The total gross collection of the General Tax Directorate (DGI) reached $50,731 million in Novemberand had a real year-on-year growth of just 0.2%, as reported by the agency on Thursday.

For its part, net collection, that is, discounting the tax refund, reached $44,155 million with a real year-on-year increase of 0.8%.

The difference between gross and net collection corresponds to the tax refund, which can be made through payments made with credit certificates issued by the DGI or by cash/bank refunds.

Collection data for the last month once again reflects the cooling of the economy shown by different indicators. Last week the national accounts report for the third quarter released by the Central Bank (BCU) marked a stagnation of activity that is projected to continue at the start of 2023.

consumption taxes

consumption taxes they were the main source of income for the state fund and totaled $29,000 million, with an increase of 0.2%.

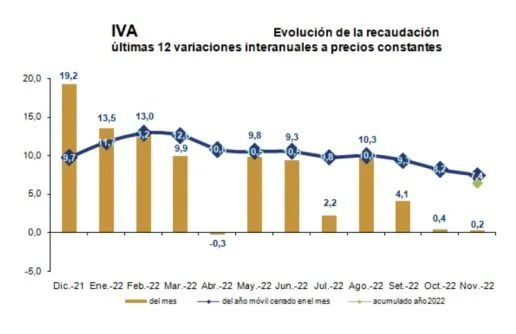

Within this group, VAT revenue totaled $23,801 million with a real variation of 0.2% year-on-year.

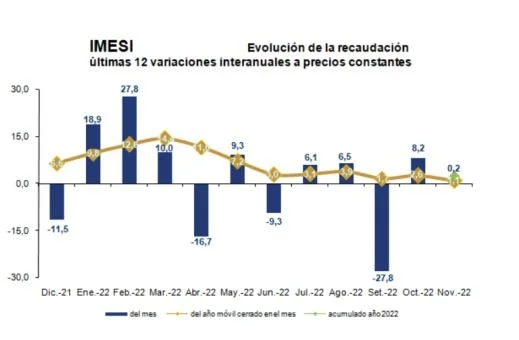

Meanwhile, Imesi’s collection reached $5,201 million with a year-on-year growth of only 0.2%.

Income Taxes

The collection of the Income Tax from Economic Activities (IRAE) reached $6,561 million and had a real year-on-year decrease of 1.8%.

Finally, the collection of Personal Income Tax (IRPF) reached $8,761 million, and increased 2.1% in real terms.

The collection of income tax category II (paid by workers) increased 2.9%, while category I (capital) fell 1.4% in the year-on-year comparison.