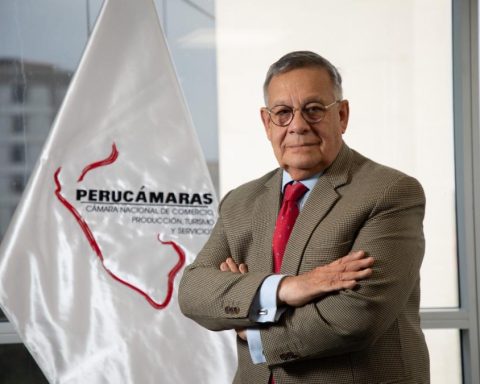

The government’s request to be delegated legislative powers in tax matters has generated controversy. On the one hand, it is perceived as an increase in taxes on taxpayers who already have a heavy tax burden but who receive almost no public compensation. On the other hand, there are those who consider that the proposed measures constitute “A reform” to raise the country’s tax pressure that will allow a better provision of public goods and services for citizens.

The efforts made during the pandemic have reduced private savings (due to AFP and CTS withdrawals that in the future may generate fiscal contingencies) and a weakening of public finances. To reverse this situation, it is necessary to increase tax revenues to restore the capacity of fiscal policy to face events that recurrently hit the economy and reduce social welfare. The issue is when and how. Regarding the first, today it is difficult to aggressively increase taxes because it would affect the economic recovery.

On how, it is important that tax measures do not distort the incentives to produce, invest, create jobs and save. In addition, they must have broad political support: the taxpayer must be sure that the taxes they pay are being spent properly. Unfortunately, in an environment of low credibility and mistrust, the sensitivity generated by the proposals reveals that this element is absent.

The government expects to obtain S / 12,000 million with these measures (1.5% of GDP). This amount will only help to stabilize public debt and not to improve the quality and coverage of public goods and services. The proposed proposals are far from being a broad reform (for example, increasing the tax base) that allows for the equitable and efficient distribution of the effort that we must make as a society to bear the costs of the pandemic.

![[Opinión] Hugo Perea: Tax reform? [Opinión] Hugo Perea: Tax reform?](https://latin-american.news/wp-content/uploads/2021/10/Opinion-Hugo-Perea-Tax-reform.jpg)