Seven months ago, the Chilean startup for the digitization of the traditional channel, Almacén Gurú, landed in the Mexican market and achieved rapid and robust growth: in 10 weeks it reached figures similar to almost a year of operation in Chile, the country in which it started in 2019 In 2021, it had already landed in Peru, another territory that has brought strength to the company.

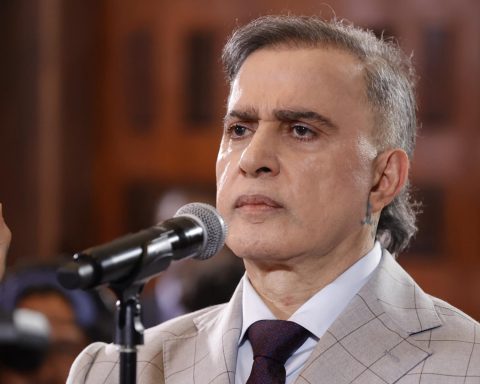

“The entry into Mexico and Peru was quite successful. Obviously, all the lessons we learned in Chile allowed us to bring a more polished model to these markets. Thus, in 10 weeks we achieved in Mexico what it took us 45 weeks in Chile”, the CEO and founder, Carlos Uhlmann, told Diario Financiero. In this way, he exemplified that, during their first month in the North American country, they started with 300 clients and “we have already served 7,100, we have grown 25% month-on-month.” In Peru it was more or less similar, they started with about 200 clients and there are already 1,800.

“In total, between the three markets, we have some 28,000 customers who are on the platform and we serve more than 40,000 points of sale. In 2022 we grew by seven in customers and points of sale, compared to the previous year. And we multiply our sales invoicing by four until we reach 10 million dollars ”, he pointed out.

This figure would increase by at least five times, for which it expects to carry out a capital raising in the coming weeks. “We intend to close it in a month or so, betting on raising about 6 million dollars, of which we already have practically 80% entered and committed,” he explained.

With these funds, Uhlmann expects to continue growing in Mexico, Peru and Chile, especially in the former, considering its large size. “Although in Chile there are 100,000 points of sale and in the Peruvian market there are close to 400,000, in Mexico there are 1.5 million,” he said. By 2023, Almacén Gurú expects to serve more than 40,000 customers in Mexico.

The 6 million dollars that Almacén Gurú expects to raise will also be allocated to its Analytics vertical, since for now it works with 20 companies and considered that “it is the best way to capture information about the traditional channel.” In addition, 2023 will be the year in which they will bet on granting financing to the premises, this after carrying out a white march that yielded a delinquency close to 1.1 percent.

“In Mexico and Peru we launched our fintech model as a proof of concept, where we delivered more than 1,500 loans that have allowed our clients’ sales to double. They turned out to be very good payers, because they are clients who live from their business, ”he explained. They expect to have approximately a 15-20% share of their sale through credits.