Recently, the government has taken firm steps to encourage the local stock market. On July 22, the Central Bank of Uruguay (BCU) modified the regulations in force regarding public offering issues under the Simplified Regime, thus culminating a process in which relevant market actors intervened through the public consultation mechanism, in order to from last year.

This regulatory advance is complemented by the articles that the Executive Power proposed on June 28 through the Bill of Accountability, where preferential rates are established in the Income Tax of Physical Persons (IRPF) and in the Tax to Non-Resident Income (IRNR) for income obtained under some instruments that are traded in the stock market.

Thus, The government seeks to stimulate the stock market on two fronts: on the one hand, it eliminates obstacles and smoothes the process so that a greater number of companies resort to the market to obtain financing, and on the other, it intends to modify the fiscal impact that these instruments have on natural person investors (in addition to non-residents) who receive an income, to encourage their participation.

The following is an analysis of the firm Bragard Abogadoson the modifications made in the simplified issuance regime and the changes that are proposed at the tax level in the Bill of Accounts project.

I. Simplified Regime

Requirements applicable to issuers

The new Simplified Regime is provided for resident commercial companies that do not have current issues under the general regime.

Likewise, it is regulated that those companies that have annual sales (excluding VAT) greater than 75,000,000 UI, may only issue debt securities. To calculate this amount, the regulations provide that those companies that belong to an economic group – whose term is defined in the Compilation of Regulation and Control Rules of the Financial System – the sales of the entire group will be used for calculation purposes. from the top.

In this way -and despite the fact that it was raised in the public consultation that took place last January-, the Simplified Regime will not have, at least for the time being, issuers structured under financial trusts and/or entities residing abroad.

How is this regime simplified?

Statutes or social contract: The requirement to present notarial testimonies with authenticated copies is replaced.

Risk Rating: The obligation to hire a risk rating agency for the issuance of the corresponding reports is eliminated.

Legal reports: The obligation to submit a report from legal advisors regarding legal contingencies is replaced by a sworn statement from the company’s legal representatives.

Financial Statements: Only the financial statements corresponding to the last two financial years will be requested (the general regime is three), substituting, likewise, the External Audit report that must accompany the financial statements by the Limited Review report, in those companies with lower annual sales to 75,000,000 IU

Corporate governance: The obligation to have an Audit and Surveillance Committee is eliminated. The obligation to have an Internal Audit is only foreseen for companies that have annual sales greater than 75,000,000 IU.

On the other hand, the requirements for the composition of the board of directors or administrative body will not apply to the Simplified Regime, nor will the suitability requirements and distinction between executive functions of its members.

Likewise, the information to be presented in the reports on corporate governance practices is considerably reduced, as well as in the periodic information that the issuers must present.

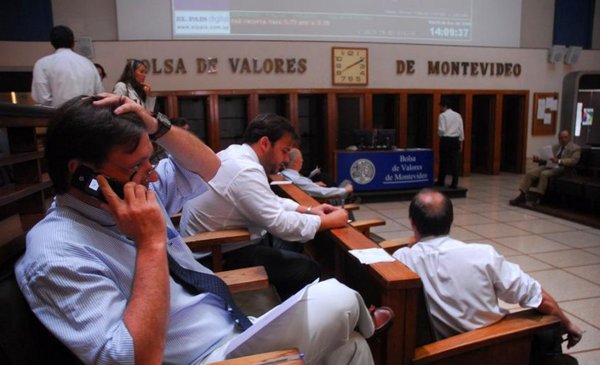

Camilo dos Santos

Limits on issuance and investment.

Issues in circulation may not exceed 100,000,000 IU per issuer or issuers belonging to the same economic group.

On the other hand, the previous regime provided for a limited list of investors who could invest in securities. The new Simplified Regime eliminates such a list, and only regulates some limits for small investors (those with assets of less than 1,000,000 UI).

Thus, for this class of investors, the amount invested may not exceed 120,000 UI per issue or 360,000 UI in securities issued under the Simplified Regime.

Likewise, it is established that this will not apply when the small investor proves that he has the advice of an institution that provides investment services and is subject to the regulation and supervision of the Superintendence of Financial Services. Therefore, prior to making each investment, the recommendation of the aforementioned unit on the limit that it considers appropriate for its profile must be submitted.

Finally, the Simplified Regime imposes on Securities Intermediaries the obligation to control whether or not investors qualify as small investors, subject to the information that they must submit to such intermediaries.

From the previous wording, the requirement that the stock exchanges be responsible for verifying the information collected was eliminated.

II. Tax incentives under the Project.

Today, there are some tax incentives for both public offering issuers and investors in those securities.

However, under the Uruguayan tax system, the issues that enjoy tax benefits are those that have the triple condition of: a) being made through a public offer, b) having a stock market listing and c) that the issuer is obliged, when the process of award is not the tender and there is an excess of demand over the total issue, once the preferences allowed by the regulations have been contemplated, to award it in proportion to the requests made.

According to the lawyer Jean Jaques Bragard, from the Bragard Law Firm, The issuance of securities under public offering already has a series of tax incentives for those issues that have the aforementioned three characteristics.

In addition to these incentives, as stated in the explanatory memorandum of the project, the government seeks to bring investors closer to the Stock Market, proposing significant reductions in the IRPF and IRNR rates, in what has to do with income obtained in certificates of participation and/or debt securities of financial trusts that meet the three characteristics mentioned above.

In this sense, according to Guillermo Lorbeer -of the same study-, the projected changes are inclined to divide the rates of said taxes into three, distinguishing the applicable treatment depending on whether they are instruments in Uruguayan pesos without a readjustment clause, in indexed units or in foreign currency. Likewise, the longer the term of the instrument, the lower the applicable rate will be.

In this way, the most efficient instruments from the tax standpoint according to the project are those originating from certificates of participation and debt securities of financial trusts, in Uruguayan pesos without readjustment clause and over three years, where the rate would exceed 7 % to 0.5%. Under this staggered regulation, the same instruments mentioned, but in indexed units, would go from 7% to 5%, while, if they were in foreign currency, the treatment would be the same as in the current regime.