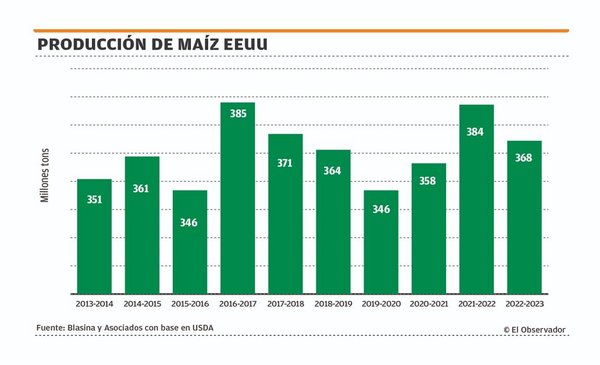

A new week of declines closed in the international grain market, which continues without finding a price floor. In addition to the wheat and corn harvest, there is a very good weather condition for crops in the United States that are going through the key moment of corn and soybean flowering and are heading for an excellent harvest.

While in the world the logic of raising interest rates continues, negotiations for an exit of grain from Ukraine also continue and thus the agricultural market continues to lose its previous references, returning to prices like those it had before the war.

Value adjustment

In this context, local prices had important corrections.

In particular, wheat for the next harvest lost the reference of the US$300 to US$310 it had and is offered at US$290. While rapeseed fell to US$560. This creates a mismatch between crops that had an expectation higher prices at planting and assumed high seed and fertilization costs and now have a more uncertain outlook regarding the price at harvest at the end of the year.

The same happens with those who undertook high rents for next year’s soybeans. This week the references for soybeans were at US$470, more than US$100 below the prices of this crop.

In contrast, a firm situation is consolidating in the price of rice in Brazil, which will also drop its production area in Rio Grande do Sul by approximately 10% as a result of the persistent expansion of corn and soybeans.

Price reference.

Uruguayan crops

Productively, a very favorable panorama continues for crops in Uruguay. The rise in temperature has allowed crops to accelerate growth and for now Uruguay may be heading for a favorable third consecutive harvest of wheat, barley and rapeseed. The spring rains are now determining the outcome of a harvest that in terms of prices seems to mark a landing compared to the previous one, although still with interesting values if productivity is indeed high.

At the close of this edition, negotiations were continuing for a grain exit from Ukraine through the Black Sea with the mediation of Turkey, a factor that may weigh on the market if it materializes, but about which there is still strong skepticism.