This is the pillar of the government program of the leftist president, who took power on March 11, with the promise of launching a robust social protection system, with improvements in health, education, social housing, pensions and the implementation of a national care system, among other points.

“The objective of the tax reform is to advance in greater equity, greater equality and social cohesion so that we are all a little more protected,” said Boric, after the announcement of the reform that seeks to collect the equivalent of 4.1% of GDP in four years.

This initiative “seeks to generate the resources that will finance many of the reforms of a social nature and productive diversification that are on the government’s agenda,” reaffirmed the Minister of Finance, Mario Marcel.

“It expresses the search for greater equity and justice,” he said. The proposed reform “fundamentally focuses on the taxation of people with higher incomes,” he added.

– Separate projects –

The reform, which is going to enter in four separate bills to Congress, where the government does not have a majority, includes a tax on people with assets greater than 5 million dollars (about 6,300 people) and an increase in taxes personal that will affect only 3% wage earners, with salaries starting at 4 million pesos (4,275 dollars).

A new tax regime is also established for large-scale mining, with a production greater than 50,000 metric tons of fine copper, of which Chile is the world’s leading producer.

“The ‘royalty’ design maintains the investment incentives that will allow the mining sector to continue developing, considering rates of return on equity that are, at all times, above the limits that companies consider when make their investment decisions,” Marcel said.

– Increase collection –

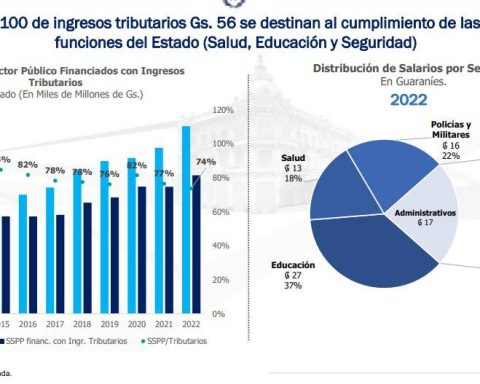

The minister explained that this reform is possible and necessary, since Chile still has a lot of room to increase the tax burden. The country’s collection structure, moreover, is more concentrated in income from VAT and corporate taxes and less in personal income taxes, which for Marcel is something “atypical”.

A recent OECD report revealed that Chile’s tax burden as a percentage of GDP is among the lowest in the OECD, at 20.7% in 2019 compared to the average of 34.7% for its members.

“Beyond the government program, this is a reform that brings the country closer to the tax structure of more advanced countries,” added the minister.

In addition to the changes to the income and wealth tax, other mechanisms are stipulated that limit exemptions and introduce measures against tax avoidance and evasion.

If these measures are approved, it is estimated that in 2023 Chile’s tax collection will increase by 0.6% of GDP, 1.8% in 2024 and 3.1% in 2025, until reaching 4.1% in regime.

– Reactions –

Germán Pinto, an expert in tax planning and management from the University of Chile, explained that the reform project “generates many expectations due to the great social needs that the population has been demanding for many years.”

He also warned that “it is a great challenge” for the government because it has to get more revenue “without stifling private entrepreneurship and foreign investment,” Pinto said.

The opposition senator from the Red Republican Party expressed his opposition to the reform, Edwards, who stressed that there had already been a “failure” with the tax reform presented by former president Michelle Bachelet in 2014. “It sank our economy and used the new resources to increase the bureaucracy”, affirmed the senator through his social networks.

Christian Democrat senator Iván Flores was in favor of the government’s initiative: “I am pleased that the government of Gabriel Boric has incorporated the essential pillar to move towards more and better social goods. We need a progressive reform to ensure financing for social demands, ”he said through his social networks.