The Association of Multiple Banks of the Dominican Republic (ABA) reported that the banking sector has increased its financial leases (leasing) by RD$2,889 million during the last four years, showing an accumulated growth of 46.2% in said period.

The ABA He explained that the financing granted by multiple banks through the leasing format went from RD$6,254 million in 2018 to RD$9,143 million, at the end of 2021.

He explained that, with respect to the previous year, said leases increased by RD$1,036 million, showing a growth of 12.7%. He stated that, at the end of 2021, 1,628 leasing operations were maintained.

Read more: ABA is now the Association of Multiple Banks of the DR

The union highlighted that leasing is gaining strength as a financial way to support companies in their investment needs in machinery and equipment for the development of their activities.

“This financial instrument allows companies to make investments without having to disburse a large amount of their resources, benefiting at the same time from the use of goods that, at the end of the term of the contract and if they want to incorporate said goods into their assets, could be acquired. for its residual value”, specified the ABA.

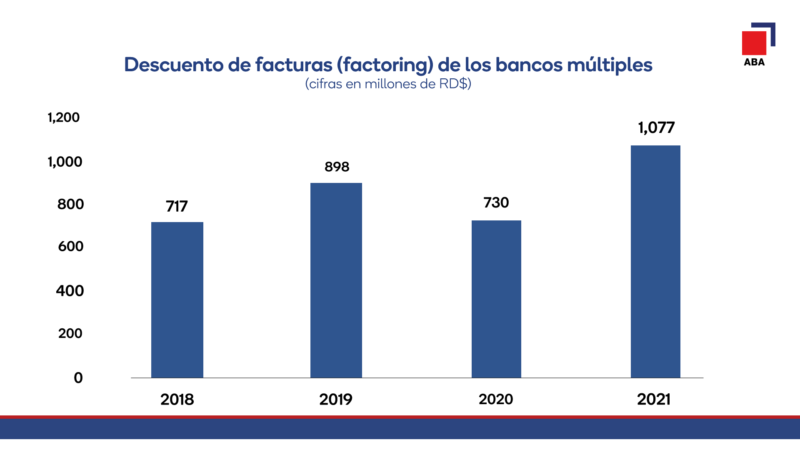

Invoice discounting or factoring

The invoice discount (factoring) of multiple banks showed an accumulated growth of 50% during the last four years, equivalent to RD$359 million, reported the banking union, explaining that this instrument went from RD$717 million in 2018 to RD$1,077 million at the end of 2021.

In the past year, the invoice discount increased by 346 million (47% growth) in relation to 2020 and reflected a recovery in this form of financing, when compared to the amount of existing credit in 2019.

The ABA highlighted the usefulness of this financial instrument that is used by companies to anticipate the collection of their credit sales, improving their liquidity and payment capacityand facilitating in that sense its commercial activity.

Similarly, the banking union highlighted the importance of this type of financing for different productive sectors, especially for working capital of small and medium-sized companies.