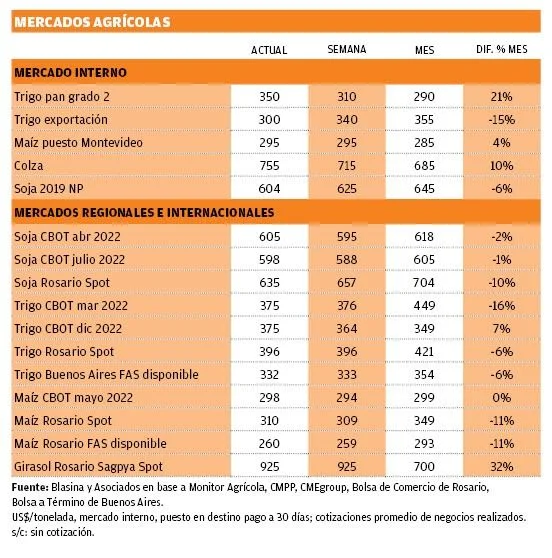

After a very strong fall, there was a gradual recovery of agricultural marketswho begin to see how the war continues and they were also influenced by the data on the poor state of wheat in the United States coming out of winter dormancy.

Only 30% of US winter wheat is good. The data surprised by the negative and added an additional stress factor to a market that is already adjusted by the difficulties of the export of wheat from the Black Sea.

On the side of corn, the outlook is not better. The high cost of fertilizer led to a sharp drop in the area of the United States and after last year’s poor harvest in Brazil, it is also a market with uncertain supply.

Both prices remain close to US$300 per ton for Uruguayan grain placed in silos, at interesting prices.

Wheat continues to go out for export in order to free the Nueva Palmira silos for the entry of the soybean harvest, which is just beginning and will pick up pace during the second half of April.

In local price references, it was a relatively stable week, in which the price of rapeseed continues to stand out above US$750 per ton, with a premium of approximately US$150 per ton compared to soybeans, which remained between US$600 and US$610 per ton.

EO

Although it was a positive week for soybeans in Chicago, the differential in favor of the grain in Uruguay –which reached US$40– is leveling off and today the prices between Chicago and what the producer receives are almost on par.

While, The grain market remains stable, with malting barley trading between US$330 and US$340 per ton, wheat planted at US$310 and corn above US$300 per ton.

With two relatively clear weeks, everything suggests that the Uruguayan harvest will advance rapidly, closing an excellent 2021/22 cycle that will set a record for exports.

This will very partially offset a very poor harvest in Argentina, Paraguay and southern Brazil. In Paraguay, for example, the harvest of 4 million tons, does not reach half of last year.

EO