaware Court against Citgo

Post Views: 753