April 30, 2024, 4:00 AM

April 30, 2024, 4:00 AM

“In no case has Bolivia failed to pay the external debt service and, in the Government of President Luis Arce, it has never failed to comply with that commitment,” the Minister of Economy and Public Finance said yesterday at a press conference. Marcelo Montenegro speaking about Moody’s rating downgrade.

In this sense, he explained that the rating downgrade (from Caa1 to Caa3) refers to the bonds that the Government has and that “surely” are valued in the (international) market with some risk of default.

Montenegro stated that in recent days a meeting had been agreed upon with representatives of the risk rating agency Moody’s Ratings, which was suspended by them, so it is unknown on what information they based to lower Bolivia’s credit rating.

“We had a meeting with Moody’s, which they have suspended and we have not had space to speak with them and they have directly released their rating, so we could not say what bases or sources they have referred to to lower our rating. What we can say clearly is that the results we show as a country do not merit a rating downgrade of that magnitude,” the authority said.

Asked about Bolivia’s indebtedness in recent years, economist José Gabriel Espinoza specified that Luis Arce is the president who, despite having had ideal governability conditions, at least during his first administrations, has received a large amount of resources. external debt and not having faced any extraordinary crisis (such as a pandemic), it has been the one that has contracted the most internal debt, reaching $8,554 million in 38 months, “practically doubling the internal debt of the General Treasury of the Nation at the beginning of his management.”

Espinoza adds that it is irresponsible and contradictory management with a sustainable technical perspective. “In fact, that is one of the reasons why Moody’s has lowered Bolivia’s debt rating,” he said.

While the economist José Luis Evia pointed out that according to the financial statements of the Central Bank of Bolivia (BCB), in 2023 credit to the public sector grew by the equivalent of $us 4,392 million. “BCB’s obligations with the public sector grew by $275 million. Therefore, the net credit (monetary financing of the deficit) was around $us 4,117 million.

Earlier, the Vice Minister of Communication, Gabriela Alcón, said that Bolivia has debt capacity and that Moody’s rating was political.

Montenegro insists on boycott

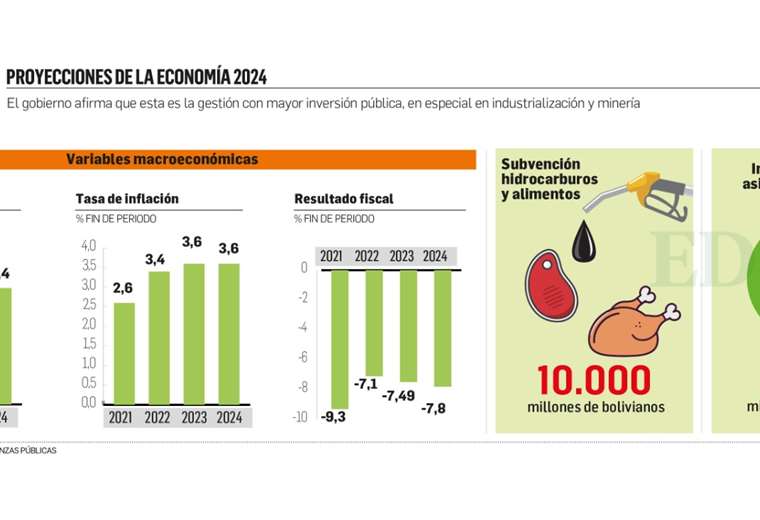

At the time of rejecting the Moody’s report, Minister Montenegro said that it would not be reflecting the economic situation of the country. He pointed out, for example, that the growth predictions for the Bolivian economy, given by the International Monetary Fund for 2023, were 1.8% and were concluded with 3%; The same with the World Bank, which predicted 2.7%, and the country ended up with 3%.

“A growth that positions it as the second fastest growing economy in the region, in an environment, as we already said, of high interest rates, high inflation worldwide, levels of vulnerability and uncertainty caused by the geopolitical issues that are living the world today,” he expressed.

He also referred to the “boycott” suffered by the Executive from the Legislative Assembly by the assembly members who respond to Evo Morales, Carlos Mesa and Luis Fernando Camacho. He also highlighted that one of the “good results” is demonstrated in the public investment executed in 2023, especially in the “industrialization” program, with $225 million, “the highest in history” since 1987.

The former president of Bolivia, Evo Morales, also did not want to be left out of Arce’s statements that “there is no money like before” and proposed a national meeting with social organizations, authorities and businessmen to save the economy.