BBVA bank revised upwards its growth projections for the Uruguayan economy for this 2022, from 3.9% to 4.7%according to data presented this Wednesday in BBVA Research’s Uruguay Situation report.

The projection is based on 2021 “carryover” effect which generates a growth floor of 3.6%, added to the good performance expected for trade in goods abroad, favored by the price of commoditiesand the investment associated with the construction of the new UPM pulp mill in Paso de los Toros.

This even when some early indicators of activity during the first quarter have shown signs of moderation compared to the dynamism that the activity brought in the last third of 2021.

By 2023 it is expected growth moderation to 3.5%. This contemplates a correction in the prices of commodities that will lower the contribution of exports. Added to this is the completion of the UPM works, with which the investments will depend on other small projects that can be launched, said the economist Adriana Haring.

Analysts and economic agents who responded to the latest Survey of Economic Expectations of the Central Bank of Uruguay (BCU) expect the GDP to expand 4.2% this year and 3% in 2023. Meanwhile, the MEF expects a GDP expansion of 3.8% for this year.

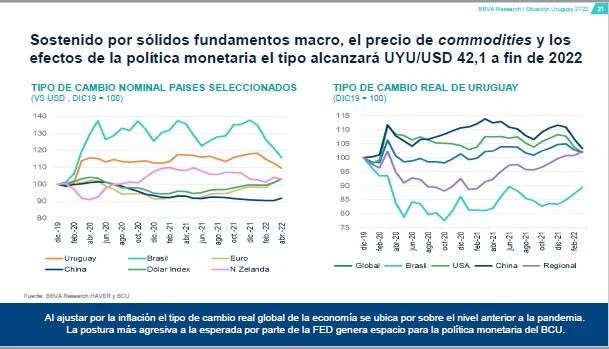

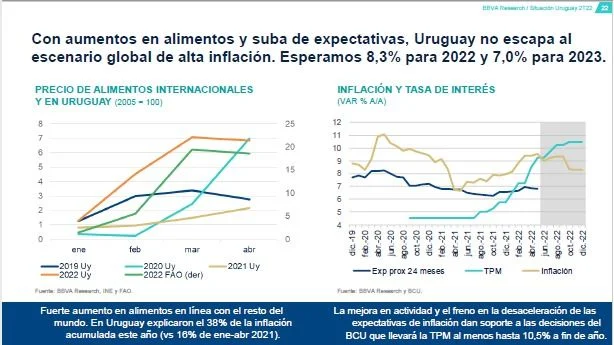

Inflation and exchange rate

The economist Juan Manuel Manías commented that it is projected an exchange rate that will reach $42.1 on average at the end of the year. This is supported by “solid macro fundamentals” of the peso, the price of commodities that generates higher foreign exchange earnings for the country, and the effects of monetary policy (due to the rise in the BCU interest rate).

In this sense, Manías pointed out that the BCU “will maintain its commitment against inflation” and will raise the reference rate to at least 10.5%.

The bank, on the other hand, expects inflation closed the year at 8.3%. The economist explained that given the increase in food prices and the rise in expectations, Uruguay “does not escape the global scenario of high inflation.”

international prices

The bank anticipates that the prices of lEnergy raw materials will remain high in the short term by the distortions produced by the sanctions of the Russia-Ukraine war; and in the medium and long term due to the difficulty of achieving a rapid energy transition, and the role that these fossil fuels will maintain as support for the new global energy matrix.

In the medium term, high prices and volatility are also expected in products such as sunflower oil, wheat, corn and fertilizers, whose values skyrocketed as soon as the war began due to fears of lack of supply.

Labor market and fiscal deficit

In relation to the labor market, unemployment is expected to reach 7.7% by the end of the year, “explaining the stagnation in the generation of jobs after the pandemic has been overcome,” they pointed out.

“At the end of UPM 2, we believe that unemployment may suffer a little if it is not compensated with new investment projects,” said Haring.

On the other hand, Haring pointed out that the fiscal consolidation of 2021 registered thanks to better revenues due to greater activity and the containment of spending “will be maintained” in 2022, “which will allow the fiscal goals to be achieved.” The projected consolidated fiscal result is 3.2% for this year.

overall picture

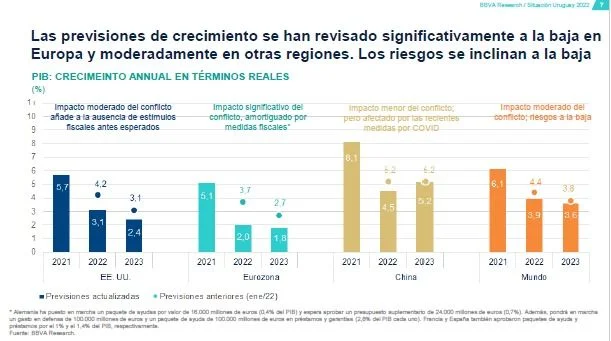

After expanding 6.1% in 2021, global GDP is expected to grow 3.9% this year and 3.6% in the following (-0.5 pp and -0.2 pp, respectively, compared to previous forecasts )

For the Euro zone the expected growth is 2% from a previous 3.7%. China is expected to grow 4.5% instead of 5.2%, and the US is expected to grow 3.1% instead of 4.2%.

The economist Marcos Dal Bianco affirmed that there will continue to be demand for the products that Uruguay exports, but in a “slower” world, and with a supply shock on prices that implies higher inflation for the world and withdrawal of monetary stimuli.

It is expected that the US Federal Reserve (Fed)be “more aggressive” and take interest rates to at least 2.75% this year and 3% in 2023. The European Central Bank will also start raising rates towards the end of the year

“A deterioration of the conflict and a new escalation of sanctions could cause a scenario of stagflation, at least in Europe. The withdrawal of stimuli by the Fed, which could cause an economic recession or financial disruptions, and a more abrupt slowdown in China, due to severe mobility restrictions due to covid, are other major global risks,” the economist warned.