Inclusion and financial education have become fundamental pieces in the progress to achieve greater economic opportunities and social development in Peru. For this, from different financial sectors, there is a commitment to improve the financial education of all Peruvians.

Since AFP Premiumone of the four AFPs of the Private Pension System, are aware that explaining to the new generations everything that the pension system implies means a great challenge, a challenge that they are facing with tools such as ‘El Depa’, the first web series of financial and pension education in the country.

Jaime Vargas, Commercial Manager of Prima AFP, in conversation with Peru21details the role of ‘El Depa’ as a catalyst for the comprehensive development of pension education and how this type of tool helps combat the myths surrounding the AFPs.

Jaime Vargas, Commercial Manager of Prima AFP

The pension sector is not easy to understand. By itself, the majority of Peruvians have not had access to financial education and worse if we talk about the private pension system. How powerful can a web series be as a tool to bridge this gap?

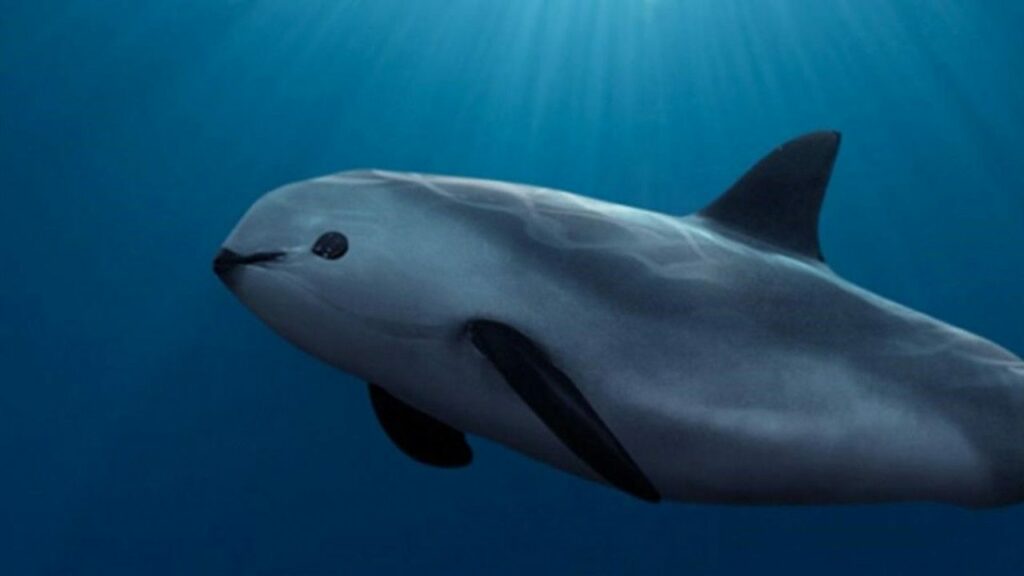

In the 17 years that Prima AFP has been in the market, we have witnessed the change in the behavior of our clients to get information. Years ago we relied on the traditional media and our most disruptive proposal was to be on the radio receiving questions from the public live. Many of the current clients in the Private Pension System and, above all, the potential ones are mostly young people and they mainly use digital media and information. I am convinced that audiovisual content has become essential for that generation and for this reason ‘El Depa’ was born as a tool to reach these affiliates. There are already more than 65 million reproductions on social networks and more than 24 chapters with which we have addressed different topics of interest such as differences between the ONP and the AFP, types of funds, profitability, among others, managing to clarify the most common myths about the Private Pension System. After being with the public for more than six years, ‘El Depa’ has contributed to financial education in Peru, presenting concepts of the pension system in a cheerful and fun way through the daily stories of a group of young people who share his apartment.

Precisely, the lack of information about the Private Pension System causes many people to have a wrong concept of it and I would even say that it is negative. Could it be said that precisely these ideas are generated by the forms of communication?

Many times we have seen that there is information that can cause confusion about how our industry works and for this reason we work every day to make our messages clearer and more understandable. During the pandemic we witnessed the need for information that thousands of affiliates had, since in many cases they were not even sure how much money they had saved, among other issues. In this way to improve this perception, “El Depa” serves as a pillar of transparency for affiliates. With its chapters it seeks to inform in a didactic and entertaining way about everything that the pension system implies.

There is an idea that the AFPs report only the good and the bad always appears in small print. Today we are even going through a difficult economic context and eyes are on the red numbers of the profitability of the pension funds. Can affiliates feel sure that the information provided by ‘El Depa’ is completely transparent?

Yes, you can feel sure of it. In fact, most of the topics chosen to develop the episodes are based on the most recurring doubts of the affiliates. In the case of investment and profitability issues, we have dedicated 4 chapters in the year. The information from “El Depa” and, in general, the information that we disseminate through all our channels, is 100% transparent and true. It is important to remember that pension funds are very long-term investments and the negative effects that can be generated in the short term should not cloud our vision of the horizon, which is to have pensions for retirement age. The current situation is atypical; however, history has shown us that the profitability of the funds has always recovered after each crisis has been overcome. From ‘El Depa’, we have addressed issues that are sometimes difficult to understand, always with complete objectivity. Moving on to our last season, we’ve covered what happens to your fund if you withdrew a portion during these past two years. We also talked about the importance of evaluating the profitability of the AFPs in the long term and the diversification that the AFPs apply to invest your money.

:quality(75)/cloudfront-us-east-1.images.arcpublishing.com/elcomercio/EJXXW3OW7ZBBZNBPDRB4NJOCXQ.jpeg)

If ‘El Depa’ was born from the need to reach younger clients, before, what were the ways that affiliates had to find out about the pension system? How important is it that affiliates have all this information from the moment they join the SPP?

We are convinced that it is very important that new affiliates have as much information as possible about their funds and about their finances in general. With this they will have more tools to strengthen the health of their own personal finances and build a dignified retirement. Knowing how the pension system works, affiliates can better choose which of the three types of funds they will contribute their money to and also make voluntary contributions to improve the profitability of their funds.

The episodes of ‘El Depa’ last between 3 and 5 minutes. Can all the concepts of the AFPs be explained well in such a short time?

We believe that the biggest challenge of our initiative is to synthesize very technical aspects of the system in simple informative pills of less than five minutes. By having a short duration, the messages of each chapter are very focused on developing in an entertaining way the topics related to the AFPs. Nor do we force all content in the series to be financial. If we review, approximately 60% is focused on the history of the protagonists and 30% is focused on the pension system.

How much has ‘El Depa’ helped Prima AFP as an alternative tool to improve financial education? Has it been effective? Have you perceived a greater interest on the part of your affiliates to learn more as a result of the last seasons?

‘El Depa’ has become one of our pillars for improving satisfaction and reputation. The more than 65 million views on social networks are complemented by a good level of understanding in our latest episodes. Precisely, the level of understanding is measured through “El reto Prima”, a mechanism carried out to validate the understanding of affiliates about the episodes released. In fact, since we started with ‘El Depa’, affiliates have felt a climate of greater closeness and the vast majority perceive a positive impact regarding our concern to educate about the SPP and to keep them informed about their funds. Even, according to one of our latest studies carried out by Ipsos, it reports that approximately 1 in 5 Lima workers (20% of those surveyed) have seen or heard something about ‘El Depa’.

When we talk about web series, we are referring to YouTube and the most classic social networks, something typical of the millennial generation. I imagine that, from Prima AFP, they are aware that at some point they will have the entry of affiliates from generation Z. Given this, what other platforms would you like to explore to continue contributing to pension education?

That already happens. The youngest affiliates are called centennials or Z. As he commented, our communication strategies always include being present in the media that our clients use for information. In fact, we have been working on content from ‘El Depa’ and Prima from our TikTok account. We hope to continue developing new content on the platforms that gain popularity in these new generations that come to be part of the system. To do this, we can rely on other proposals of ours such as Micros Abiertos, a transparency platform with members where we answer their questions in a simple way, and Ahorrando A Fondo, our pension education website.

RECOMMENDED VIDEOS

:quality(75)/cdn.jwplayer.com/v2/media/yILMlUTZ/poster.jpg)