The last decade has seen an accelerated pace of growth in sustainable investing, becoming a trend that shows no signs of abating. For decades it has been common to have traditional investments that only seek a financial return for the investor, but now sustainable investments generate opportunities for environmental, social and corporate governance (ESG) improvement, while also providing attractive returns.

According to the report Global Financial Stability Report (GFSR), sustainable investments will help reduce the most damaging effects of climate change. Although these investments are growing rapidly, they are still in the minority. The investment fund industry handles some USD 50 trillion in the world, but sustainable funds represented just USD 3.6 trillion at the end of 2020, that is, 7% of the sector. Meanwhile, financial services with specific objectives in climate change mobilized USD 130,000 million of that total.

Sustainable investments are a set of strategies and practices that incorporate environmental, social and corporate governance criteria in the investment process, known by the acronym ESG, which in English correspond to: environmental, social and corporate governance. In that sense, impact investing is intended to generate a positive and measurable social and environmental impact, along with a competitive financial return.

“We are going through a crucial moment in which everyone, from where they are, can drive change and generate interest with sustainable investments. Precisely from tyba we have investments with return generation for our users and, at the same time, we generate a social or environmental impact” comments Valdemaro Mendoza, CEO of tyba.

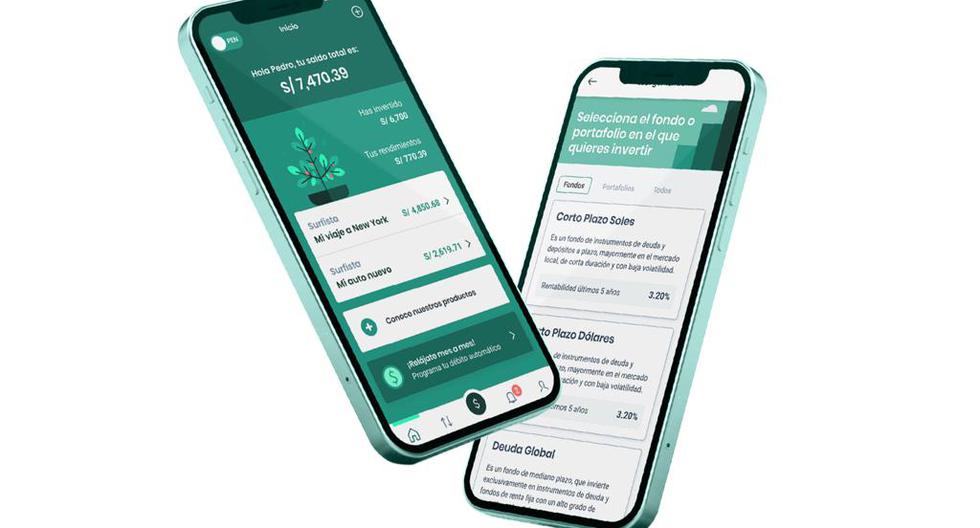

tyba, BCP’s investment platform, which arrived in Peru in 2021 and works as a digital channel to easily and quickly access investments through mutual funds managed by Credicorp Capital SA SAF, has enabled mutual funds in its application that allow generating this type of investment with shares at a global level; focused on issues related to improving the quality of life such as financial inclusion, affordable housing, alternative energy, among others. Two of them generate a much more direct impact that is measurable and materializable:

- Fund of Funds Credicorp Capital Oncology Impact: This fund invests more than in health. They are companies that actively fight against cancer, from research, diagnosis, characterization, technology and medicines.

- Fund of Funds Credicorp Capital Sustainable Impact: It is the one that aims to generate a positive impact on society and the environment, through the empowerment of people (eg financial inclusion), access to essential aspects of life (eg affordable housing); and preserving the environment.

What is most interesting is that these investments also deliver a competitive financial return. tyba points out that the annualized return in the last 2 years of the Oncology Impact Fund is 12.6% and the annualized return in the last 3 years of the Sustainable Impact Fund is 14.2%. “As more people become familiar with this type of investment, more companies will be encouraged to improve their production dynamics, use of resources and will begin to qualify as responsible companies with a positive social and environmental impact.Mendoza concludes.

Modern society is going through one of the most challenging economies of all time and investment innovation needs to evolve. Sustainable investment funds focus on innovative companies with products and services that address the world’s major environmental and social challenges. These companies are dedicated to generating a positive environmental and social impact, while not neglecting the potential for growth in investor returns.

DATA

- According to the report Global Financial Stability Report (GFSR)sustainable investment funds manage around USD 3.6 trillion in the world.

- Credicorp Capital Sustainable Impact Fund, available on the tyba app, invests in global companies accredited as sustainable according to ESG parameters.