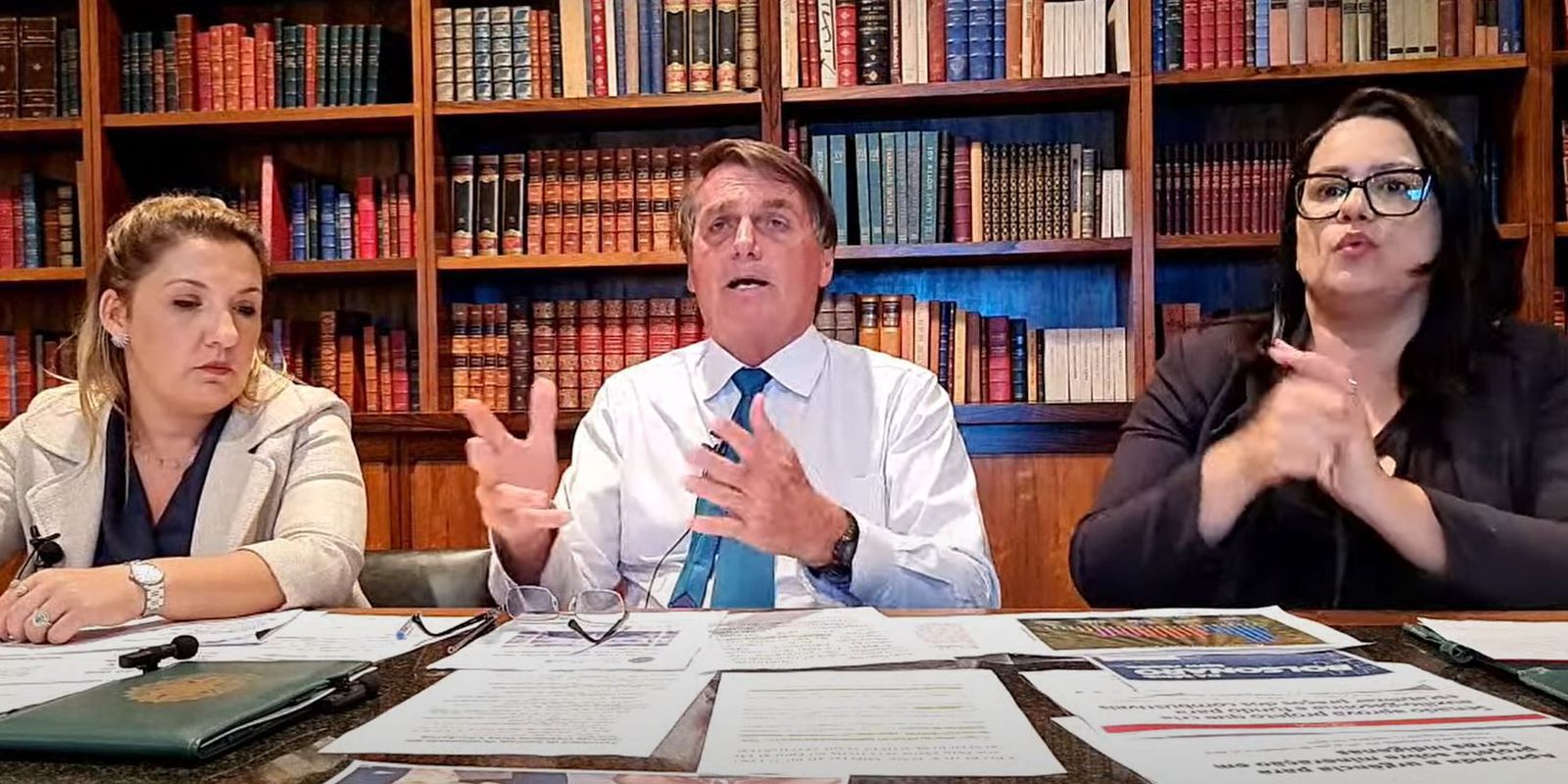

President Jair Bolsonaro said this Thursday (10), during his live weekly on social networks, which intends to immediately sanction the Complementary Law Project (PLP) that changes the way of charging the Tax on the Circulation of Goods and Services (ICMS) of fuels. The text was approved during the afternoon by the Federal Senate and can be voted on this Thursday by the plenary of the Chamber of Deputies. If approved, it goes to presidential sanction.

“It becomes a fixed amount of ICMS, which is no longer a percentage of the price above the pump. Basically, it freezes, for real, the ICMS, which is a state tax, on fuels. If the Chamber approves today, on my part no matter the time, I sign at any time of the night or dawn and publish it on Official Diary of the Union“, he stated.

The proposal establishes that ICMS, which is a state tax, will be charged in a single amount per liter of fuel. Currently, the tax rate is a percentage charged on top of the final price of the liter at the pump, which undergoes variations in the dollar and in the international price, further burdening the final amount charged to consumers. The text, which must be approved by Parliament, determines that ICMS should be charged on the price at the refinery or at the import counter, when the fuel comes from abroad. The new values, by the proposal, will be defined through the National Council of Finance Policy (Confaz), which brings together representatives of the economic area of all states and the DF.

In addition to the fuel bill, the Senate approved another proposal that creates a Fuel Price Stabilization Account. This is a fund that will act as a buffer against fluctuations in the price of oil on the international market.

During the livethe president criticized Petrobras’ decision, announced in the morning, to raise fuel prices before approval of projects that seek to reduce the economic impacts of products.

“How good it would be if Petrobras readjusted Monday or Tuesday, but I cannot interfere in Petrobras, even though I am the majority shareholder,” he said.

The liter of gasoline sold at the refinery by the state-owned oil company will have an average increase of R$0.44, while diesel will increase by R$0.81. Cooking gas will rise from R$3.86 to R$4.48 per kg, equivalent to R$58.21 per 13kg, reflecting an average adjustment of R$0.62 per kg. As a result, the price of gasoline at stations should exceed R$ 7 per liter, while diesel can reach almost R$ 6.50. The gas cylinder may rise above R$ 140 in some regions of the country.