The election of Gustavo Petro as the next president has generated uncertainty in the markets, however, for Ernesto Revilla, Chief Economist at Citi Research For Latin America, as has been seen in other countries, a major change in the country’s macroeconomy is not expected.

(Read: Uribe said that he will support what he considers positive from the Petro government).

They do not expect a strong impact on the macroeconomy, why?

Local analysts are usually more pessimistic than foreign ones, since they live the news day by day and are immersed in the political environment. But once it is coldly compared with the rest of the countries, the strengths and trade-offs are more evident.

Petro arrives after a cycle in which Boric, Castillo or López Obrador already won, which aroused a lot of uncertainty in the private sectors, but what we have seen is that in the macroeconomy they have not changed so much the trajectory that already existed of responsibility and orthodoxy, everyone has turned to it in government.

What are the strengths of Colombia?

Colombia has even more tradition than the rest of fiscal responsibility, it is the only one in the region that has never defaulted, so it seems even more difficult to change the macroeconomy. In addition, institutions such as the Cortes or the Banco de la República are going to be counterweights. There could be a deterioration, but not as strong as one thinks.

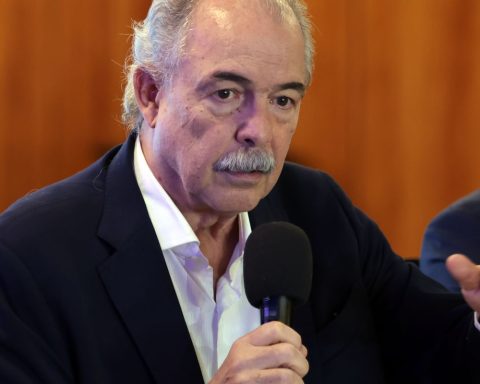

Ernesto Revilla, Citi’s chief economist for Latin America.

private file

What are Petro’s proposals on which they have the focus?

It is difficult for campaign proposals to become reality, when the government is reached is when the margins to govern and the need for resources are known. I give little weight to the campaign proposals and we are going to wait for the government measures and his royal cabinet.

What has been said about oil exploration sounds difficult, since it is going to need that income for the budget. Also, we have spoken with your economic advisers and yes, greater public spending is expected, and although financing it with taxes is not so easy to do, we like that you do not want to finance it with a deficit.

How difficult do you see carrying out this great tax reform?

The proposal that we hear is to collect 5% of GDP, which is very difficult and there are few or no exceptions in emerging markets of reforms that have achieved that amount, but it is a process in which there will be a negotiation and in the approval the numbers will go down. Some reform will come out, perhaps not with the ambition that Petro has today, but it will give him the possibility of financing some proposals, and he will have to limit others.

Everyone has been very optimistic about Colombia’s GDP in 2022. What are the downside risks that you see?

There is a vulnerability that worries me, which is its high fiscal deficit coupled with the current account deficit, and that is an almost exclusive problem in the region, since part of the countries improved their current account with the pandemic by stopping importing. That means it needs more external financing, and that leaves Colombia more vulnerable when conditions get tougher with the Fed raising rates and a downside outlook for oil prices. They are worrying issues.

What do you expect for the country’s inflation?

It should already be hitting its peak between June and July. Interest rates have already picked up and that will help bring it down, although the economy will slow down. Inflation is high, but we expect a gradual slowdown, although upside risks remain with the conflict in Ukraine, which is unpredictable, and further hikes from the Fed, which may depreciate currencies and may end up hitting inflation.

We expect inflation of 8.1% this year and 4.2% next year, while GDP would grow 5.9% in 2022 and 2.9% in 2023.

How have you seen the impact of the loss of investment grade in Colombia?

The loss of investment grade is a reflection of those tensions. And it’s unfortunate, because it raises the cost of financing just when those resources are becoming scarcer in the world.

(Also: Gustavo Petro gave details of what his tax reform would be).

The common cause of downgrades and current account is the fiscal deficit, which is the original sin. If this is corrected as stated in the Fiscal Framework, the current account will improve and Colombia could aspire to recover the investment grade, but certainly not in the short term, but rather in the medium term.

Do you think that the Petro government will be able to improve social indicators?

The social challenges are common throughout Latin America, with high and sustained poverty, also with inequality, a very inconsistent provision of public services and with poor quality in some cases of education and health. Everyone agrees with an agenda that improves this situation, but the big question is how to do it, because in the region we have had the experience that when it is done wrong, it ends up being detrimental to the population that wants to benefit.

There is a shift towards greater demand for social services and governments must respond, even with more spending, but in a way that does not undermine sustained long-term growth.

Why is optimism still with the country if the world is slowing down?

It has many strengths, such as the dynamism in its internal demand, which is not common in Latin America, thus, consumption and investment continue to surprise on the rise. Another is its broad social consensus in favor of macroeconomic stability regardless of the government. And Colombia has a great opportunity with nearshoring thanks to a flexible and innovative population and economy.

BRIEFCASE