The Economist Henri Hebrard considered yesterday that the country should increase tax pressure for which it would merit the realization of a profound fiscal reform of both income and expenses and the management of the debt and assets of the State.

He specified that for 2023 budget the same level of fiscal pressure as this year is being contemplated.

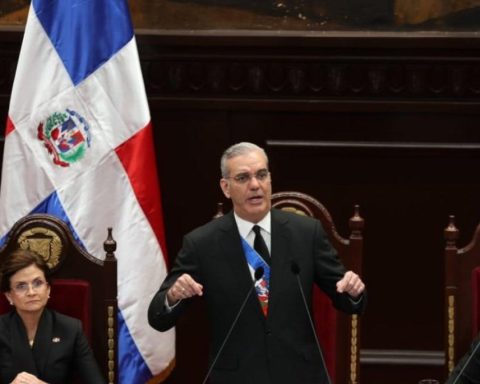

He argued that the tax reform will be carried out by the government that emerges from the polls in the 2024 elections, because the administration of Louis Abinader It has not been able to address this issue due to the crisis generated by covid-19 and inflation.

Can read: Bagrícola announces renewal of 100 thousand tasks of cocoa plantations

He considered that this reform is a necessity for the Dominican economy and should be discussed in the platforms of the different presidential candidates and that it produce a certain level of consensus.

He considered that the fact that the economic growth it failed to be well distributed and that it still has high inequality and informality in the economy are consequences of how the model is.

He stated that not applying the Tax Reform it has delayed the possibilities of reducing the social debt, the inequality gap and having higher quality growth. He believes that not only is efficiency in the quality of spending sufficient, but that more revenue is needed.