Page Seven Digital

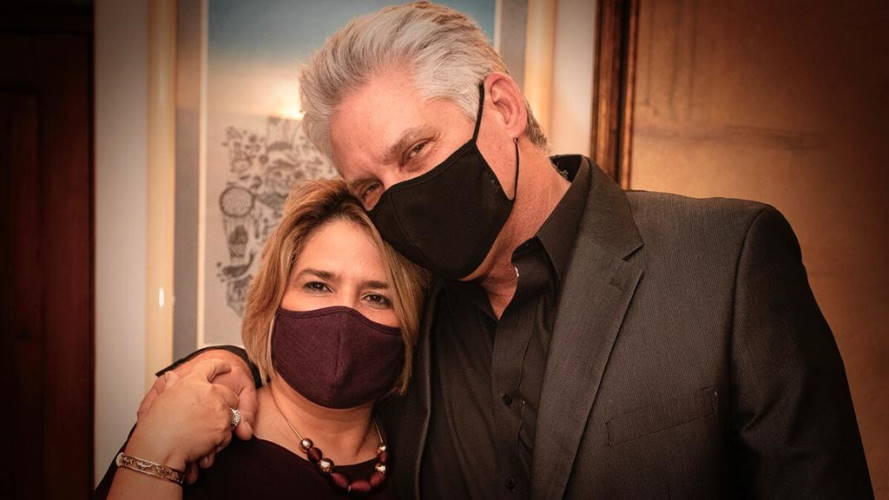

Through his Twitter account, President Luis Arce reported on Monday that the country managed to collect Bs 163.4 million in the first quarter of this year from the Great Fortunes Tax (IGF).

Compared to a similar period, but from 2021, an increase of 2.5% is registered.

“In the first quarter of 2022, the collections of the Tax on Great Fortunes #IGF totaled Bs163.4 million, that is, 2.5% more than in the same period of 2021. We are closing the gaps between rich and poor, because a a more equal society grows faster,” the president wrote.

The National Tax Service (SIN) collected Bs 240.2 million for this concept last year, reports an institutional bulletin from the Vice Ministry of Communication.

You can also read: Study: More than half of the gold that leaves the country does so without state control

A total of 206 people registered with the collecting entity to comply with the tax, which exceeded initial projections, adds the document.

The tax is applied to natural persons residing in Bolivia and abroad who have real estate, movable property, luxury property, financial assets, money and all other material or immaterial assets that represent assets greater than Bs 30 million.

The IGF was approved by Law 1357 of December 28, 2020. The Government assures that the purpose is to promote the redistribution of wealth, the execution of works and strengthen the health and education sectors.

In the opposition, they consider that this type of measure discourages private investment.