The Government, through Treasurymade a repurchase for RD$37,221 million of bonds internationally, indexed to Dominican pesos maturing in 2023, and issued indexed securities in both local and foreign currency.

The resources from these issuances, for a total amount equivalent to US$1.8 billion, They will be used for the repurchase of the aforementioned title as well as to cover part of the needs of the General State Budget 2023.

According to a Treasury press release, the first instrument was issued for an amount of $700 millionwith a coupon of 7.05% and maturing in 2031, and the second, denominated in Dominican pesos, for an amount of US$1,100 million (RD$62,282 million) with a coupon rate of 13.625%, maturing in 2033.

The Treasury explained that the bond in pesos has an important effect on the debt portfolio of the Non-Financial Public Sector, because reduces the proportion of debt in foreign currencymitigating the exchange risk in fiscal accounts.

Likewise, the institution highlighted in a press release that the Peso-denominated bond adds liquidity and visibility to the Dominican currency and its instruments in the international market.

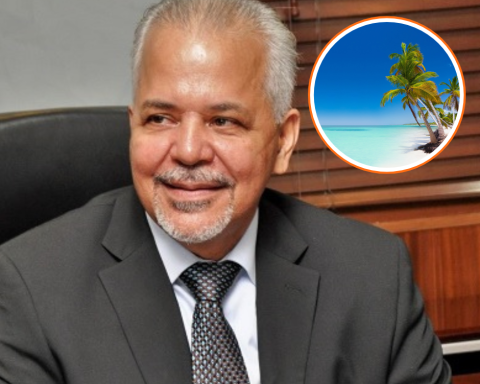

“This repurchase and issuance operation currently allowed the Government to secure resources in US dollars for up to half the year without putting pressure on the domestic exchange rate, without incurring a high cost, taking into account current interest rate conditions.”said Jose Manuel -Jochi- VicenteMinister of Finance.

He pointed out that the results of the operation are a clear effect of the recent rating upgrade from BB- to BB by Standard and Poor’s“which reflects the confidence and robustness of the sovereign credit of the Dominican Republic”.

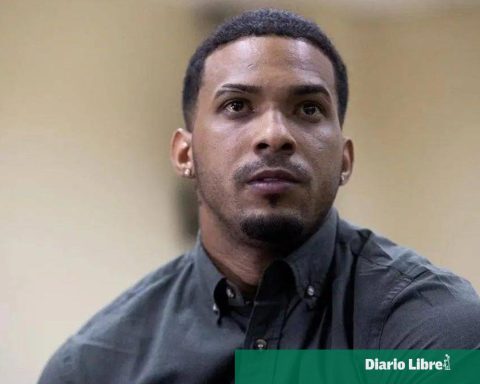

Meanwhile, the Vice Minister of Public Credit, Maria Jose Martinezdescribed the demand received from the issuance of the new instruments as a success, where investors submitted bids four times the amount announced in pesos and 10 times in dollars.

In the same way, he explained that “the repurchase of the instrument with a maturity of 2023 was extremely positive, receiving and accepting a total of RD$37,221 million in offers, which represent 93.05% of the total amount of circulation of the title offered, demonstrating the confidence of the investors in our economy by showing greater interest in a new title with a higher tenor in an instrument indexed to the local currency”.

The institutions that served as structuring banks for the transaction were Citigroup Global Markets Y JP Morgan Securities.