The pension reform based on the individual capitalization model was approved within the framework of Law 87-01 that created the Dominican Social Security System. Under this system, companies and workers would contribute a monthly percentage of their salary to the worker’s capitalization account, resources that the pension fund administrators (AFPs) would receive and invest in pursuit of the highest return within the established regulatory framework.

When the system started there were very few investment options. The AFPs invested practically all their resources in investment certificates issued by banks and other entities in the financial system. The AFPs could invest a reduced percentage of the portfolio in financial certificates denominated in dollars. The Ministry of Finance had made an issue of US$500 million in September 2001, but it had been placed on the global capital market. AFPs, to this day, are not allowed to enter the global market to buy sovereign or corporate bonds.

Starting in August 2002, the foreign exchange market began to show pressure on the demand side, which accelerated the depreciation of the peso. While the dollar was selling at 16.95 pesos in December 2001, by December 2002 its price had reached 21.24. Although the pension reform had not started, the AFPs in formation considered that, in order to guarantee good returns to workers, they had to structure a diversified investment portfolio: part of the funds would be placed in financial instruments denominated in pesos and the other in certificates denominated in dollars. In this way, the worker-investor would partially benefit from the depreciation of the exchange rate.

The first contributions to these accounts are made in July 2003. The AFPs analyze the available offers of financial instruments and decide to place most of the contributions received in financial instruments denominated in pesos and the rest in financial certificates in dollars issued by the banks. based in the country. Things were going well. In 2003, the AFPs generated an annualized return for workers of 24.2%. In 2004, to the extent that the peso accelerated its depreciation against the dollar as a result of the depositor rescue model adopted by the Central Bank, the AFPs’ decision to place part of the workers’ contributions in financial certificates in dollars turned out to be a blessing for the latter. The situation began to change to the extent that the Central Bank accelerated the placement of investment certificates in pesos with high interest rates to collect the enormous excess of liquidity generated by the rescue of the depositors of the collapsed private banks; the change accelerated when Leonel Fernández won the May 2004 elections. Fernández announced well in advance that Héctor Valdez Albizu would return as Governor of the Central Bank. The exchange rate, which had reached RD$55.07 per dollar on February 3, 2004, fell to RD$45.60 per dollar on May 14, and continued to decline until reaching RD$42.19 per dollar on August 13. The new authorities of the Central Bank understood a greater appreciation of the peso to be convenient. The exchange rate closed at an average level of RD$29.50 in December 2004. The strong and surprising appreciation of the peso caused a significant erosion in the balance of the pension funds; the appreciation of the peso had reduced the value in pesos of investment certificates denominated in dollars. The unexpected appreciation of the peso left a bad taste for the AFPs and practically all of them liquidated the positions in dollars they held in the pension funds they managed. As a result of the appreciation of the peso, the pension funds suffered a loss of RD$170 million in 2004, equivalent to 4.9% of the annual average of the pension fund managed that year. The AFPs had to request contributions from their shareholders to nourish the workers’ pension funds and thus comply with the requirement of the minimum guarantee of profitability.

The AFPs, after the bad experience of 2004, chose to keep the investments of the pension funds in pesos. As of 2010, they gradually re-invest in dollar-denominated fixed-income instruments, specifically, dollar debt securities issued locally by the Ministry of Finance, some dollar-denominated corporate bonds issued by electricity generation companies, and other fixed-income securities. denominated in dollars. Between 2010 and 2020, the experience was favorable because the peso, instead of appreciating, depreciated every year at an average annual rate of 4.2%. During that 11-year period, just due to the depreciation of the peso, the balances of the pension funds managed by the AFPs reported a profit for workers of RD$16,464.7 million.

In 2021, the appreciation returned. Between December 31, 2020 and December 31, 2021, the Dominican peso appreciated by 1.6%. As expected, the balance of the pension funds, in its component denominated in dollars, suffered a decline. Preliminary information indicates that the loss suffered by the balance reached RD$3,079.8 million, equivalent to 0.4% of the average annual balance of the pension funds managed by the AFPs in 2021. Given that the peso, in relation to its value at the end of the year 2021, it has appreciated by 4% so far in 2022, it is foreseeable that workers, upon receiving and reviewing the balance of their capitalization accounts, will observe a slight reduction. This reduction is temporary. The peso has appreciated due to the fact that the Central Bank, since the end of 2021, has changed its position from a very accommodative or expansive position to another totally opposite, with which it seeks to moderate the intensification of the external price shock that the Russian invasion has produced. to Ukraine.

The Central Bank has done so to make life more bearable for workers who are consumers and who have suffered since last year from the loss of purchasing power caused by inflation. But since in economics nothing is perfect, policies that on the one hand help us, on the other can end up harming us. The working consumer can today benefit from consuming cheaper gasoline because the Central Bank has decided to appreciate the peso. The worker-investor, the one who contributes monthly to his individual capitalization account, may not appreciate it so much, because the appreciation has reduced the balance in pesos that he maintains in the account that will feed the flow of the monthly pension that he will receive when he reaches the retirement age.

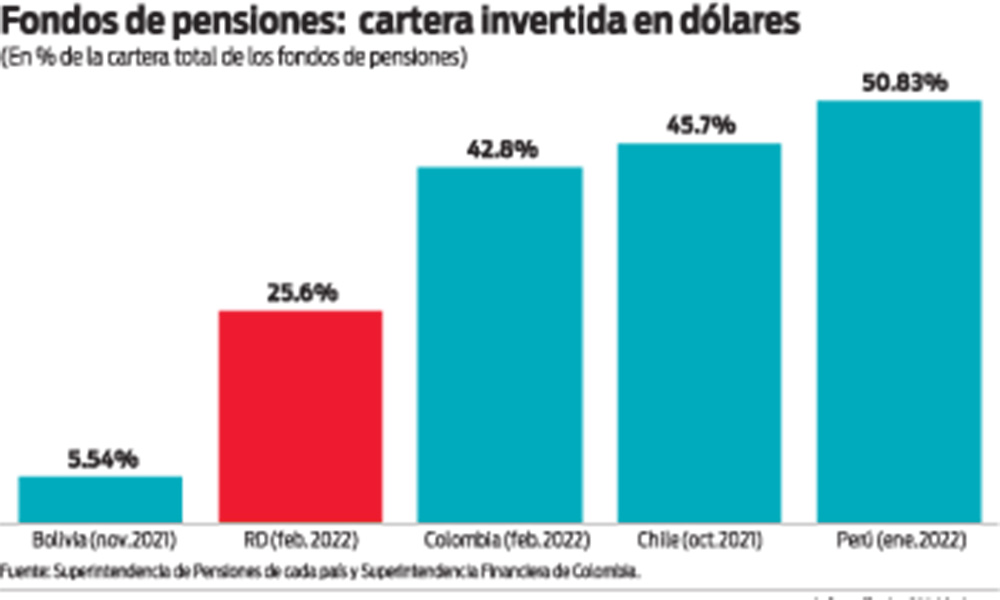

The resentful defenders of the pay-as-you-go system and the trucutuses who want to destroy the individual capitalization system lie and defame when they affirm that the drop in balances in pension accounts is a scam by the AFPs. One of the fundamental principles to maximize the long-term profitability of investments is the diversification of the portfolio. That is what the AFPs have done. Today, they have 25.6% of their pension fund balances invested in fixed-income instruments denominated in dollars, mainly dollar bonds from the Ministry of Finance. The proportion is low when compared to the participation of the portfolio invested in fixed and variable income instruments denominated in dollars exhibited by the AFPs in Peru (50.8%), Chile (45.7%) and Colombia (42.8%). Ours do not have more, because we do not allow them to invest in equity securities denominated in dollars, such as shares of global companies.

No one has stolen a peso. What has happened is that the peso has strengthened. Today he buys more dollars than he bought at the end of January. But the phenomenon has not happened only here. The Chilean peso has appreciated 6% in the first two months of this year, while the Peruvian sol has appreciated 5% against the dollar. No one should be alarmed. The investments of the pension funds are made thinking about the long term, since the idea is that, during a minimum period of 30 years, the workers can accumulate the largest possible balance. Portfolio diversification is the appropriate way to guarantee this result. If someone has doubts, look at the exchange rate of RD$12.46 pesos per dollar that we had on February 28, 1992 and contrast it with that of RD$54.53 per dollar on February 28, 2022. The peso may appreciate for short periods of time; In the long term, however, the AFPs know that the depreciation of the peso against the dollar is inevitable.