Lessening tensions in Ukraine and high interest rates in Brazil caused the dollar to fall below R$5.20 and close at its lowest since September last year. The stock rose and reached the highest level in five months.

The commercial dollar closed this Tuesday (15) sold at R$ 5.181, with a decrease of R$ 0.038 (-0.72%). The price even opened close to stability, but retreated with the opening of foreign markets. At the day’s low, around 11:30 am, it dropped to R$5.16.

The US currency is at its lowest value since September 6 of last year, when it was sold at R$5,177. The currency accumulates a fall of 2.36% in February and 7.08% in 2022.

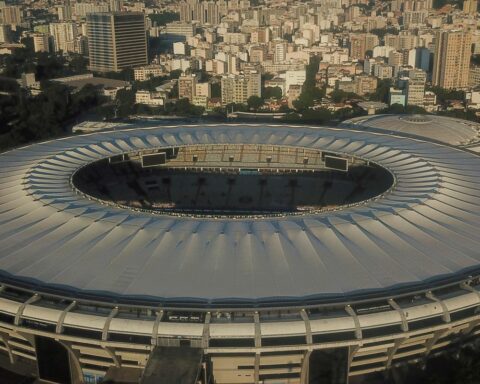

The day was also marked by euphoria in the stock market. The B3 Ibovespa index closed at 114,828 points, up 0.82%. The indicator closed at the highest of the day, boosted by bank shares, which are reporting better-than-expected earnings. This offset the fall in shares of mining companies and commodity exporters (primary goods with international quotations).

The Ibovespa is at its highest level since September 15th. The indicator accumulates high of 1.11% in the week and 9.55% in the year.

The global market had a day of relief after the announcement that part of Russian troops are returning to bases after military exercises near the border with Ukraine. The North American and European stock exchanges had a strong increase. The international price of oil, which yesterday had reached US$ 96 (Brent barrel) dropped to US$ 93 today.

In addition to the temporary international relief, the high interest rates in Brazil contributed to stimulate the inflow of foreign capital into the country. At the beginning of the month, the Monetary Policy Committee (Copom) increased the Selic rate (basic interest rates in the economy) to 10.75% per year, with double digits for the first time since 2017.

* With information from Reuters