For her part, the net collectionthat is, discounting the tax refund, totaled $39,562 million with a real year-on-year fall of 0.3%.

In the first two months of the year, net collection decreased 0.2% in the interannual comparison.

The difference between gross and net collection corresponds to the tax refund, which can be made through payments made with credit certificates issued by the DGI or by cash/bank refunds.

consumption taxes

The excise tax were the main source of income for the State fund and totaled $25,490 million, with a fall of 3.9% compared to last January.

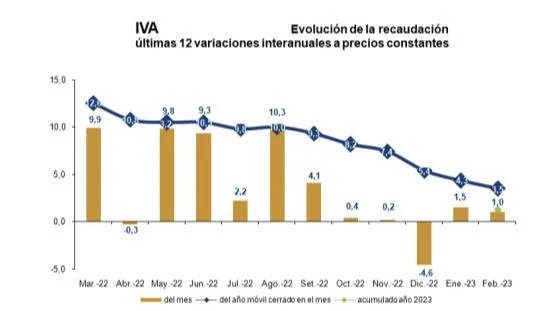

The proceeds for VAT totaled $21,394 million with a positive real variation of 1% year-on-year.

Meanwhile, Imesi’s collection was $4,096 million and registered a year-on-year drop of 23.4%.

There was a drop in the majority of goods that are taxed by IMESI last month: fuels (-25.3%), automobiles (-21%), tobacco and cigarettes (-29.5%), and beverages (-1.2 %).

For the comparison of fuels, the collection of February of last year for this concept ($3,127 million) is taken into account, with the total of February 2023 that includes two items (fuels and CO2 emissions that add up to $2,338 million).

Income Taxes

The collection of the Income Tax from Economic Activities (IRAE) reached $5,728 million and had a real year-on-year growth of 17.6%.

Finally, the collection of Personal Income Tax (IRPF) reached $8,449 million, and fell 11.4% real year-on-year.

The collection of income tax category II (paid by workers) fell 13.4%, while category I (to capital) grew 2.4% in the interannual comparison.