The Dow Jones Commodity Index –Indicator dedicated to monitoring the prices of raw materials– up 9.7% year-to-date and 16.2% since December began. The increase in the index is promising for the performance of the Uruguayan agro-export sector, which has already closed 2021 at full steam.

Likewise, throughout last year, some of the most relevant export prices for Uruguay accelerated to the benefit of local producers. goods like the soy, meat and milk powder show values in international markets not seen since the boom of the last decade or even before.

The strong push of the market on these products became tangible in the performance of the Uruguayan economy during the past year. While 2021 GDP growth will be known in the middle of next month, private analysts forecast that it will exceed 4%well above what had been estimated a year ago and even higher than the projection of the Ministry of Economy (3.5%).

Days ago, the Center for Development Studies (CED) published a report in which he detailed that 90% of the jobs generated in 2021 were in the interior. The work considered that this may be due to “the great dynamism shown by the agro-industrial sectors and their spillover effect on activity and employment –typically more concentrated in the interior of the country–”.

Unemployment fell from about 11% at the beginning of the previous year to 7% todaythe best figure since the end of 2017. The activity rate, for its part, stood at 62%, a level similar to that of the end of 2019.

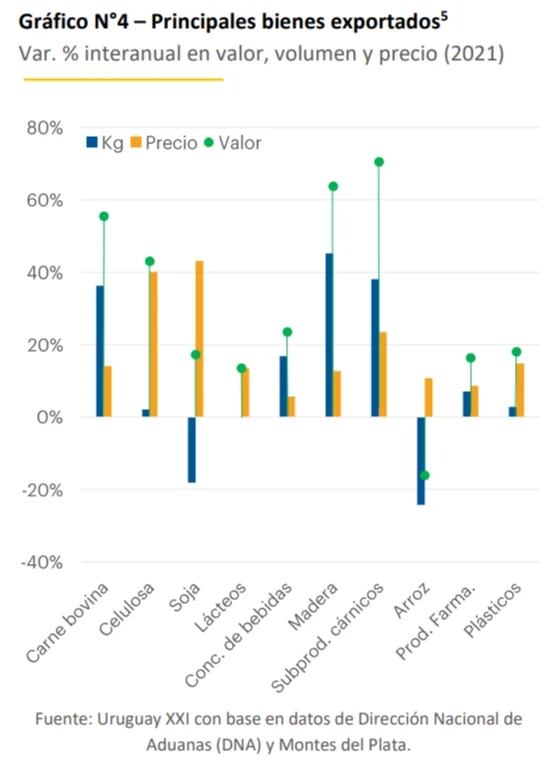

The Uruguayan exportshand in hand with very high export prices, closed 2021 with historical record: US$ 11,549 million. That year was recorded a growth of 43% compared to the figure for 2020 and 26% compared to 2019 (that is, compared to pre-pandemic levels), according to Uruguay XXI.

The decline of the dollar

It’s not all good news for the export chain. As is often the case with other commodity price booms, the dollar shows the opposite behavior. The US currency, which had closed 2021 at $44.70, it is currently $1.5 below that benchmark (down 3.3%).

In other agro-exporting countries such as Australia or New Zealand, the exchange rate rose (1% and 2.2%, respectively). Even so, in regional competitors such as Brazil it fell more (6.1%) than in Uruguay, which leaves local producers in a better place when it comes to competing in international markets.

What does the dollar have to do with “competitiveness”?

Those who sell their products abroad collect their sales in dollars, but must exchange them in the local market for pesos to pay most of their costs (such as salaries or fees). Therefore, they are better off against foreign competition when the greenback is trading higher. This implies lower costs compared to sellers from other countries and allows for better margins with the same international prices.

the negative side

Although the commodity price scenario is very favorable for economic recovery after the pandemic and the progress of an agro-export economy in general, it is not optimal for the Central Bank (BCU) to be able to converge expectations with its inflation target.

Inflation closed last year at 7.96%, above the current target range (3% to 7%). The president of the BCU, Diego Labat, mentioned the rise in international values of products such as oil or meat among the factors that pushed prices up during 2021.

This imported inflation conspires so that the entity complies with lowering the acceleration of prices from the current 8.15% to the 5.8% proposed for this year, within the target range (more demanding) of between 3% and 6% that will govern from September. Meanwhile, the private analysts expect 6.9% for 2022 and entrepreneurs 8%.

Regarding the downward movement of the dollar, although it harms competitiveness, it helps the Central Bank to anchor prices, and so far the institution has decided not to interfere in the decline in the price of the foreign currency. A month ago Labat, consulted on the matter on radio Carve, recalled that the BCU does not have exchange rate targets and that the floating policy would be maintained.

This Tuesday a delegation from the Union of Exporters met with the Central Bank of Uruguay. The businessmen conveyed their concern to the monetary authority about the current path of the exchange rate and their fear that the current trend will consolidate in the coming weeks, as a result of a change in the portfolio of investors who choose to get rid of their positions in dollars. to go to pesos.

The other bad news about the push in commodities is the appreciation of oil for the fuel tariffs that Ancap markets. Brent crude oil –the one imported by Uruguay– was trading this Wednesday at US$92, 18% more than the close of last year. Precisely, this scenario led the government to increase fuel rates to the public in Februaryafter freezing them for four months.

sky high prices

Soybeans increased 29% in the last nine months. When future prices for the current harvest began to be quoted last May, they were US$450 per ton placed in Nueva Palmira, compared to $581 of this Wednesday. Oilseed values are at their highest point since 2013, about the same as the boom a decade ago. The maximum peak then was $651 in 2012.

Bovine meat, for its part, appreciated almost 28% in one year. Last February, the average value of a ton of beef was US$3,731: now it is at US$ 4,771 per ton. It was the main Uruguayan export product last year and accounted for more than 21% of the total value.

In November, Uruguayan beef reached its maximum peak of US$ 5,472 per ton, when China left Brazil out of the market for three months due to two atypical cases of mad cow disease in the northern country. Anyway, neither the level then nor the current one have been seen in the last 20 yearsas far as the record of the National Meat Institute arrives.

The cellulosesecond export of the country, also saw their prices increase by 40%, according to data from Uruguay XXI. In turn, the milk powder -which constitutes 70% of the country’s dairy exports- increased from US$ 3,615 per ton to $4,082 in the international market (13%) in the last 12 months.