In mid-September, if nothing changes in the Government’s accounts, the Ministry of Finance is expected to present the Financing Law with which it seeks to collect the $12 billion needed to complete the expenses projected in the General Budget of the Nation for 2025; while agencies as the Carf warns that the fiscal gap in this project is much larger.

According to Minister Ricardo Bonilla himself, this initiative is vital for the fiscal stability of the country, since more than 92% of the budget for the previous year is inflexible, either due to State programs and subsidies or due to debt commitments that were acquired in past governments and this requires looking for additional resources, which is what they are doing with the tax reform.

Read also: Gas market conditions are relaxed in search of more efficient prices

“The country will have to examine these inflexibilities going forward in order to reduce them, because there is no room left to do other things and the greatest inflexibility is paying debt and that takes away space from investment, so the 2025 budget has an increase in debt payment from $95 billion to $112 billion and a reduction in investment from $99 billion to $82 billion, that is, what we need to reactivate the economy is investment and that is where we have the least room,” explained the official.

It would not be enough

When explaining the financing law and after denying that he is going to introduce taxes As with the 5×1000 and reaffirming that there are red lines on products exempt from VAT, the Government has proposed the possible axes of this project on two fronts, starting with the wealth tax, which although it is an idea still under analysis, reviews aspects such as expanding the taxable base and reaching new areas that have not been touched for now.

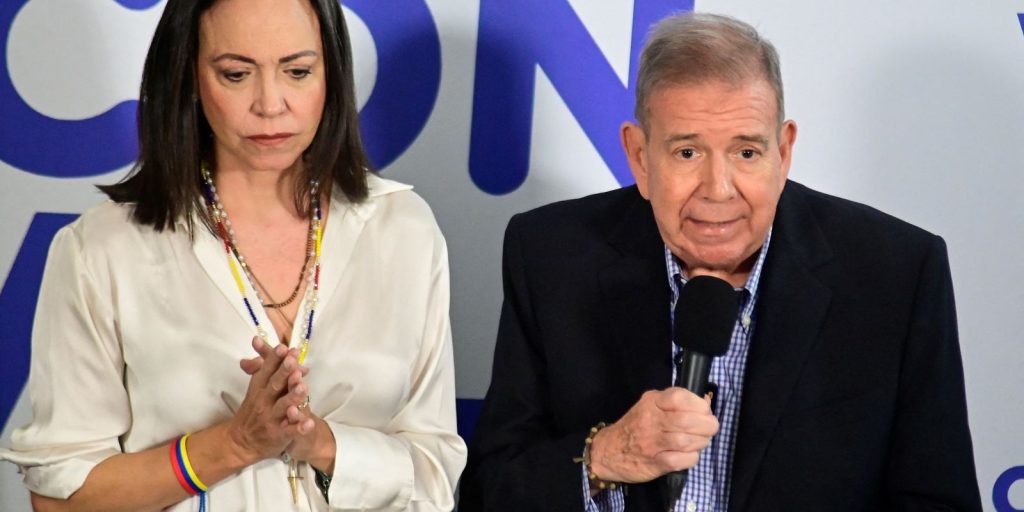

Minister of Finance, Ricardo Bonilla.

Courtesy

“There is no organized text yet, but what is certain and I can point out is that we are not going to make adjustments on the VAT side of exempt and excluded products and we are not going to make adjustments on the tax on financial transactions either,” said Minister Bonilla in this regard.

Another of the fronts that the Ministry of Finance is studying is non-labor income, That is, all those items that are not part of income from salary or the provision of personal services. These include income obtained from the provision of professional or technical services independently, such as consultants, lawyers, and self-employed doctors.

There are also financial returns such as interest generated by savings accounts, fixed-term deposits, bonds, stock dividends; money received from renting real estate such as houses, apartments, offices, commercial premises, or any other property or occasional profits; as well as income generated by the exploitation of copyrights, patents, royalties from the sale of books, music, software, etc.

For reading: Bogotá’s economy is growing slowly: the capital still faces poverty challenges

For Jairo Higuita, partner at Esguerra JHR, increasing the effective personal income tax rate will not have a significant impact on revenue collection, as current rates are already high. On the contrary, he says that more environmental taxes, such as carbon taxes, could be explored to diversify revenue sources.

“The problem is not the 4×1,000 or 5×1,000; the proposal has to be in the VAT, but evidently the Government does not want to touch it because it seems that it is not popular, I do not think it will achieve the objective, despite the fact that in the Medium Term Fiscal Framework the benefits of VAT are more or less $90 billion, so there is a lot to do there,” explained Higuita.

Here it must be said that government sources assure that the latter is a possibility. which is being analyzed, starting with the income surcharge for coal that was approved in the 2022 tax reform and which would be raised in the percentile ranges that currently govern this industry.

Economic recession

PHOTO: iStock

Review the collection

On the other hand, Camilo Cuervo, Partner at Holland & Knight, argues that the main problem is not the lack of taxes, but the state’s ability to collect them due to the blocked economy that is generating the slowdown. He also recalled that the 2022 tax reform, which anticipated collections, is not giving the expected results due to the current economic crisis.

“The issue is not about tax reforms but about economic reactivation and that was demonstrated in the past, when we came out of the pandemic and the social crisis that it generated. At that time, the mechanisms were put in place, people were allowed to reactivate and in the end everything translated into a substantial increase in tax collection. in 2021, which ended up providing new resources for the economy,” Cuervo said.

José Manuel Restrepo, former Minister of Finance and rector of the EIA University, has the same opinion. He believes that neither the wealth tax nor the taxes related to non-labor income will be sufficient to collect the $12 billion pesos that the National Government is seeking, which is why he does not believe that this tool should be relied upon.

More news: Corruption among companies increased by 15% until June

“The right way is not to present a tax reform, but rather to implement it. “We need an economic recovery project now, a program that encourages growth and thereby generates revenue. Two, we need to make an effort to cut public spending. There are already studies that show that this austerity could easily reach between $15 billion and $17 billion; with that there would be plenty of room to manage finances,” he said.

Cut spending

It should be noted that within the Congress of the Republic there is a group of legislators who are seeking to speak with the Ministry of Finance to reduce the spending of the 2025 Budget by $12 billion and thus avoid having to process the Financing Law at a time that is not convenient.

Colombian pesos

iStock

Finally, for Lisandro Junco, former director of the Dian, taking into account that if If VAT is not touched, the Government’s goals will not be met. Alternatives must be sought, such as the sale of SAE assets and the anticipation of dividends from Grupo Bicentenario companies to get closer to the collection goal without the need for new taxes.

“If you look at that, with SAE, plus Grupo Bicentenario, plus the sale of unproductive assets, I think we can reach $12 billion, which could generate relief if added to the spending cuts. Spending must be reduced, because otherwise we are returning to a scenario like that of Carrasquilla’s tax reform,” he said.

The fact that next year’s budget and investment needs have been linked to a financing law did not go down well with some academic sectors and unions, since they consider that The country’s economic development and growth is being tied up, something that could be counterproductive in the future.