The Multiple Banks Association of the Dominican Republic (ABA) today valued the boost to the financing of low cost housingwhich allows buyers to obtain resources with low interest rates, conditions that have been possible through the implementation of Law 189-11 on the Development of the Mortgage Market and the Trust, the Vivienda Feliz program and the monetary stimuli provided by the Bank Central.

In a press release, he considered that an element that favors the access of more people to acquire their own home is the increase in the price range limit for the classification of low cost housing from 2.6 to 3.5 million pesos up to 4,852,211.2 pesos where it currently stands, according to the recent adjustment made by the General Directorate of Internal Taxes (DGII).

The ABA highlighted that, through the liberalization of the 21,424 million pesos approved by the First Resolution of the Monetary Board dated January 12, 2023, aimed at low cost housing which includes those of the Happy Family Housing Program of the Ministry of the Presidency, the contribution of commercial banks to this type of housing will be significantly increased.

“The houses belonging to said project have a series of conditions such as the initial amount bonusITBIS bonus and rate bonus, incentives that have an important effect in reducing the financing requirement and in the financial cost for the purchasers of these homes,” the banking association said in a press release.

“For the first time in the financial history of the Dominican Republic, it will be possible to grant financing with a final rate of 4% for the acquisition of a low cost housingby combining these facilities granted by the Trust Law, together with the aforementioned provisions of official subsidies announced, “said the union.

Also, with these subsidies from Happy Housing programthe banks will be able to finance the family nucleus, so that this makes possible the possibility of jointly opting for a decent roof, reported the union.

Banks allocated RD$188,000 million for housing loans

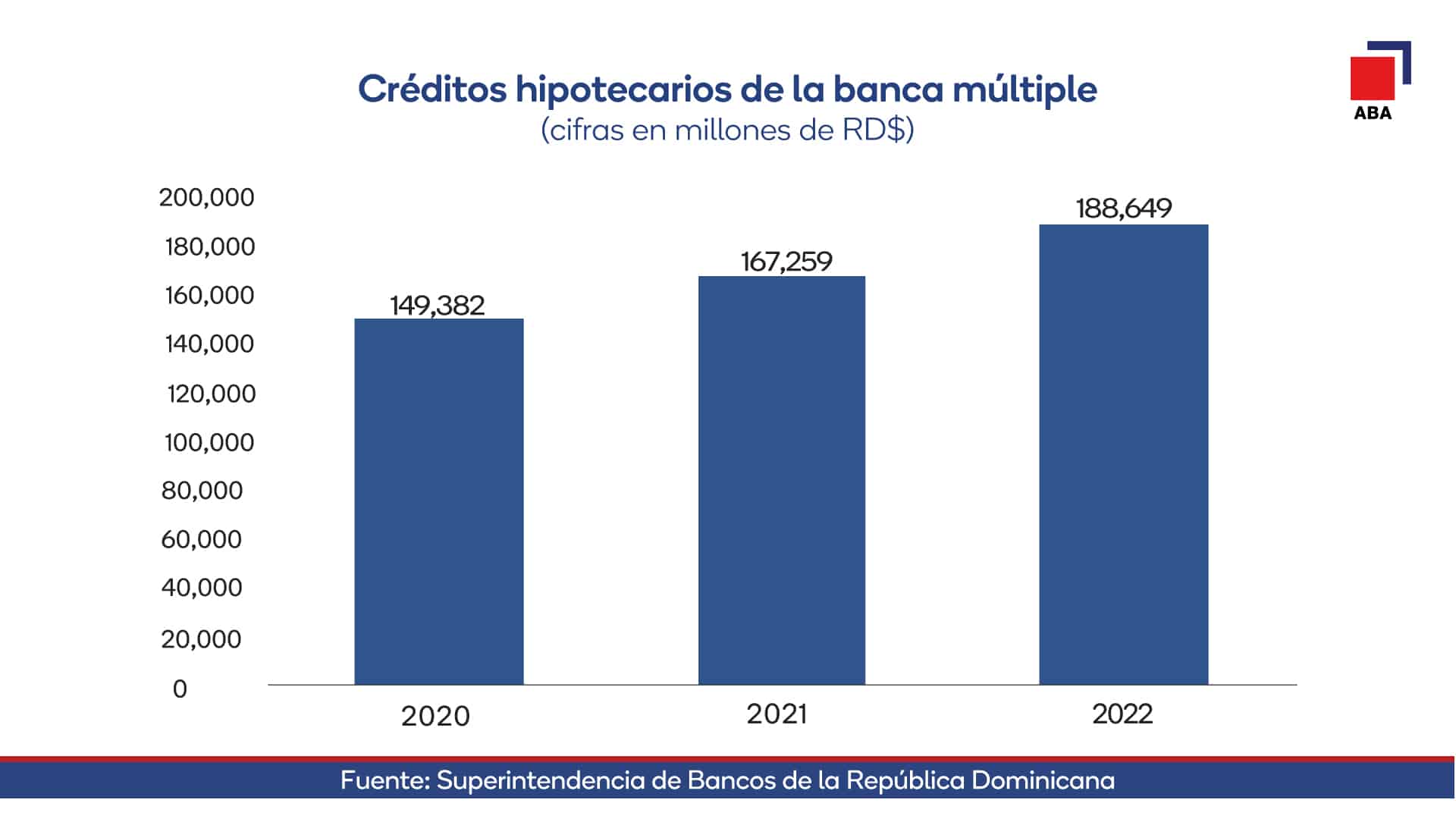

Between the years 2020 and 2022, the mortgage credits of multiple banks increased by 39,268 million pesos, a result that was mainly favored by the placement of resources by multiple banks through the monetary flexibility measures promoted by the Central Bank of the Dominican Republic, affirmed the ABA.

The Association of Banks detailed that the portfolio went from 149,382 million pesos in December 2020 to 188,649 million pesos in December 2022, showing a cgrowth of 26.2%expressed the ABA in a press document.

It specified that the indicated increase was channeled through 8,080 new loansout of a total of 76,545 current loans, according to data from the Superintendency of Banks.

The union broke down that, of the total portfolio, were allocated:

- 171,314 million pesos (90.8%) to the debtor’s home acquisition

- 8,493 million pesos (4.5%) to the acquisition of a second home or summer vacation

- 6,787 million pesos (3.6%) corresponded to the acquisition of low-cost housing from a trust

- To the remodeling and construction of said homes 2,055 million pesos, equivalent to 1.1% of the mortgage portfolio

The union indicated that the multiple bankingwith its financing, contributes to the acquisition and remodeling of clients’ homes, and to the reduction of the housing deficitstanding out as the main provider of these resources if one considers that the resources provided by multiple banks for the purchase of homes represent 64.4% of the total mortgage portfolio of the financial system.