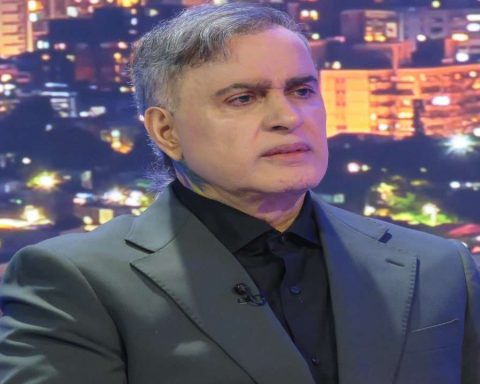

Leonardo Palacios, also a tax lawyer, affirms that the discussion of a tax reform should be broad and open. He emphasizes that a structural element is necessary since any action will be insufficient if an integral modification of the State does not take place.

The president of the Caracas Chamber of Commerce, Leonardo Palacios, proposed a tax reform plan for Venezuela. He pointed out that an urgent modification is required in this matter and a broad proposal that is for open and public discussion with all sectors of the country.

«We have proposed, like other specialists, the need for a tax reform master plan. This is different from the unsystematic, contradictory, confiscatory and multiple taxation modifications. generated by the government in recent years, through the use of the figure of the Constituent Assembly and the decree laws that for several years have replaced the will and work of the National Assembly as a legislative body,” he said.

Palacios, also a tax lawyer, argued that tax reforms constitute a political market in which there are several completely defined parties. «The economic aspect, of public finances, refers to the need for income with respect to spending, taking into account the structural fiscal deficit that allows recovery, growth and economic stability as an economic policy, “he explained.

He also stated that, from a budgetary point of view, it is important that the reform guarantee the

fiscal sustainability in terms of balance and transparency, reduction of opacity in the management of subsidies and other mechanisms that make effective control of public finances impossible.

He emphasized that a structural element is necessary since the tax reform will be insufficient, if there is not a comprehensive reform of the State.

«If this is achieved, it can be translated immediately or in the short term, an increase in national investment, attraction of foreign investment in fundamental elements such as tourism, construction and oil and mineral activity, as long as a series of incentives such as legal stability agreements are guaranteed. And, above all, take into account elements of respect in terms of strengthening the judiciary in relation to tax matters, “he stressed.

The president of the Chamber of Commerce of Caracas stated that, from an administrative point of view, it is important that the tax reform promotes a change in conception according to which, «The businessman is not a warrior or warmonger who generates anxiety and uncertainty to the detriment of the population. On the contrary,

it implies an agent that generates stability for the worker, the investor, the employer himself and, of course, for the State through taxation”.

Palacios added that elements against tax evasion such as electronic invoices or simplified means of the tax regime for small merchants are required, which would prevent smuggling and informality.

He believes that a Tax Amnesty Law should be applied, a law to be honest with the taxpayer that tends to eliminate sanctions based on tax units, prevent the closure of companies and tax evasion.

*Read also: Guilds warn about the impact of the “cumbersome and expensive” procedures of notaries

Management in the Chamber of Commerce

On the other hand, the outgoing president of the Caracas Chamber of Commerce pointed out that during his tenure he sought to enhance the role of this centennial instance as a generation of discussion and public debate, as well as the opportunity to sit down with different government instances, according to stated in a press release.

«The Chamber is dynamic and updated to the new times. We had important inter-institutional collaboration agreements with instances such as the National Academy of Political and Social Sciences, the National Academy of History and with the Venezuelan Society of Tax Law, with the universities, and we lead the Chamber to understand that the best tool that citizen participation has, and above all the business to have effectiveness and achievements of its proposal, is through this topic, “said Leonardo Palacios.

At the same time, he recognized the support of the board of directors that accompanied him, important members of all sectors.

*Read also: Conindustria: tax pressure and high utility rates limit growth

Post Views: 24