If you want start this 2023 With your finances better under control, a good idea is to organize them into a budgetwhether personal or family.

To help you, Free Daily republica part of a story originally published on February 10, 2022, for assessing the usefulness of tips shared at that time by the finance advisor Personal and SMEs, Savioly Castillo.

—What do you recommend to manage an income of 30,000 pesos if the person is the head of the family and perhaps has two or three children?

Starting from the reality that the budget is a system to organize our finances and a means by which to tell the money where it will go, then we must be clear that, from there, we organize ourselves.

In summary, the budget will come to tell you one of two things: first, you need more incomeand second, we must reduce expenses.

With this information, we then organize and distribute the games. Regarding the question, the most opportune response is recognition of our reality. From there, then prioritizeseparating needs from tastes and establishing a Lifestyle commensurate with income; that includes choice of address, studies, meals, etc.

In this case, the 50 percent or more of the budget will be allocated to housing, food and education.

—If the person who earns that 30,000 pesos is married, but has no children, and their partner also earns a similar salary, what do you recommend for managing their income? family budget?

This budget would be more comfortable. If good use is made and addressing money wiselymay increase the item assigned to the savingwhich can then become investmentand in this way increase your capital, improve your quality of life and benefit your environment.

—And if the person who wins it is a single person who lives with their parents? What do you recommend?

The organization is as necessary in the first case as in this one as well. In the case of those who live with parentsit is best to assign them one or another of the fixed household expensesso that they assume responsibility and can also establish a special item for the contribution in the family, since they may spend more than they really should or, failing that, do not assume any responsibility, then they waste the total income that perceives.

It is an ideal stage to create the saving habitGive yourself opportunities for a more active social life and create an economic cushion to guarantee a better economic situation once you become independent and start a family.

—Taking into account that 30,000 pesos is an amount lower than the national average for the basic basket (which in December was 40,074.16 pesos), what do you suggest to avoid incurring drowning debts?

There’s a saying very acquaintance for all of us that I understand fits very well in this part: “You wrap yourself up to the extent of the sheet.”

Here we have to choose our expenses well, and always, but always, have the gap of creating new sources of income ahead of us. The parallel venture at a fixed salary is always an excellent option.

—If a person earns that salary and is drowning in debt, what do you recommend to get them out of that situation?

The first step is to do the budgetbecause there you will realize what your monthly needs are versus your current income, where part of those needs must include the payment of debts.

Once you are clear about your commitments I paythe most recommendable is:

1.- Identify your debtsall and each one.

2.- Create payment agreements with debtors, so that it can comply.

3.- Go paying off the debts one by onestarting with the smallest, and, if they are not bank, with the one with the highest rate, because this way they will realize that it is possible to achieve it and they will gradually remove mental burdens.

4.- With your established spending budget, prioritizing needs (home, food, study) and reducing tastes or whims (going out to restaurants, trips, clothes, etc.), not incur new expenses that exceed its capacity and, within the budget, establish an item of at least 5 percent for contingencies. In this way, you can deal with any health situation or emergency that may arise, without the need to incur new debts.

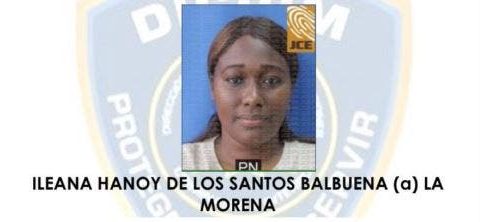

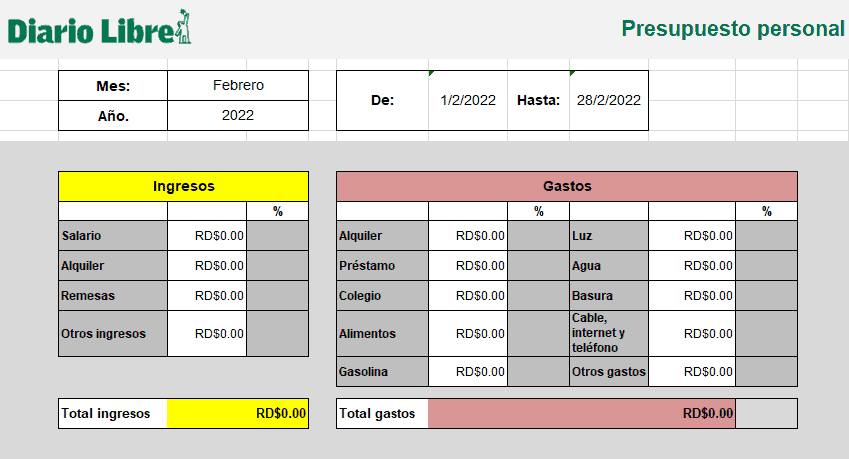

Castillo shares for our readers the following template model to make a budget, which can also be downloaded in its entirety at the end of this article.

The counselor observes that it is important to carry out the budget with net values, that is, free of taxes and deductions. This way you can really know how much money you have.

“With these clear items, you will quickly realize your financial situation and you will be able to plan better your finances, create investment plans and live a calmer life, debt free”, he says.

Notice also that the budget in itself has no value if it is not regularly evaluate and there is no continuous follow-up.

“Step by step, you will see with practice how you will improve over time”, he says to motivate.