Lemon, one of the main wallets that provides the cryptocurrency purchase and sale service in Argentina, announced today the dismissal of 38% of its workers, in the face of what it defined as “a scenario of uncertainty of new investments in the technology industry in general” and with the aim of achieving the sustainability of the company in the coming years.

The measure, the company assured, seeks to give it solidity and “stop hypergrowth” they had had in recent months, in order to avoid resorting to new capital injections for the next three years, given the difficulty for startups around the world to access financing given the rise in interest rates and the aversion to risk of the main investment funds in the world.

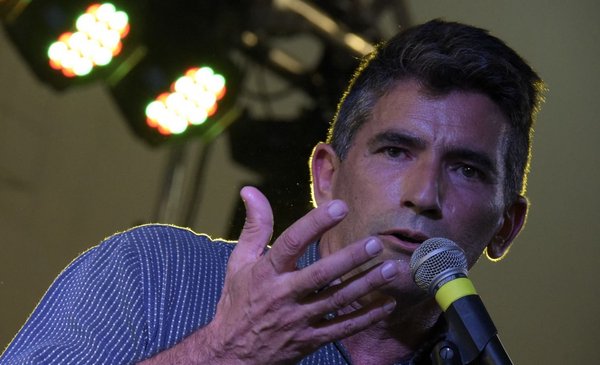

“It has to do with an organizational decision that is not made from one day to the next, but something that I had been thinking about for a long time. It is not related to what happened with FTX, although it is related to the change in economic conditions at the international level“, Marcelo Cavazzoli, CEO and founder of Lemon, told Télam.

Open letter to the communityhttps://t.co/uiUAAeE5XF

— Marce Cavazzoli (@lemoncheli) November 24, 2022

In this sense, Cavazzoli pointed out that they regret “having to let go of many very talented people” -close to 100 of their 260 workers-, after which he argued that the decision “has to do with the change in the startup market and a new focus”.

Despite having reached an expansion of US$ 27.8 million this year from the investment round they had in July 2021, Cavazolli said that they seek “not to have to depend on investments for the next three years, which will be very hard “, since they foresee a complex panorama for small companies.

“We want to stop hypergrowth and move towards a more sustainable structure, with a greater focus on transparency and innovation. In this context of a crypto crisis at the confidence level, a very important pillar will be transparency,” Cavazzoli said.

FTX’s bankruptcy at the beginning of the month exposed its financial fragility and lousy risk management of many of the cryptocurrency buying/selling platforms.

Faced with this scenario, Lemon launched this week an online verification scheme of its users’ deposits and what are the assets of the company that support them, all live and checkable through the blockchain.

The bankruptcy of FTX at the beginning of the month exposed the financial fragility and lousy risk management of many of the cryptocurrency buying/selling platforms.

“What happened with FTX cannot happen again. The market is going to demand transparent platforms that have solvency guarantees. That is why I believe that despite all this crisis, there is something good. We have to take care of the crypto retail user in Argentina , which is one of the places where there is the most adoption in the world,” he said.

It is worth clarifying that after the fall of FTX A stir was generated on social media, where users posted screenshots of Lemon’s “terms and conditions”, which contained an exposure of user funds to FTX.

On this point, Cavazzoli acknowledged that a minor part of the company’s funds were deposited on the platform, but that they managed to withdraw them at the beginning of the month, before FTX paused the withdrawals.

DeFi protocol system

To avoid new conflicts of this type, Lemon announced the adoption of a DeFi protocol system and choice by the user.

That is, it will be the user who chooses which fund to invest their money in and, in all cases, it will be decentralized and transparent options, with operation through smart contracts.

The layoff of employees at Lemon adds to a trend among companies in the sector this year.

In May, the Mexican company Bitso announced the dismissal of 80 employees out of a total of 600 that it has in 35 countries, while the Argentine Buenbit announced the layoff of nearly 50% of its workforce, both citing the difficulty of accessing a new financing context.