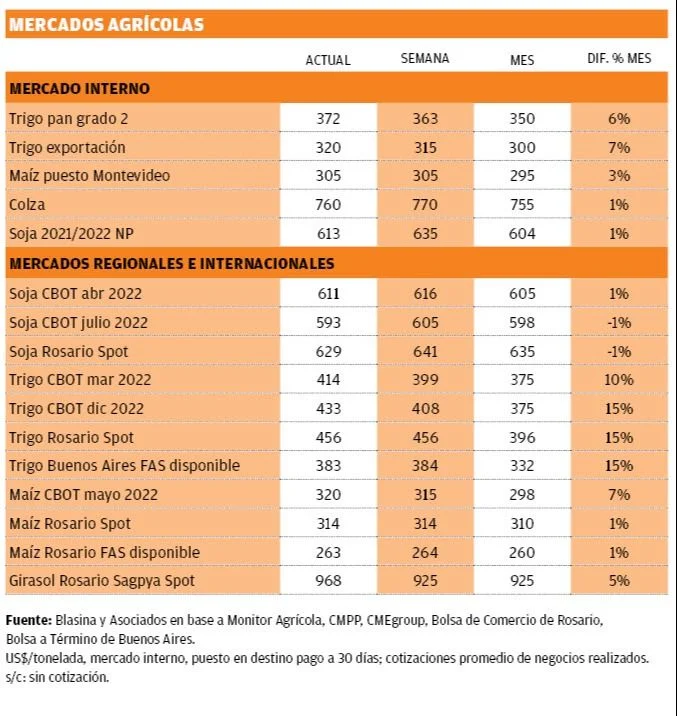

After a hesitant start to the week due to the sharp fall in the stock markets and the prospect of rising interest rates, the grain market had a strong momentum this Thursday afternoondue to a report from the United States Department of Agriculture (USDA) that unexpectedly cut the availability of wheat in that country and began to correct downwards the expected yield of corn, due to late planting.

Wheat led the rises, which were accompanied by corn and soybeans. The US has little stock of the three grains. The drought in the west has decimated wheat and that added to a sharp drop in expected wheat exports in the European Union sent the market soaring.

More calm was the reaction of the soybean market. In the US, it is projected that it will have a historical production record of 126 million tons, above the 121 million in 2021/2022 and the 125.5 million calculated by private companies. This figure was reached based on a planted area of 36.83 million hectares and a projected yield of 3,463 kilos per hectare.

The report gave the first projections of the 2023 South American soybean harvest, where part of a record in Brazil and a continuation of the stagnation of soybeans in Argentina. The expected harvest in Brazil was placed at 149 million tons and that of Argentina at 51 million, a strong difference compared to what was recently harvested in Brazil (125 million tons).

With a supply of soybeans that is projected to be abundant, the data that strengthens the market is a projection of imports from China of 99 million tons, 7 million more than expected.

The delay in planting leads to a projection of corn production in the US lower than expected and with a reduction in the stock of wheat in that country (47 million tons, expected 49 million), which generates an unexpected drop in stock.

Piqsels

Wheat seeds.

The wheat market had a strong rise that comes at a very propitious moment for Uruguay, where the sowing of wheat and barley is starting.

On Thursday afternoon, US$ 390 per ton was offered for maltingwhile December wheat in Chicago jumped to the $430 linewhich gives a direct signal to barley but also indirectly to wheat that is being sown, with a very good price, but which may continue to rise as the harvest in November approaches.

The agricultural firmness continues and while the producers cross their fingers so that it can be exported without problems.

Ruben Martínez, director of Corporación Navíos, estimated that approximately 10% of exported soybeans go, while on sunny days the harvesters advance, usually lifting more than 3,000 kilos per hectare.

There is a fundamental consolidation of prices, a reality that allows farmers to face higher costs this year with significant price support.

EO