Concern about what is happening in Ukraine helped to raise prices in the grain market at the end of this week and in Uruguay soybeans are once again above US$505 per ton, while the price of corn begins to loosen. Due to the entry of free-range cattle, the pressure on the demand for the finished cattle subsides, although the limited supply sustains the values. Wool had its best week since February, breaking the downward trend.

Next, the weekly closing in the markets of the main items of agribusiness in Uruguay.

Stable livestock market

May begins with a stable livestock market that is resisting downward pressure for nowbeyond concerns about the forage outlook, with little water ahead and winter just around the corner.

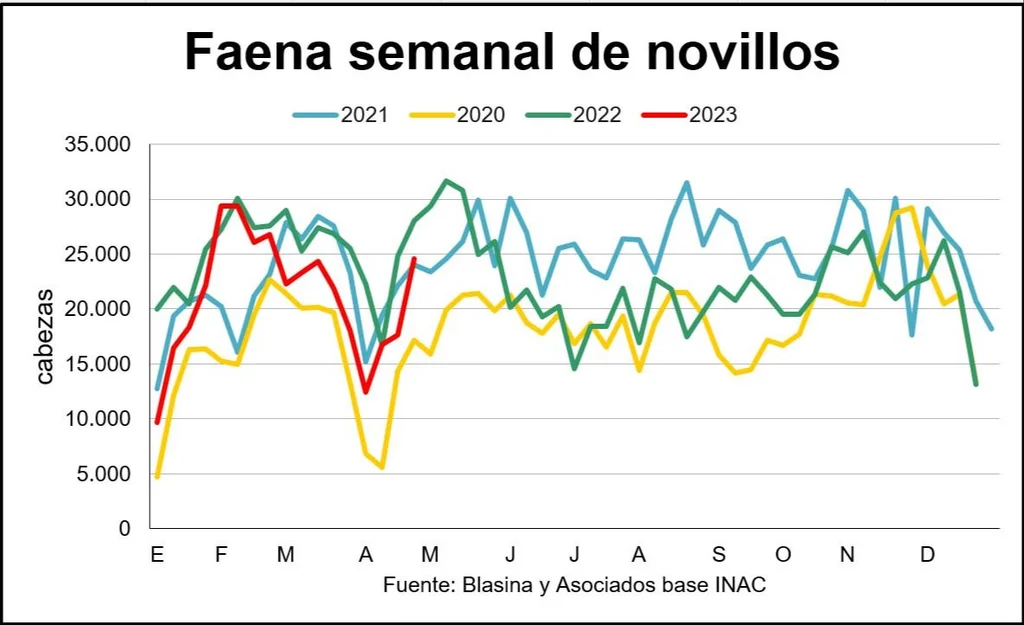

The entry of free-range cattle in a new 481 quota slaughter window boosted slaughter and had a stabilizing effect on prices, but with greater room for maneuver for slaughterhouses and less purchasing pressure on pasture cattle. From the industry there is an intention to lower prices.

The The highest business frequency for the fat steer is between US$4.10 and US$4.20 per kilo in fourth scale and between US$3.80 and US$3.90 per cow, in line with the previous week. The gap in prices and tickets between plants persists, ranging from a week to 15 days.

Closing in the markets.

If the slaughter is observed, the lack of supply is hidden by a greater participation of fattening cattle, but it is expected that after this quota window the minimum availability of grazing animals will once again be noticeable.

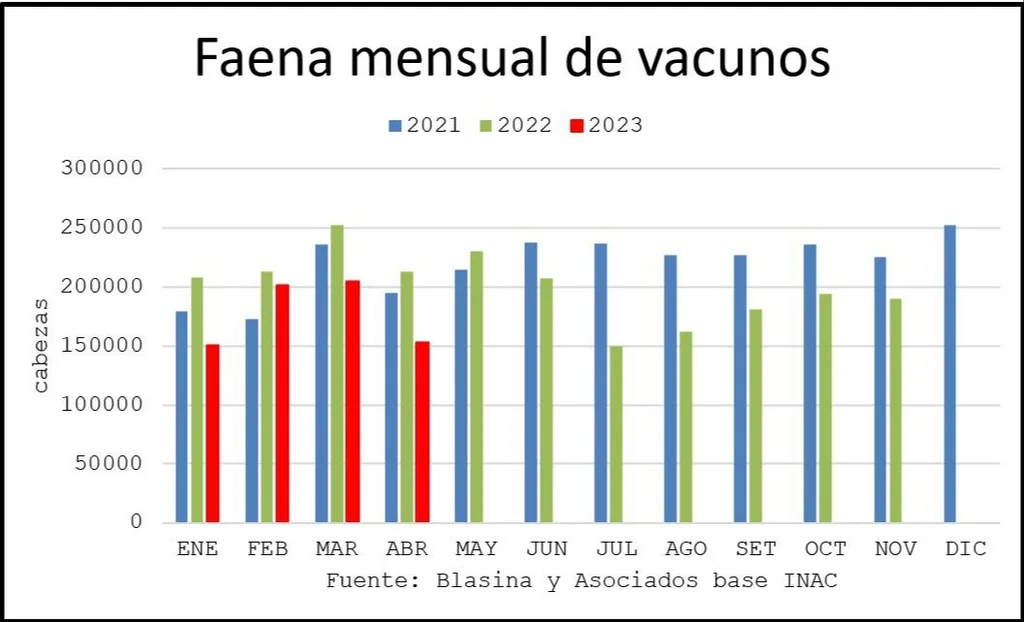

The operation in refrigerators last week grew 27% to 47,231 cattle, almost 10,000 heads more than the previous week. The largest increase was in steers. The monthly slaughter in April was the second lowest of the year, with 152,574 cattle: 26% less than a year ago and just above January, which registered almost 151,000 heads.

Closing in the markets.

Closing in the markets.

In foreign markets, China has shown calmer demand and values in recent weeks. For now, the export price remains stable, very close to US$ 4,500 per ton. Last week the average was US$4,663 for meat, according to provisional data from the National Meat Institute (INAC) and US$4,418 in 30 moving days, similar to the previous week.

In the replenishment, with more supply, and caution due to a drought that has not yet gone, demand is selective and values seem to have peaked. This was reflected in the average grid of the Consignee Association (ACG) this week, with drops for some categories such as calves that went from US$2.56 to US$2.49. Not so the calf destined for export, which remains firm and rose to US$ 2.53.

In the auction of Lot 21 this week, the calf showed firmness, with an average of US$ 2.53. There was a strong participation of live exports, with interest in whole calves. The pens were also operational.

Closing in the markets.

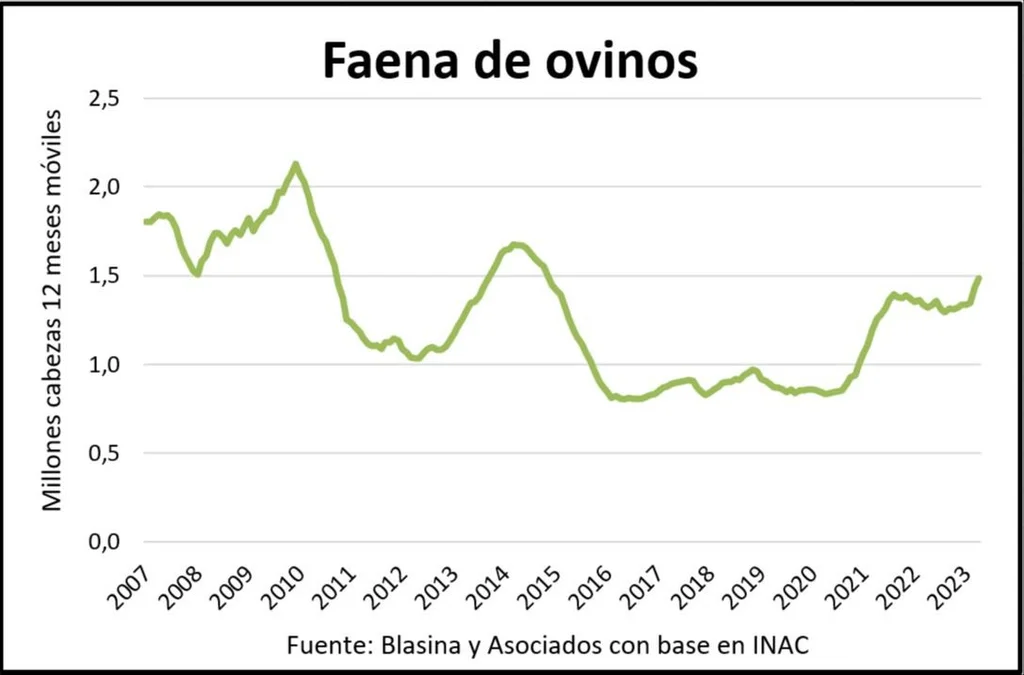

There has been a price correction for sheep, with a Chinese demand that has slackened hand in hand with a greater supply from Oceania. Business is around US$3.45 for heavy lamb and sheep and US$2.90 for capons.

Taking advantage of the drought and the very good condition of the animals, many producers rushed the sale, which explains the high volumes of slaughter registered in the first four months of the year.. In April, sheep slaughter almost doubled that of the same month in 2022: there were 118,921 heads against 60,785, an interannual increase of 95.6%.

“The value of the wool is one of the factors that has led to getting rid of flocks and that has affected this bulky number of sales this four-month period,” said Gustavo Basso, from Gustavo Basso Negocios Rurales.

So far in 2023, sheep slaughter has climbed 41%, going from being below 400,000 head between January and April 2022 to almost 560,000 in the first four-month period of this year.

Ovine meat values are still significantly lower than the records of a year ago, and atypically below the price of beef. The latest data published by INAC indicates that in the accumulated of the last 30 days the average has remained on the axis of US$ 3,900 per ton and is 24% below the US$ 5,148 registered in the same period of 2022.

Closing in the markets.

to the rhythm of war

The international grain market had a rebound towards the end of the week which allowed it to finish balanced, and still with slight increases after beginning by extending the losses of the previous two weeks.

The scant progress in relation to exports from Ukraine -it is not known if they will continue after May 18, when the current agreement expires- and the doubts about the volume of production in the United States are the factors that have played a role in making the funds go strongly buyers on Friday and accentuate the rise of the previous day. A rebound in oils also had an influence.

Defections from shipping companies increasingly reluctant to take grain from Ukraine made themselves felt by the end of the week.

Since the agreement was signed, Ukraine has been able to export about 29.5 million tons of grains and oils, including 14.9 million tons of corn and 8.1 million tons of wheat.

This week the number of ships going to lift cargo dropped to two per day from a daily average of three to four ships in the last three weeks.

Danish shipping group Norden is among the companies that do not send ships to the region. “We are not engaging in that trade at the moment. It is a risky area, it is very difficult to predict what will happen,” Norden Chief Executive Jan Rindbo told Reuters.

“Things can change quickly… from the time you agree to come in and pick up a shipment to the time the ship arrives,” he said.

Currently, each shipment takes an average of at least nine days and involves sailing to one of the three Ukrainian ports involved in the pact and undergoing required inspections.

Analysis by commodity and maritime data platform Shipfix showed the number of cargo orders — global requests for ships available to transport grain from Ukraine — fell to 355 in April from 489 orders shipped to market in March, Reuters reported.

As of this week’s close, there are 107 ship forward grain orders on the market: 94 for May and the remainder for the coming months, Shipfix data shows.

In addition, between 40 and 60 commercial ships are still stuck in all of Ukraine’s ports that have not been able to leave due to strict restrictions on which ships can leave the corridor, adding to concerns about holding more assets if it is not reached. an agreement.

Insurance for incoming ships has been another critical factor, and war coverage policies have to be renewed every seven days, costing thousands of dollars.

Rates have held steady at around 1% of a ship’s value for weeks, according to market estimates.

Insurance industry sources say there are no changes to coverage arrangements for now, although conditions could change quickly.

“We would expect a significant review of what is currently charged and how it is underwritten if the grain broker agreement is not extended and if there is an escalation of the dispute,” an industry source said.

To the weight of this framework of uncertainty due to the supply is added in Chicago that the winter wheat crop in the United States does not improve, with only 28% in good condition: the same as last year, which showed poor results.

The uncertainty about the output of the oils coincides with the end of the harvest in Brazil, which may encourage greater firmness in soybeans in the coming weeks.

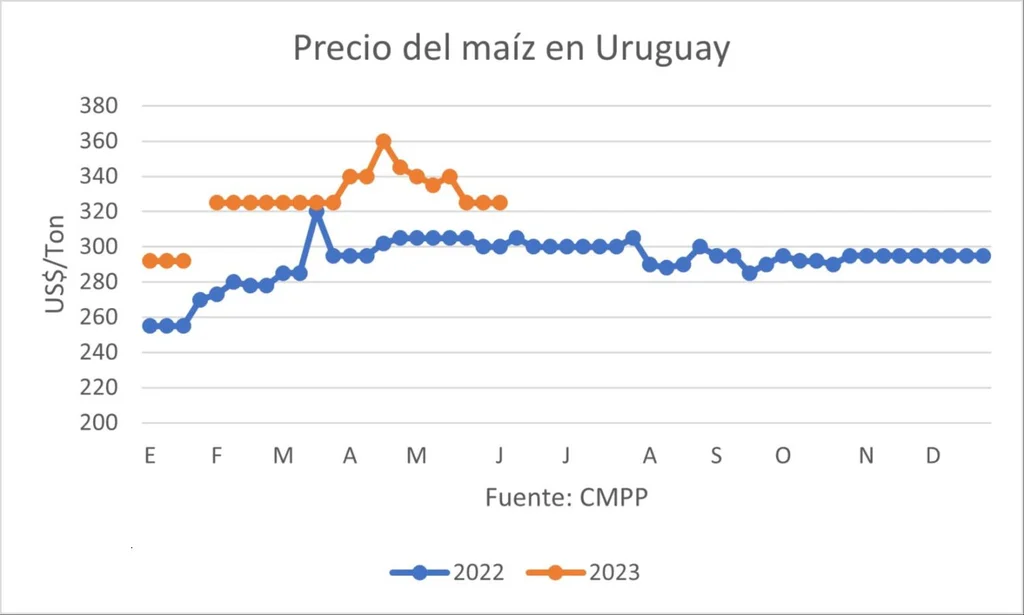

At the local level, this allowed soybeans to return to above US$500, above US$505, while the price of corn begins to loosen as the harvest of safrinha corn from Brazil and Paraguay begins.. This can mean a relief for feed costs in livestock and dairy. The winter promises to be a high demand for grain to complement the forage shortage derived from the drought.

The drought continues and its effects are felt in the delay in planting in Argentina and parts of Uruguay, especially Colonia and Soriano, and due to the magnitude of the problem in the neighboring country, it could be an important factor in the markets in the coming weeks.

Closing in the markets.

The price of wool is affirmed

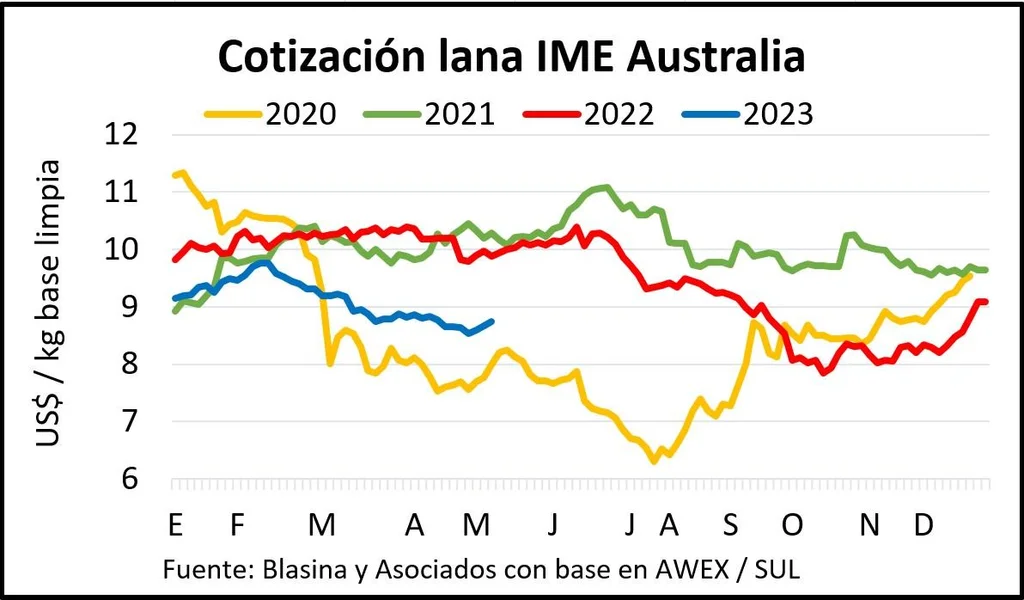

Wool prices in Australia rose in most categories, confirming the change in trend that began in the middle of the previous week. At the local level, the demand continues proposing values below the expectations of the producers, so the operation is scarce. Prices are still 15% below those of a year ago and 10% below those of early 2023.

It was the best week since February at Australian auctions, building local dealers’ confidence that price levels will continue to rise.

The market perceives greater competition among buyers due to the need to acquire inventory, with renewed demand from China, a customer of 80% of the wool exported by Australia.

The Eastern Markets Indicator (IME) closed at US$ 8.74, with a weekly increase of 1.6%. Prices in dollars performed better than in the local currency, strengthened against the US currency.

Superfine wools of less than 18.5 microns were the most prominent, in a context of strong demand for all types of Merino wool. Lower supply volumes and increased interest from Chinese buyers along with textiles from Europe and India stimulated bidding, particularly on higher-quality lots.

Next week the offer in the three centers of Australia will consist of 48,500 bales, almost 10,000 more than this week, a volume that could be a brake on the momentum of the values.