The General Directorate of Internal Taxes (DGII) announced the start of the 2021-2022 Bachelor of Tax Administration Internship Program, with the participation of 73 students from 27 polytechnics from different provinces.

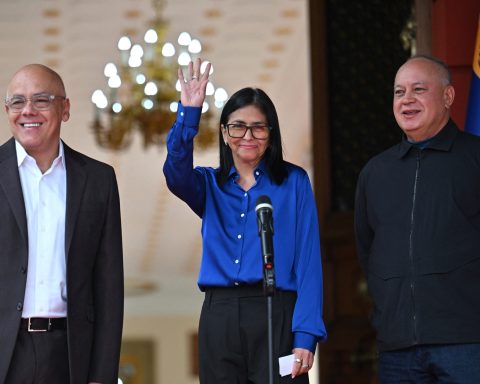

The announcement was made during an act at the Tax Policy and Management Training Center (Capgefi), headed by the head of the DGII, Luis Valdez-Veraswho said that it is a source of satisfaction and joy every time a seed is planted that germinates in the preparation of a human being.

“We feel good when we manage to pass on our learning to this generation,” said the head of the DGII, while adding that he sees young people as the people who will lead the country’s destiny.

In the activity, Valdez Veras was accompanied by the director of Capgefi, Juan Jose Disla Ledesma; the Deputy Director General and Compliance Management, Francisco Torres; the deputy director of Facilitation and Services, Ricela Spraus; Joseph Cancelvice minister of the Ministry of Higher Education, Science and Technology (MESCYT); Vincent de PenaDeputy Minister of Youth and Miguel Andres Abreuof the Professional Technical Directorate of the Ministry of Education of the Dominican Republic (MIINERD).

Can read: Banesco holds a meeting with Cibao clients

Planning

Valdez Veras highlighted the tax education programs to masters and doctorate level with universities in the country and abroad. One of them is Law and Society, which is attended by 10 employees of the DGII.

“Another milestone in the matter is that October 27 has been declared the “School Day of Tax Culture”, highlighted Valdez Veras.

“Weekly trainings are carried out aimed at companies, universities, polytechnics, public and private schools, therefore, both the Veranito program and this internship program will contribute to creating a better tax awareness in the country,” explained the head of DGII.

For his part, Disla Ledesma advised this new generation to empower themselves to establish the vision that society has of an official of believing himself to be the owner of state assets.