MasterCard’s plans consist of discontinuing the Maestro cards and focusing solely on the Debit Mastercard line with contactless technology as of January 1, 2023, although this does not mean that the Maestros stop working, but rather that all new products that issue Venezuelan banks must have the new technology

After years of technological stagnation and backwardness, Venezuela is beginning to catch up with the advances that were taking place offshore. Banking was no exception. Although banking has seen the need to find solutions to deal with the particular conditions of the Venezuelan economy, it has also suffered from lagging behind the cutting-edge banking systems.

In most developed countries, technological development has run its course. The banking sector has become involved in this process to give rise to dozens of new financial solutions, which has led to the evolution of payment methods.

In this sense, for almost five years it has been more and more common to appreciate technology in everyday life. contactless, which allows actions to be carried out without any contact. Generally, it is used in cards and there are different areas in which they have a place. For example, in Venezuela this technology —although less sophisticated— is already common in the transport sector, with the cards used in the Caracas Metro.

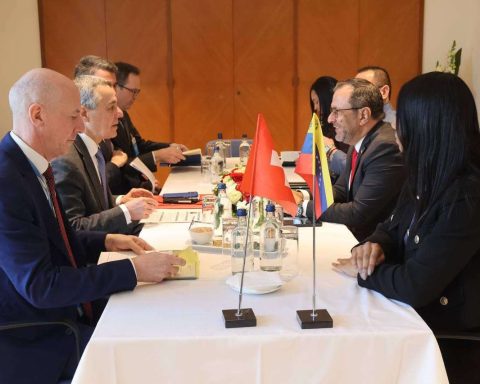

The bank hopes that it is time to make this technological transition with debit cards, which is why today the company specialized in payment solutions, Inteligensa, launched the first contactless card manufactured in Venezuela.

The president of Inteligensa, Venanzio Cipollitti, explained that, unlike Metro cards, bank cards have a much more specialized chip and work with a peripheral antenna that communicates with the terminals (points of sale) at a short distance. Therefore, by bringing the card a few centimeters closer to the point of sale, the transaction would be carried out, without the need to introduce the plastic at the point of sale.

Although each bank must establish the protocols with which this technology will be implemented, also taking into account the regulations of the country’s banking authorities, the initial approach is that they dedicate themselves to microtransactions for day-to-day purchases.

With this technology, the aim is to streamline payment methods in commerce, since no type of data is required. When making relatively low payments, the card would simply be swiped near the point of sale, without entering the password or providing the ID number. This data would be inside the chip.

«The great advantage, in addition to its speed, is that you do not need to give the card to the cashier. Everyone handles their card. That is very convenient in this context of a pandemic,” said the Inteligensa representative.

*Also read: Find out which banks increased the limit of their credit cards

For more significant transactions, of a few tens of dollars —although the limits are yet to be established—, the points of sale would request the user’s pin, as a security mechanism.

In fact, the card can operate like the plastics used today. In case the point of sale is not compatible with the technology contactless (as is the case with most terminals in the country), the card will have the ability to be introduced at the point of sale to be processed as usual today.

“During this transition, the terminals that cannot read contactless with all the speed and security that it offers, will be able to continue to be used in the same way provisionally,” Cipollitti pointed out.

MasterCard will transition in 2023

On the technological aspect, spokesmen for MasterCard —a multinational payment method— present at this launch, suggested that there will be a substantial evolution compared to the Maestro cards that have dominated the market in recent years.

Now the company will focus on the production of the ‘Debit Mastercard’, which constitutes a technological advance in almost all aspects compared to Maestro and will also be developed with the contactless system.

The most important transition that occurs is towards digital commerce, since the Maestro debit cards are not fully compatible with the new commercial modalities that are handled online. For this reason, it is not possible to pay for consumption in service applications such as Yummy without transferring money to the digital wallet through mobile payment.

The new Mastercard Debit cards would allow this type of consumption as if it were a credit card. “The Mastercard Debit Card is ready for all eCommerce transaction models,” said the company’s representative for Venezuela, Claudia Acosta.

For some Venezuelans, this technology is not unknown. Those who have international cards issued by banks such as Banesco Panama or Mercantil Panama, or even preloaded cards such as Zinli or Payoneer, have already accumulated experience with the benefits that MasterCard sells, although the points of sale in Venezuela are not yet adapted to process contactless payments.

Regarding the terminals, Cipollitti explained that much would depend on the businesses. Replacing outlets requires investment. In fact, with the entry into force of the Tax on Large Financial Transactions (IGTF), many companies were forced to renew their equipment, but not all of them succeeded. The National Council of Commerce and Services (Consecomercio) estimated expenses around 1,800 dollars per device.

*Also read: Polesel: Businesses that did not adapt to the IGTF lost up to 20% of their sales

Therefore, the transition from existing points of sale to new contactless ones is likely to be delayed. Meanwhile, different providers are beginning to market new terminals with this technology. Inteligensa itself already offers the Move2500 point of sale through its line of products InteliPointa brand with which it would have strategic alliances with up to 15 national banks to sell these devices.

Despite these obstacles, change appears to be imminent. Mastercard works abroad only with these new technologies and for the Venezuelan market an exemption was applied due to the situation of the country’s banking system. That license to continue issuing discontinued products was extended twice and is currently valid until December 31, 2022, but will not be renewed again.

MasterCard’s plans consist of discontinuing the Maestro cards and focusing solely on the Debit Mastercard line as of January 1, 2023. This does not mean that the Maestros will stop working, but that all the new products issued by Venezuelan banks They must have the new technology.

Keys and doubts about the launch of contactless

- Inteligensa did not reveal the number of banks that would start acquiring this technology, but a significant group attended the event and at least 15 institutions have alliances with the company.

- It is not clear if cardholders will have to pay for the new plastics with contactless technology, since it depends on the banking institutions. However, Inteligensa announced that the unit price would probably be a few dollars in case the bank decides to sell them to their clients.

- Banking institutions will announce their own dates to launch their products, but it could be before 2023, since MasterCard does not expect to continue issuing Maestro cards for next year.

- The new cards will continue to be compatible with most points of sale without contactless technology. They will simply be introduced like current plastics.

Post Views:

766