The concern in the livestock market transcends the situation of current values: slow forage recovery turns a yellow light on medium-term availability of cattle for slaughter. At the grain market the rains in Argentina influenced the price of soybeans downwards – which on Tuesday reached its highest value in seven months – and corn. At once, Wool chained its fourth consecutive week on the rise.

Drought hits the livestock market. The momentum brought by fat cattle was halted due to a lack of supply in the first days of the year, the pressure is increasing due to the lack of water and the week closes with falling values.

A marked disparity between plants remains, with the supply paying more. Some refrigerator with kosher equipment operation “stretches” to get heavy, special cattle, and it is where shorter entries are achieved.

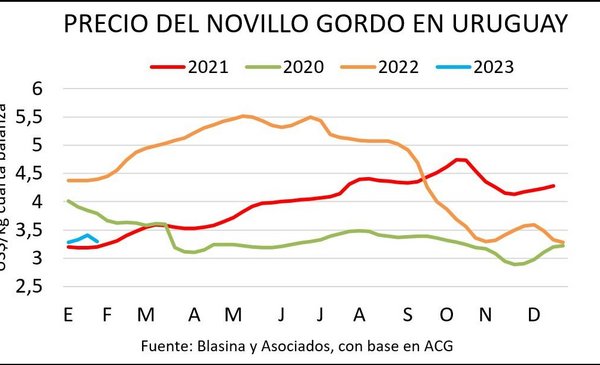

Peak prices for steers range from US$3.30 to US$3.40 per kilo in fourth scale and no deals are made above that reference, as they were until last week. The cow trades between US$3 and US$3.15 per kilo and the heifer between US$3.30 and US$3.35 per kilo, mainly driven by the supply.

Although there has been some movement in the offer, there is no output of volume cattle that corresponds to the critical situation of the fields, said Facundo Schauricht, from Zambrano y Cía.

Faced with a very complicated forage situation, Concerned about future supply availability. “All the grass that is not generated now, meadows, sorghum, everything that the cattle do not walk on, will be cattle that after it rains will be missing,” the operator commented.

The numbers to enclose do not give. “We are at 10% of the capacity that the corral can work,” producer and collector Gastón Silva told Tiempo de Cambio on Rural radio.

“It is worrying (…) fat animals are not seen, pasture availability is not seen in any part of the country. The question is what is going to be done from here to the future, ”she stressed. For Silva, it would be necessary to think of a steer at US$ 4.30 so that they give the numbers of the corrals.

John Samuelle

The drought will impact the future availability of an adequate supply of cattle for slaughter.

Added to the lack of water are few external signals that stimulate demand. “The industry continues without taking a position in the future, which shows that everything is very quiet outside,” Silva commented. For now, the export price of beef was US$ 4,034 per ton last week, and marked an average of US$ 3,815 in the last 30 days. At the start of the year, the value of the exported ton is 22% below the prices of a year ago and far from the peak of May 2022, when it exceeded US$ 5,600.

In China there are few movements, ahead of the New Year celebrations that begin this weekend. The United States Department of Agriculture (USDA) published a report projecting a recovery in Chinese demand for beef in 2023, with a greater participation from Australia and Brazil compared to a lower exportable supply from the United States, Uruguay and Argentina.

Although the slaughter rebounded last week compared to the previous one, with 32,421 cattle, the volume at the beginning of the year was 43% and 29% below 2022 and 2021respectively.

The replacement market continues to decline, with great caution, depending on the weather. There are movements in live exports that drive prices for whole calves. In recent days, value proposals of up to US$ 2.40 per 180-kilo calves by an exporting company have been reported. It was the only replacement category to move up the ACG grid this week.

In wool, as usually happens, the offer is reduced after the end of the year harvest. The values are firm, but the restrictions per kilos of carcass are maintained. All categories show green arrows, with lamb up to 35 kilos and heavy lamb at US$3.07, suckling lamb US$3.02, sheep US$3, capons US$2.71 and ewes US$2. 56.

Sheep slaughter at the start of 2023 was 48% lower than a year ago, totaling 28,473 heads.

John Samuelle

Movements in the grain market in Chicago.

Soybean peaked

Soybeans closed the week in Chicago at $553 a ton, down $15 from the peak of $568 hit Tuesday, the highest price in seven months. Rains in Argentina’s main agricultural areas put downward pressure, as did Brazil’s record crop progress. Corn, which closed at US$ 266, slightly down, was also influenced by the rains in Argentina taking a bit of risk premium to the South American climate.

The local reference for soybeans fell to US$540 and corn remained at US$310.

In Uruguay, soybean and corn crops are complicated by the lack of water, although they still maintain their potential. “The situation is not critical, but we need urgent precipitation so as not to start losing potential. The game will be played in February,” Copagran vice president Juan Manuel García said this week.

Rice is also entering a delicate situationwith less and less water availability for a sector that expects a good harvest that will allow it to capture good prices on the international market.

In Argentina, the drought affects wheat, first class soybeans, second class soybeans, first class corn and now late corn, “the crop that seemed to have the best chance of escaping,” according to the Rosario Stock Exchange (BCR).

The BCR report of this Thursday, January 19, discounts 135,000 hectares of second-rate corn from sowing and considers 60,000 hectares to be lost. Of the remaining 1.1 million hectares, 35% is in fair to poor condition.

“No agricultural strategy has been enough because it is as if almost a year and a half of rains were missing from the beginning of 2020 to the end of 2022 to reach the normal rainfall level,” the report says.

The Rosario Grain Exchange estimates the corn harvest at 44.5 million tons. USDA’s latest adjustment under the projection of 55 to 52 million.

With 85% of fair to bad soybeans, new area losses are expected and the 115,000 ha may be increased. which are already lost. In second-hand soybeans, 20% is in poor condition, 70% regular, and 10% good.

Wheat in Chicago corrected the March position upwards to US$ 272, after positive reports on US exports. The USDA reduced the prospects for the Argentine harvest, but maintained the export projection at 4.75 million tons, less than a third of the 2021/22 harvest.

Wool: fourth week on the rise

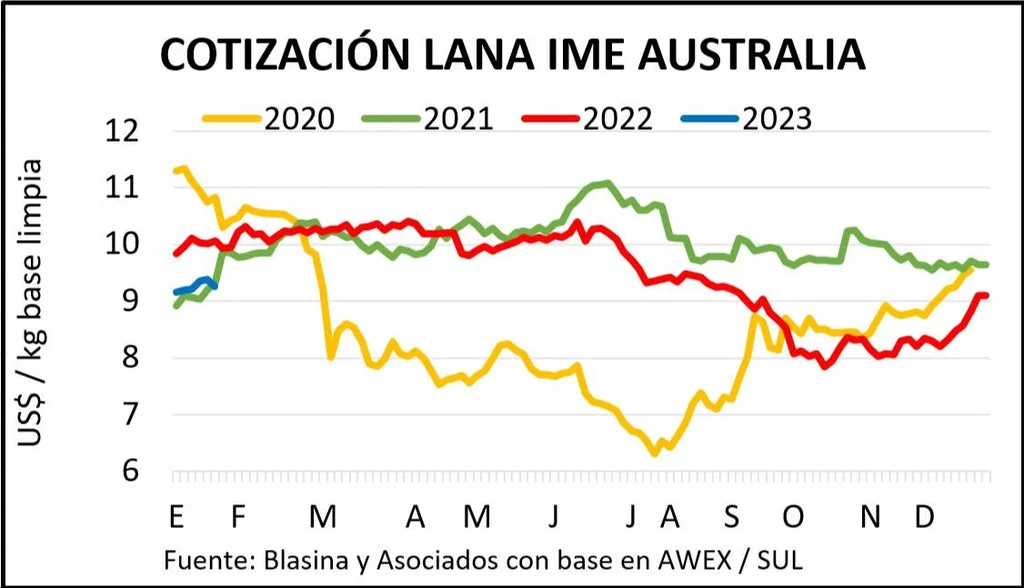

The wool market maintained its momentum and registered its fourth consecutive week of growth. The Eastern Markets Indicator (IME) in Australia closed at US$9.26 per clean basis kilo, five cents higher than the previous week.

This week the indicator reached US$ 9.38, its highest value since August 2022 and on the last day of sales (Thursday 19) it fell due to the effect of the exchange rate, as the Australian currency weakened 1.14%.

The volumes offered were high and the high quality and certified wools generated good demand with differentiated values. Chinese buyers were particularly active in the last week of activity before the Lunar New Year.

“It is important that the market shows some stability, we come from a difficult harvest and today we can say that the market is approximately 80 cents below last harvest, so there is still a way to go,” said Santiago Onandi, head of wool of Zambrano and Company.

The last businesses reported for wool in the local market, around 18 microns with certifications, obtained between US$8 and US$8.20 per kilo of dirty base. For 20.5 microns between US$6 and US$6.20 and 23 micron batches between US$3 and US$3.50 depending on the type of wool and washing performance.

Between 26 and 28 microns, conditioned wool is between US$1 and US$1.10 and uncertified US$0.70 to US$0.80.

According to Australian Wool Innovation (AWI) the relatively strong demand since December “has moved away from the sharp and rapid spikes and dips that wool prices can be subject to and is perhaps indicative of a more stable demand scenario now.” that global users are returning to a point close to normal in operations, both in sales of wool products and in matters of personnel”.

Wool and values that are still far from expected.