The Central Bank of the Dominican Republic presented this Sunday its analysis of the rise of electronic means of payment in the country.

In this document, the financial institution ensures that remains the guarantor of the proper functioning of the Securities Payment and Settlement System of the Dominican Republic (SIPARD).

Also, he indicated that has not ceased to provide SIPARD with the necessary regulations that allow access and operation of payment service providers with fairness and regulatory certainty, as well as the due protection of the users of said services.

comprehensive analysis

Boom of electronic means of payment in the Dominican Republic

Transactions through electronic means of payment are increasing, this as a result of the preference of its use by financial users, the wide availability of digital products and services, as well as the initiatives promoted by the Central Bank to promote electronic payments.

The Securities Payment and Settlement System of the Dominican Republic (SIPARD) It provides the mechanisms through which monetary resources are channeled in the economy, so that economic agents and the general public can carry out their financial and payment operations with security and legal certainty.

Nowadays In the country, there is evidence of a notable expansion in the use of electronic means of payment, where a significant proportion of bank customers use the electronic channels available to them to make fund transfers and payments, withdrawals and deposits at ATMs, as well as purchases at physical and virtual point-of-sale terminals.

The electronic means of payment used in SIPARD are electronic fund transfers, such as: direct debit, direct credit and BCRD Instant Payments; debit, credit and prepaid cards. Each of these with differential characteristics that determine the access channels, as well as the type of use and preference by the users of the same.

To have a precise view of the boom experienced by electronic means of payment, it suffices to observe that between 2008 and 2021, the volume of payments of this type increased 503.5%, while checks decreased 33.7%. In 2008, 76.5 million electronic payments were registered and 32.0 million checks were issued, while in 2021, they became 462.0 million and 21.2 million, respectively. In terms of participation, in 2008, 70.5% of payments were made with electronic means of payment and 29.5% with checks, while in 2021, they stood at 95.6% and 4.4%, respectively.

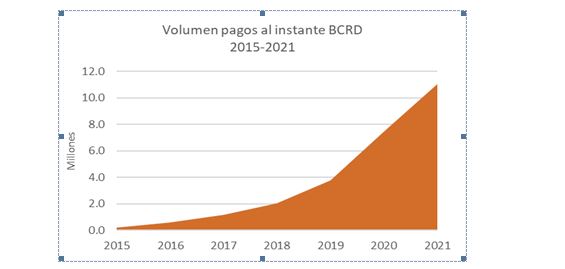

It is worth noting that The COVID-19 pandemic has accelerated the growing use of electronic means of payment, presenting an increase of 28.1% in the volume of operations in the year 2021, compared to the year 2019 before the pandemic. This behavior can be observed mainly in BCRD Instant Payments, which increased by 192.7% in the aforementioned period, that is, from 3.8 million transactions in 2019, to 11.1 million in 2021.

Now, let’s see the aspects that have driven the expansion of electronic payment methods, evaluating the current situation of its main players, such as:

- Users, who today have greater access to the internet and electronic devices such as cell phones, computers and tabletswhere 92.7% of households have a cell phone[1] and there are 9.5 million internet accounts[2], which has allowed them to be better informed about financial and payment services, as well as the rights that correspond to them. These users prefer the use of electronic channels for their transfers and payments, especially channels that allow immediate accreditation. In this sense, at the end of the year 2021 there are 5,566,792 internet banking users, 299.9% higher than the number of current users as of December 2014 of 1,392,051.

Banking entities are devoting more resources to expanding services through electronic channels and offering new digital products.

To date, 100% of multiple banks offer services through internet banking and 90% of savings and loan associations, as well as 58% of savings and credit banks, which shows the recognition of the importance digitization and services through electronic channels.

- New and traditional non-bank payment service providers are making inroads with innovative and attractive alternatives, such as payment system administrators, acquisition companies and ATM network administrators, the latter with almost 150 devices of this type operating in areas of the country traditionally with few cash dispensers; Y,

- The Central Bank is constantly updating regulations on payment systems and modernization of technological and operational infrastructure which provides services to payment systems, thereby guaranteeing the security of SIPARD’s payment settlement services.

In this sense, when evaluating the causes of the strong increase in payments through electronic means, the stellar role played by the Central Bank must be highlighted, through accurate and timely measuressuch as the implementation of the LBTR system to settle in real time all payments made between financial intermediation entities, securities intermediaries, the centralized securities depository, the Social Security Treasury and the National Treasury, as well as the Central Bank itself.

This platform is also used to settle operations in the country of Visa and MasterCard cards, ATMs, checks, direct debits and credits (ACH), mobile payments and bank sub-agents.

In the case of the latter, they correspond to the transactions carried out in the almost 5,000 sub-agents that operate throughout the national territory, which facilitate access and use of financial and payment services to communities without a bank presence, as well as contributing with inclusion and banking.

Likewise, The BCRD Instant Payments service has been another determining factor in the rise of electronic means of paymentThrough this service, bank customers make fund transfers and loan and card payments 365 days a year, from 7:00 am to 11:00 pm, with a maximum crediting time of 8 minutes.

This service has been very well received by bank customers, increasingly eager for immediacy and security in their payment operations, in 2021 alone 11.1 million transactions were made, while in 2015 0.2 million were made of payments. From the start of the service in November 2014 to December 2021, 24.8 million transactions have been made.

In the regulatory field, The Central Bank has not ceased to provide SIPARD with the necessary regulations that allow access and operation of payment service providers with fairness and regulatory certainty, as well as the due protection of the users of said services.

To this end, through the integral modification of the Regulation of Payment Systems, approved by the Monetary Board through its Second Resolution of January 29, 2021 and the approval of its complementary instructions, these objectives are met and therefore contributes to promote the development of financial activity and the economy in general.

In that tenor, The new regulatory framework has made it possible for Fintech payment companies, such as electronic payment entities and payment aggregators, to enter SIPARDwhich through the management of electronic payment accounts and other payment instruments, respectively, promise to bring payment services to sectors traditionally neglected and outside traditional financial services.

In a constantly evolving financial and payment system, the Central Bank remains the guarantor of the proper functioning of the Securities Payment and Settlement System of the Dominican Republic (SIPARD)thus complying with the mandate provided in article 15 of Law No. 183-02, Monetary and Financial, on its functions of “supervision and final settlement of payment systems”.