The value adjustment that began last week for fat cattle is consolidated, after 17 weeks in a row with increases. refrigerators they propose prices of about 20 cents per kilo of carcass minors than two weeks ago. Y that starts to carry over to the replenishment.

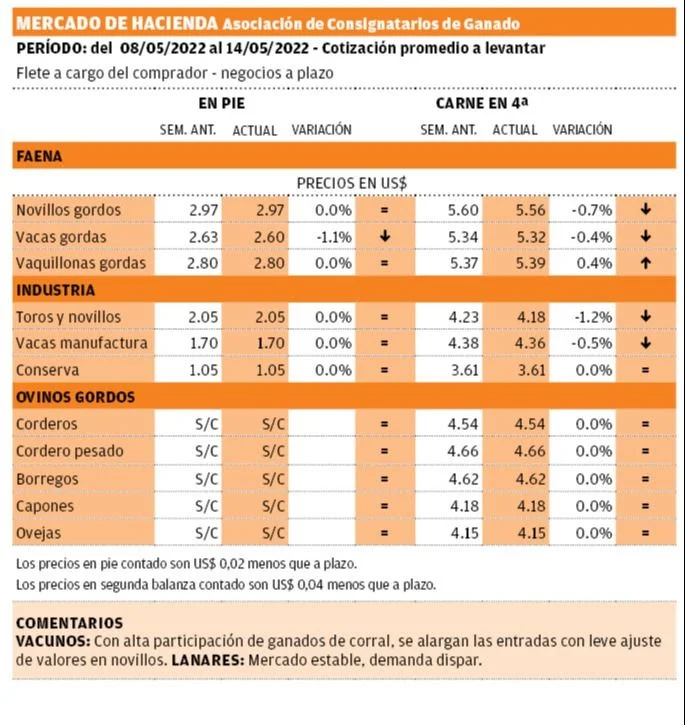

Prices per special steer are around US$ 5.30 to 5.35 per kilo. In cows, the range of prices is broader, with values offered from US$5 to US$5.20. The heifers are about US$ 5.20 per kilo. And the tickets go from 10 to 15 days.

“If there was ever a time to lower prices, this was it,” said Alberto Arocena, from Silveira Rural Businesses. Volume of free-range cattle is entering in the middle of the 481 quota window. “We knew there were a lot of cattle locked up,” he said. To this is added the arrival of the first cold weather and a little more supply appears, in general not so well finished. The green ones come slowly, only in the first blunting.

“I think it’s a temporary low. Probably in a month, when all the free-range cattle are slaughtered, the trend will return to the upside,” she estimated. The expectation is that the supply will be limited after the bulk of the poultry slaughter.

Slaughter: more than 60 thousand cattle

Will the high volumes of work be maintained? Last week the activity set a record for 2022, with 60,156 cattle. This year the million heads were exceeded, with the best January-April quarter of the last four years. The heifer category is the one that grew the most, 29% year-on-year and 40% more than in 2020.

john samuel

The demand for cattle, from the industry, continues to be very high.

external impacts

In the foreign market there is uncertainty in the population of Shanghai, due to government restrictions. The slowdown in activity has led to lower purchases of merchandise. And the values that pay for beef in that market have registered adjustments, accompanying the devaluation of the yuan.

In Europe, the demand for refrigeration has been falling and prices have fallen.

In the United States there were also corrections in values.

For now, none of this has been reflected in the export price published by the National Meat Institute (INAC), due to the gap of up to two months between deals made and shipments. The value of the exported ton marked a new maximum of US$ 5,613 last week and the accumulated figure for 2022 reaches an unprecedented average of US$ 5,04730% above the US$ 3,881 achieved a year ago.

The replacement is accompanying the fat adjustment. In Plaza Rural the bullish tone stopped that had the auctions since December and that set records in April. Calves averaged US$3.01, 4.8% below the prices of last month, although they remained 32% above the values of a year ago. 93% of the offer was placed in that category.

Between individuals there is some difficulty in “joining the ends”. There is an offer that seeks prices that are no longer there, but deals are being made.

EO

Stable values in sheep

In sheep, the values are stable, with disparate demand. There is more supply than in other times, possibly producers lowering cargo, Arocena said. Prices are around US$4.54 per kilo for lamb, US$4.60 for heavy lamb, US$4.62 for sheep, US$4.18 for capons and US$4.15 for ewes.

Last week, 17,250 sheep were slaughtered, less than in the previousbut the volume was higher compared to the same period of 2021 and 2020. In the annual accumulated there are 440,879 animals, 7% less than a year ago.

So far in May, there has been a sharp drop in sheepmeat exports to China. So far in 2022 there is a reduction in the total volume exported to all destinations, with 7,611 tons compared to 9,693 in the same period of 2021.

Despite lower volume, values remain firm, averaging $5,530 per tonne last week, the best record since the beginning of April. In the annual accumulated, US$ 5,160 are reached, with 9% over the US$ 4,740 of a year ago.