Page Seven / La Paz

The National Tax Service (SIN) reported yesterday that it asked taxpayers who already register the sale of goods and services through digital media in Bolivia, to update the information on Economic Activities in the National Register of Digital Biometric Taxpayers (PBD ) within 60 days, but ruled out a new tax as denounced by opposition lawmakers and some analysts.

According to the SIN, the task is carried out in response to the request of business associations such as the National Chamber of Industry (CNI) and that the measure only applies to firms that operate in the national territory.

The SIN statement comes to light after opponents, including deputies Marcelo Pedraza and Luisa Nayar, from Comunidad Ciudadana (CC), denounced an alleged “imposition” or collection of taxes on digital services and online study platforms .

“The MAS put him no more,” said Pedraza, while Nayar spoke of “taxes on housewives, students and citizens in general.”

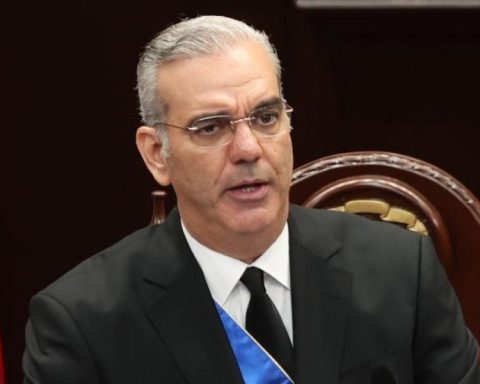

Given this, the executive president of the SIN, Mario Cazón, rejected those versions. “It is not the responsibility of the SIN to create taxes. The law creates taxes, the Plurinational Legislative Assembly passes it to the Executive so that the President promulgates it; We have not created any taxes, the only thing we have done is to adapt our classifier of activities to the current reality ”, he asserted yesterday.

The provision is contemplated in the Normative Resolution of the Board of Directors (RND) No. 102100000020 of November 4, 2021 that was published by the SIN. “This regulation has a national scope; therefore, it only includes taxpayers who already operate in the national territory with the sale of goods and services through the internet, as their main and / or secondary activity; therefore, it does not include services offered from outside the country, “the statement said.

Taxes reported that among the taxpayers that to date carry out related economic activities are: “Intermediation Services in the Sale of Goods and Services through Digital Media”; Orders Ya, Yaigo, Tigo Money and Superticket are included; the sale of airline tickets online from companies such as BOA or Tropical Tours. In the category of “Provision of Digital Content by Download or Streaming” are companies such as Bolivia Cine.

While the “Provision of Technology in the Cloud” includes telecommunications companies such as Entel and Tigo, “which have been providing these services for quite some time,” complements the SIN newsletter.

Analysts see new tax

Analysts Roberto Carlo Gil, from the Bolivian Institute of Tax Studies, and cyberactivist Mario Durán believe that the government intends to tax people for digital services.

“This implies that any person who develops a legal economic activity within the field of the digital economy, must issue an invoice and benefit from the tax debit and credit,” said Durán, noting that the SIN may have “difficulties in identifying the taxpayer in the virtual world ”.

Gil says that “the usual steps are being laid, which would be followed, in the event of a law that sought to insert the payment of Value Added Tax (VAT) for digital services.” Cazón recalled that the Government froze in May the bill of taxes on Digital Services in Bolivia.

The expert Gil adds that it is intended to oblige “all natural and legal persons to modify their registration in the Taxpayers Register”.

The resolution of the SIN gives a period of 60 calendar days (January 2022) for updating the data. “Once said period has expired, the procedure for Reliability of the Register will be followed.”