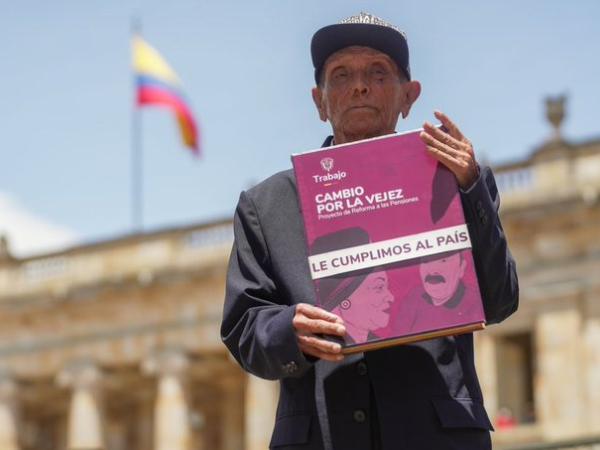

Last Tuesday, July 16, the president Gustavo Petro signed the pension reformgiving a twist to the way the pension system works in Colombia.

When this project becomes the law of the Republic, there are those who remain doubtful and critical of how it will work.

(Further: What alternatives do Colombians have with the new pension system?l).

Portafolio spoke with Kevin Hartmann, a lawyer specializing in pension issues and partner at Hartmann Asociados, to understand what was approved, taking into account that it will begin to be implemented as of July 1, 2025.

What is a pension like in the current Colombian system and what would a pension be like in the system that became law?

In the current system, you have two ways to reach retirement. On the one hand, the route through private pension funds. On the other, the route through Colpensiones.

As for private pension funds, you, as a young person and throughout your working life, contribute to an account that is your property. The AFPs take that money, invest it in the financial market and what will constitute your pension tomorrow will be the capital and the returns you have collected.

In the case of Colpensiones, a different mechanism works, so that the current generations of contributors, the young workers, immediately pay the pension to those who are currently retired. So there is no individual transfer of my contributions to the future, but rather my contributions go directly to pay today’s pensions, with the expectation and hope that tomorrow, young people will do the same for me when I retire.

This is how the system works in general terms today. You can choose either one and you have time limits to do so. Of course, there are rules about which one suits you best or not, the number of weeks, the retirement age and so on.

The general rule is that you have a full pension at 62 years of age if you are a man or 57 years of age if you are a woman, and after completing a minimum number of weeks in the case of Colpensiones. In the case of private pension funds, if you are 62 years of age if you are a man and 57 years of age if you are a woman, the legal way to retire is normally to have enough money in your individual savings account to finance a pension of at least one minimum wage. If you do not have this, the pension fund administrations’ plan B is activated and they require that you have contributed at least 1,150 weeks, 3 years less than with Colpensiones, to have access to a pension of one minimum wage in that individual savings scheme.

Pension reform

Photomontage from iStock images.

So, with the new system that will be implemented, Colombians will no longer be able to choose whether to join Colpensiones or private funds. The 25 million people who are the economically attractive population will have an account in Colpensiones, and people who earn more than 2.3 minimum wages will be in both Colpensiones and in a private pension fund. Their contributions will be divided in two.

At the end of your working life, how will you receive your pension?

You will receive a portion if you meet the minimum requirements: 1,300 weeks, 62 years for men and 57 for women, but that is not changed by this reform.

You will receive two checks. Check number one, paid by Colpensiones with its settlement rules up to the threshold of 2.3 minimum wages. And the other check will come from the AFP, the one you choose of your preference, where the money you have saved there will be converted into another life annuity. The sum of the two will be your pension tomorrow. This is broadly how the new pension system in Colombia is expected to work.

(Further: Pension reform: who will start paying into Colpensiones?).

So, will it no longer be possible to choose the contribution regime with this new reform?

You will be able to decide, if you contribute more than 2.3 minimum wages, which of the four AFPs you will continue to join. That will be your decision-making power. The rest, the rules of the system will be the same for everyone.

We will all be under the same rules, we will all be affiliated with Colpensiones and people who earn more than 2.3 minimum wages are affiliated with both Colpensiones and the AFP of their choice.

Can you choose Colpensiones to manage the rest of the contribution threshold?

Considering that the threshold is 2.3 times the minimum contribution wagewhich go to the public fund, cannot remain in Colpensiones, you will have to join an AFP of your choice, which you can choose.

If you do not choose any private fund, the law says that you will be randomly assigned to a private pension fund. So, all people who earn more than 2.3 minimum wages, which is essentially only 23% of the economically active population in the formal sector, will have to be in Colpensiones and in an AFP of their choice.

Colpensiones

Cesar Melgarejo / CEET

Choosing the rules that apply to me will no longer exist, and in any case, I think that is better. There is no other country in the world with a system like the one we have in Colombia, where you choose the rules for pensionability. This creates enormous problems of inequality in the way the law treats people who are going to retire.

How will the transition work and what does it mean for these pension systems?

What the transition means is that people who are close to meeting the minimum requirements for a pension will be exempted from the new law, because it is understood that Law 100 of 1993 is more beneficial because it gives them more generous pensions.

Therefore, those people who meet the requirements of this new law, in this case, if you are a man, you must have a minimum of 900 weeks of contributions, or if you are a woman, you must have a minimum of 750 weeks of contributions by July 1 of the following year, enter the transitional regime.

(See: With the pension, the Petro government approves its first social reforml).

Pensions

iStock

How will this pension reform impact young people?

On the one hand, our pensions are going to be lower. The large pensions we see today, of 15, 16, 20, 25 million pesos, will no longer exist in the new system. These high pensions today, which are mainly from Colpensiones, are based on a mechanism that is quite unfair, and that is that they are supported by subsidies from the State, the national budget, and the taxes of Colombians.

This happens precisely because the current legal contribution states that you can earn up to 25 minimum wages in Colpensiones and you will receive a fraction of that contribution. These pensions are capped by the threshold ceiling, 2.3 minimum wages, which prevents pensions recognized by Colpensiones from being higher than 1.8 minimum wages of today.

So, the subsidies that support, unfair subsidies, I repeat, that support high pensions, are significantly reduced for people who are going to retire tomorrow. That means that, as a net effect of the reform, young people today will end up having lower pensions.

How will pensions work for women with children?

This new system also brings with it, in a certain way, a gender approach for women who have children, and it does so in two ways. On the one hand, by adopting a rule of the Constitutional Court from last year, a ruling by virtue of which women will, by 2036, have their number of weeks required to receive a full pension reduced to one thousand weeks.

On the other hand, the second compensation that is also made in the pension system to women is for those who have children and are very few weeks away from retirement, up to 150 weeks, and the system essentially recognizes 50 weeks for each of the children they have, because it is assumed that the person raised their children.

So, it is essentially a maximum of three years of contributions that will be granted to women who, lacking those three maximum years, are close to having the minimum contribution weeks. And if they have up to three children, they will be granted 50 weeks per child.

BRIEFCASE