The prospect that the Central Bank (BC) will end the interest rate hike at the end of September made the dollar detach itself from the international scenario and fall sharply this Friday (5th). The stock market benefited from the rise in commodities (primary goods with international quotations) and rose for the fourth day in a row.

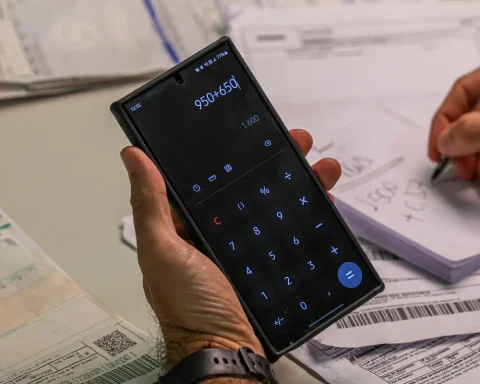

The commercial dollar closed this Friday sold at R$ 5.167, with a decrease of R$ 0.054 (-1.03%). The price started the day on a high, reaching R$ 5.27 around 10 am, but the inflow of external flows during the afternoon caused the currency to reverse the movement and begin to fall.

With today’s performance, the dollar closed the week practically stable, with a drop of 0.07%. In 2022, the currency accumulates a fall of 7.26%. The commercial euro closed at R$5.26, down 1.66% on the day and 0.53% on the week.

After the euphoria of the last few days, the stock market had a more moderate day this Friday. The Ibovespa index closed at 106,472 points, up 0.55% and at the highest level since June 9. The Brazilian stock market benefited from the rise in commodities, which benefited shares of oil and mining companies, and from the release of balance sheets of companies that had higher-than-expected profits.

The dollar’s fall and the stock market’s rise occurred despite the unfavorable external scenario. The disclosure that the US economy generated more jobs than expected in July added pressure for the Federal Reserve (Fed, US Central Bank) to raise interest rates beyond expected.

Typically, the expectation of high interest rates in advanced economies harms emerging countries. However, the Brazilian financial market is still under the influence of the meeting of the Monetary Policy Committee (Copom). Last Wednesday (3), the agency raised the Selic rate (basic interest rates for the economy) to 13.75% per year and indicated that it intends to end the high cycle at the next meeting, when it will raise the rate to 14% per year. .

As Brazilian interest rates continue to be attractive to international investors, this stimulated the inflow of dollars into the country during the afternoon, pushing the price down. On the stock market, the expectation that interest rates will stop rising favors the purchase of shares by investors who prefer to invest in riskier assets.

*With information from Reuters

![[Video] Petro opens the debate on carrying weapons in Colombia: he seeks that no civilian has one [Video] Petro opens the debate on carrying weapons in Colombia: he seeks that no civilian has one](https://latin-american.news/wp-content/uploads/2022/08/Video-Petro-opens-the-debate-on-carrying-weapons-in-Colombia-1024x593.jpeg)