The dollar In uruguay registered a minimal fall (-0.04%) in wholesale operations this Tuesdays, which was $43.07. However, in theSo far this year, the exchange rate weakened 3.6% against the Uruguayan peso. This behavior worries the Union of Exporters of Uruguay (UEU), which Last week he conveyed his concern about the trajectory of the greenback in the future. On the BROU public board, the dollar closed at $41.95 for purchase and $44.15 for sale. In Brazil, for its part, the dollar fell sharply this day (0.7%), to 5.18 reais per greenback.

Precisely, the last macroeconomic bulletin of the Center for Development Studies (CED) is entitled What happens to the dollar in the world and Uruguay? with the aim of putting different elements on the table and implications of this depreciation of the dollar in the domestic market.

The paper recalls that, fundamentally, the price of the dollar in Uruguay “usually depends more on factors from the external scenario than from the domestic scenario.” In this sense, the CED points out that the dollar is usually a countercyclical variable in the level of global activity, particularly in the United States and China, today the great drivers of world growth. “In times of strong economic expansion the dollar tends to weaken and in times of recession or slowdown in growth the dollar tends to strengthen“, he indicated.

Second, the evolution of the dollar directly affects the prices of raw materials as long as they are expressed in said currency. When the US currency strengthens, the purchasing power of the other currencies is reduced, that is, those who demand it have to spend more of their own currency to purchase the same amount of goods.

On the contrary, when the dollar weakens, the purchasing power of those who demand raw materials increases, which increases their demand and consequently their prices. In particular, it is relevant to look at the relative yuan/dollar price given that China has long been the main buyer of raw materials in the world, and also of Uruguay.

CED

Third, the CED report maintains that the dollar also shows a countercyclical performance of international financial conditions. In contexts of high liquidity (low rates, unconventional monetary expansions, large fiscal stimuli, etc.), the dollar tends to weaken, while when more restrictive conditions prevail, the dollar tends to strengthen.

The current cycle and the future of the dollar

He adds that international financial conditions are still expansionary, which reinforces the relative weakness of the US currency despite greater volatility since the second half of 2021. “This scenario seems to be consolidating, although we do not know for how long; that The big question is where are we in the cycle? It’s not a trivial answer,” says the CED report.

The novelty of 2021, which is accentuated at the beginning of 2022, is the intensification of inflationary pressures at a global level not registered for at least 40 years. This generated that the central banks in the world have discussed for much of last year about the beginning and the pace of a monetary normalization process (increase in interest rates).

CED

“The developed economies paved the way for a gradual rate hike in 2022 and more importantly, the markets have internalized it. For this reason, not necessarily a rise in rates by the Fed could imply a relative strengthening of the dollar. It could be a scenario similar to the one discussed between 2003 and 2007,” warns the CED.

In that context, the bulletin indicates that perhaps the “The greater cost of having underestimated the persistence of inflation by the Fed comes from the side of the cost to be paid in terms of activity (today with a relevant dynamism, in particular in the labor market) to reduce inflation. There could be higher risks of forced landings of the US economy that eventually lead to some recessive process. In any case, the economic slowdown itself would mitigate inflation.”

The implication for Uruguay

So far this year, the dollar in Uruguay has decreased by 3.6%. Said bearish streak has been aligned with what has happened in the emerging world since the beginning of 2022, according to the CED.

CED

The appreciation of the exchange rate is the flip side of commodity prices at levels not seen since the 2013-2014 boom. “In other words, there are fundamentals in line with the dollar remaining weak: increased spending/GDP, improved terms of trade and higher relative productivity of the tradable sector. A weak dollar does not mean a drop in nominal terms. The most plausible scenario is that, as happened in 2021, the increase in the nominal exchange rate in 2022 is below inflation.that is, we have an inflation scenario in dollars (such as we had between 2005 and 2014), “estimates the CED.

CED

“The above, noor does it necessarily imply a competitiveness problem beyond the increase in internal costs measured in dollars. In particular for sectors that sell outside the region or with respect to competitors in third markets,” the report explains.

The mistake of appealing to monetary policy

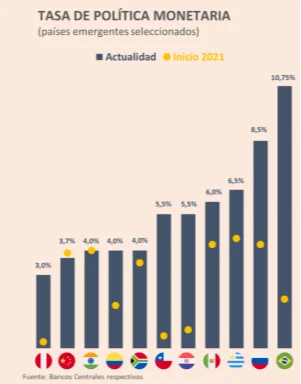

On the other hand, the CED considers that the BCU should not modify the emphasis of its monetary policy, which since the second half of last year began to raise the interest rate seeking to anchor the inflationary expectations of economic agents. The monetary authority expects to bring the rate to 8% for the second quarter of this year, in neutral territory (it currently stands at 6.5%).

“In that sense, it is important to point out two things aspect. First, no carry trade phenomena have been observed because rates rose in most emerging countries and remain negative in real terms (data on LRM holdings by non-resident investors are convincing in this regard)). Second, you have to begin to internalize that this scenario of high international prices is transitory, with the consequences that this has in fiscal and competitive matters”, considers the CED.

According to the report, “basically, in order to be competitive, an improvement in the productivity of the non-tradable sector is required, tending towards a fiscal balance and promoting a greater opening of the economy, all issues that should not be overlooked despite the good cycle of prices”.

Finally, the CED maintains that the “competitiveness problems” with Argentina and Brazil are rather a symptom that they became “much cheaper” (as a result of unstable economic dynamics) that Uruguay became too expensive. Thus, “It does not seem reasonable to ask monetary policy to act subordinately to mitigate this exchange rate gap, which tends to be more structural than temporary. Although it is true that there are affected sectors (such as export industries to Mercosur), the focus should not be on the value of the dollar but on all the other costs for which Uruguay is structurally more expensive than Argentina and Brazil.”