Page Seven / La Paz

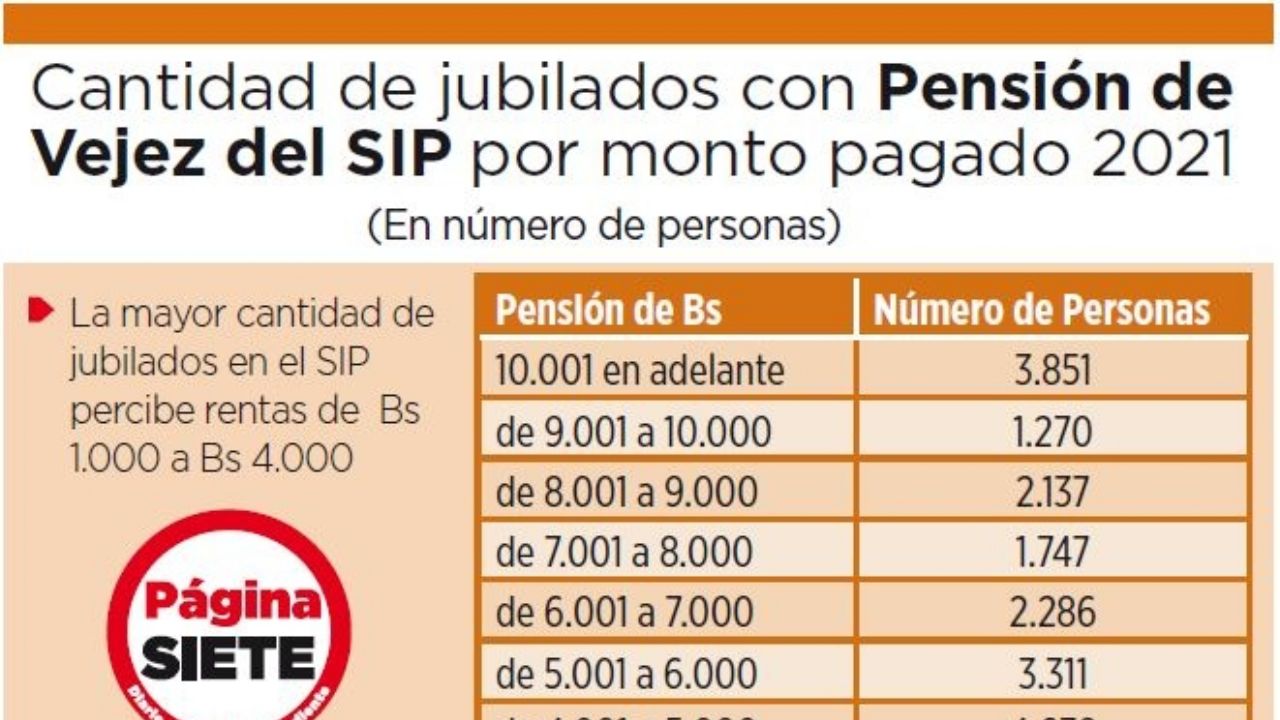

58.3% of retirees with an old-age pension in the Comprehensive Pension System (SIP) receive an income that ranges between 1,000 and 4,000 bolivianos, according to data from the Vice Ministry of Pensions and Financial Services and the Ministry of Economy and Public Finance.

The SIP 2021 economic bulletin indicates that the number of beneficiaries who have an old-age pension as of December last year reaches 46,235 insured.

Retirees who receive a pension of up to 1,000 bolivianos reach 1,900; those who have a pension of between 1,001 and 2,000 bolivianos reach 9,933 insured; those who obtain between 2,001 and 3,000 bolivianos add up to 8,700 and those who receive a pension of between 3,001 and 4,000 bolivianos are 6,462 (see table).

This group with a pension of up to 4,000 bolivianos represents the majority, 58.3%, of retirees with an old-age pension.

The report reveals that those who receive an income of 4,001 to 5,000 bolivianos reach 4,538 insured; In the range of 8,001 to 9,000 bolivianos, 2,137 are insured and those with a pension above 10,001 bolivianos are 3,851 retirees.

An insured person can access the lifelong old-age pension when, with their contributions (plus their yield) and the Monthly Contribution Compensation (CCM), if applicable, they are able to finance an income of at least 60% of the average salary. of the last 24 periods (old-age wage reference).

This benefit does not require having a minimum age for its access, nor does it have an established maximum limit on the amount of the pension to be granted, the report states.

Upon the death of the holder, the beneficiaries of the first, second or third degree, according to order of priority and exclusively, may access a pension for death derived from old age, in accordance with the percentages established in the regulation.

The analyst and pension specialist Alberto Bonadona pointed out that income levels are low and most people do not have enough contributions to access a pension equivalent to 60% of their salary reference. “You have to keep working because if you don’t, the drop in your income is brutal. A person who, for example, earned 14,000 bolivianos, if he retires he will receive 3,200 bolivianos and then he does not retire completely, manages the AFP payment, stops contributing, but continues working, ”explained the expert.

He added that a few days ago, a 77-year-old woman told him that she must continue working because if she stops working and retires, her income will drop from 12,000 to 3,800 bolivianos.

To reach the benchmark of 60%, the person would have to have worked in a stable way in his life, but also contribute more than 10% of his salary to the AFPs because the profitability of the pension funds has been very low.

“Unless the investments of the AFPs had generated a return of 8%, no more would have to be contributed, but since that did not happen, it must be replaced with a higher contribution rate, something difficult,” he stressed.

Bonadona believed that the creation of a pay-as-you-go fund could be analyzed for people who are about to retire with a very sharp drop in their income.

According to the report of the Vice Ministry of Pensions, the profitability of SIP funds in December 2018 fell to 1.7% and in December 2021 it reached 4.1% on average.

Óscar Tapia, former Secretary of Finance of the Central Obrera Boliviana (COB), argued that Law 065 on Pensions has not been a solution because 95% of workers who decide to retire barely receive 25% or less of their last salary benchmark.

“The worker can have 25 to 30 years of work activity, but he has not had stability, he worked 10 years, left five years or one year and came back. That person will receive a pension of less than 3,000 bolivianos, it is very rare that it reaches 30% of his salary in recent years, ”he lamented. Those who could aspire to a better old-age pension, he said, are those who throughout their lives had stability and their salary was greater than 10,000 bolivianos.

For Tapia, the only way to improve the pensions of workers who will retire is for the State to contribute to the SIP in solidarity. “With the 1% contribution of the General State Budget, it could help improve income. For example, it can be established that workers who earn up to 5,000 bolivianos receive a pension equivalent to 100% and go down from there, ”he pointed out.

But beyond studying alternatives, Tapia believes that as long as there is no job stability in the country and informality is reduced, it will be impossible to improve pensions.

The COB asks that workers retire with 100%.

The report of the Vice Ministry of Pensions indicates that since Law 065 came into force between 2011 and 2021, more than 156,000 people have accessed retirement.

The number of SIP retirees as of December 2021 reaches 186,721. Of that number, 127,079 have an old-age solidarity pension, 46,235 have an old-age pension and 13,407 have monthly contribution compensation for having contributed to the old pay-as-you-go system and having retired from the SIP.

Death payouts skyrocket

This increase was possibly due to the effect of the Covid-19 pandemic, the report states.

From December 2019 to December 2020, the amount of payments for death pension was only 874 deaths.

The heirs of the deceased insured who regularly contributed to the SIP, have the payment of a benefit for death (for Common, Professional or Occupational Risk), prior fulfillment of requirements, for life (spouse or parents) or temporary (children or siblings ).

In the case of disability pensions, the Collective Risk Fund finances monthly contributions (equivalent to 10% of the amount of the pension received by the insured) until the person can retire.