The blockade that Washington exercises on the financial operations of federal banks with money from the cannabis business hit Uruguayan pharmacies who cannot place their collection in local banksfor using United States (USA) institutions as correspondents.

The problem manifests itself, for example, when When buying marijuana at the pharmacy, credit or debit cards are not accepted, due to the risk that banks will close the accounts at these businesses. So so that the own Institute for the Regulation and Control of Cannabis (Ircca) does not advertise which are the 38 premises authorized to legally market this productso as not to expose them to the sanction

The issue has been on the agenda of the authorities for years – in a country that from the government of José Mujica sought to make a point in the regularization of the sale– and last week they raised the discussion in the committee of Deputies to legislate for the fight against money laundering. The deputy of the MPP, Diego Reyes, consulted the IRCCA about the difficulties that the North American regulation – which considers as illegal and on a par with cocaine or heroin any substance with more than 0.3% of Tetrahydrocannabidol (THC)– has generated in Uruguay.

Despite the various –unsuccessful– missions of the Central Bank and other authorities to unlock a way out, the IRCCA acknowledges that there are no “substantive advances”. Juan Ignacio Tastás, executive director of the organization, reported that on his trips to Canada they found an operation that “does work” and that “calls for curiosity”: “The product was purchased with credit cards and we did not find that there were any problems,” he said. .

“That made us think and wonder why those countries – which also have interaction with other banks that must go through the US – can operate, at least, with less difficulty than us, and here we have that drawback,” he said. and admitted that it may “deserve additional work” to study the case.

Photo: Leonardo Carreno.

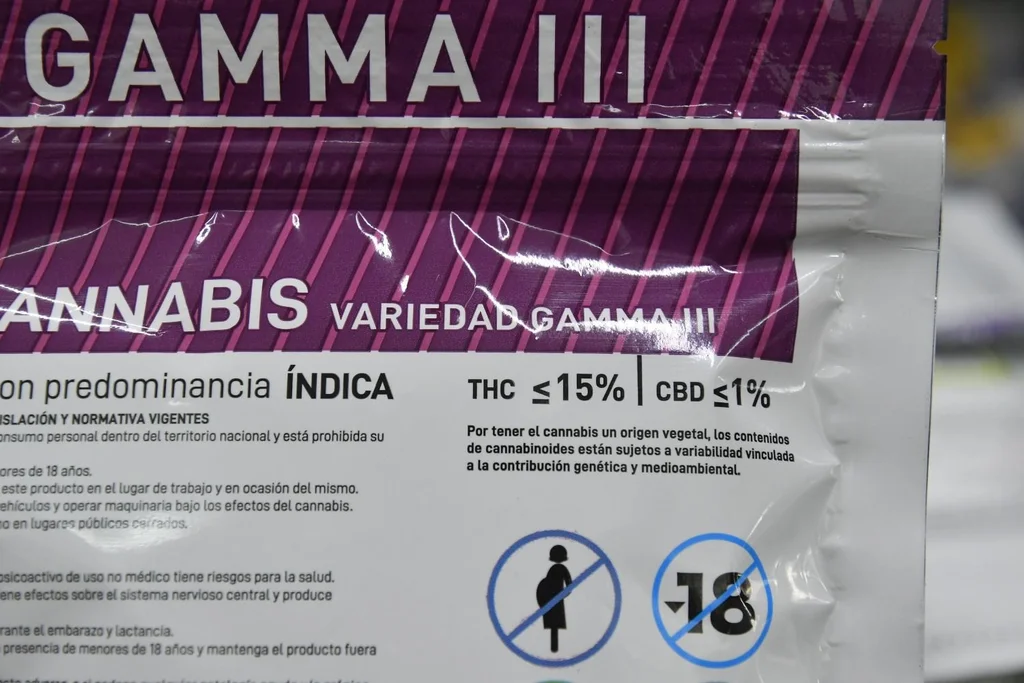

New Gamma variant marketed in pharmacies

The representative of the Ministry of Industry within IRCCA, Gonzalo Maciel, added that one of the most important Canadian banks told them that “they were encouraged to enter the cannabis business but for a cost-benefit issue and, in addition, bank backs “. “Canada is a North American trading partner; must have another weight when sitting down to talk that, evidently, Uruguay does not have“said assistant minister Omar Paganini.

“Uruguay does not have a back to be able to negotiate or twist that arm and overcome that obstacle”concluded Maciel, who added that the California model cannot be applied in the country either, which operates with the local banks of that State with the advantage of having a “very important” market and with state banks that do not report to international institutions.

According to Maciel, the explanation of the Bank of Montreal in Canada was that “they put in the chest because they have the back to do it”. “They gave us to understand that they even threatened: ‘If you don’t let me operate with this, I’ll close accounts of your businessmen who have accounts in Canada.’ But everything associated with the fact that the business was worth it.”

The MIEM delegate added that the only international company in Uruguay that was authorized to have an account at the bank received “twenty days later” the call “from the president of Banco República and told them: ‘Guys, everything you We said we were going to do it and the accounts, it doesn’t run'”.

The IRCCA authorities stressed that they know that “many pharmacies have been reluctant to enter the marijuana dispensing system for recreational use for fear that their bank accounts will be closed.” “They send them a telegram announcing that they have so much time to close the accounts and to withdraw the money, which obviously generates brutally important costs and problems for the operation.“, said Tastás, who affirmed his conviction that “the vast majority of pharmacies” would turn to the sale of the product if the financial “stumbling block” did not exist.

Deputy Reyes, from the MPP, stated that “it is clear that In addition to being the first country to regularize, we are the first to have these obstacles in the financial system”.